It's vital to understand the relationship between mortgage rates and your purchasing power if you're going to buy a property. The amount of housing you can afford to buy within your financial means is referred to as purchasing power. Mortgage rates have a direct impact on the monthly payment you'll make on your new house. As a result, as interest rates climb, so does the monthly payment you can lock in on your home loan. That could limit your future purchasing power in a rising-rate climate like the one we're in now.

The average 30-year fixed mortgage rate is currently around 5%, and analysts predict that it will rise in the coming months. If you buy now, before the increase affects your purchasing power, you can get ahead of the game.

Mortgage Rates Have a Significant Impact on Your Purchasing Power.

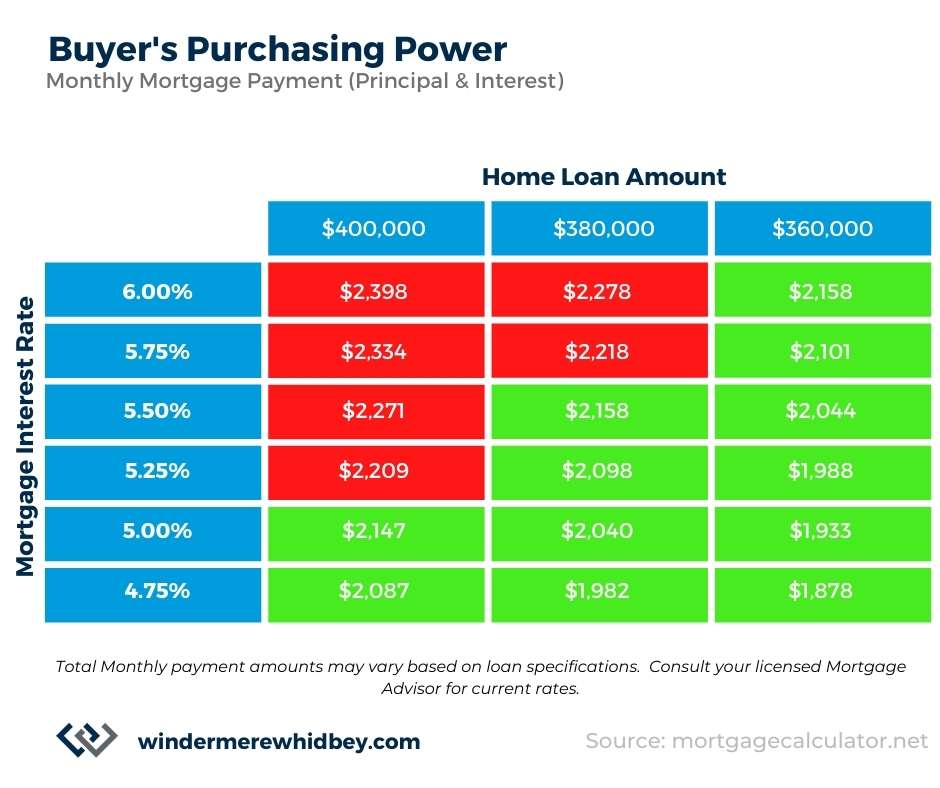

The graph below shows the overall link between mortgage rates and a common monthly mortgage payment for various loan amounts. Let's say your finances allow for a $2,100-$2,200 monthly mortgage payment. The green in the graph represent a payment that is within that range, while the red represents a payment that is outside of that range (see graph below):

As the graph demonstrates, unless you pursue a smaller home loan amount, you're more likely to surpass your desired payment range as mortgage rates rise. If you're ready to buy a home, use this as encouragement to do it now, before interest rates rise and you have to decide whether or not to reduce the amount you borrow to keep inside your budget.

Consult with a Trusted Adviser to Understand Your Budget and Develop a Strategy

When looking for a property, it's vital to keep your budget in mind. The easiest way to express it is as follows,

Get preapproved with today's rates, but also think about what would happen if rates rose another quarter of a point,... Know what that would mean for your monthly bills and how comfortable you are with it so that if rates do rise, you'll already know how to adjust.

Whatever the case may be, the ideal method is to collaborate with your real estate agent and a reputable lender to develop a strategy that takes rising mortgage rates into account. Together, you may examine your budget in light of current rates and devise a strategy for adjusting when rates change.

In Conclusion

Even minor increases in mortgage rates can have an effect on your purchasing power. If you're in the market for a home, having a solid plan is more important than ever. Work with a trusted real estate advisor and lender to plan your strategy for achieving your dream of homeownership this spring.