Should I wait for mortgage rates to go down?

Contributed by Si Fisher

Homebuyers, are you ready to take the next step but feeling unsure with rising interest rates? Mortgage rates have indeed increased significantly over this past year. But don’t worry because Windermere Whidbey is here for all your needs! We've compiled a wealth of information that can help you make an informed decision when it comes to buying a home in 2022 and beyond - just keep reading below:

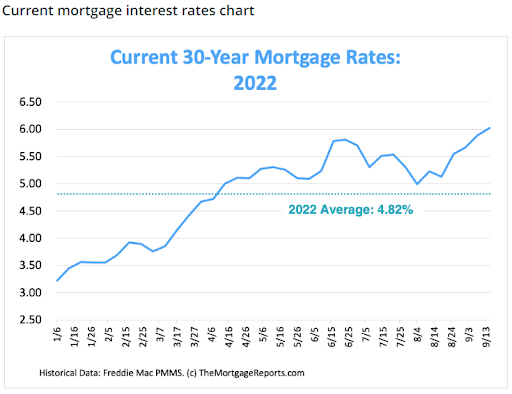

First, let’s look at some historic mortgage rate data to put things in perspective. During the Covid pandemic, mortgage interest rates reached all-time lows in 2020 and 2021. Mortgage rates were pushed below 3% and were kept there thanks to emergency measures taken by the Federal Reserve. However, if you look at the chart below you will see that throughout 2022 we have seen interest rates gradually rise.

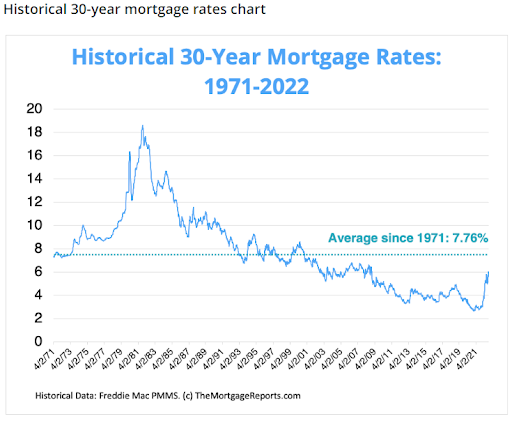

While this may appear scary, I want to provide one additional piece of information that will give you even more perspective. Examine the chart below:

The graph above certainly tells a different story. Despite recent increases, 30-year mortgage rates now are still below the historical norm. With that being said, a 3% rate does seem a lot more appealing than a 6% or higher rate. Especially when you look at how this will affect your purchasing power.

Contact a local expert about financing your next home

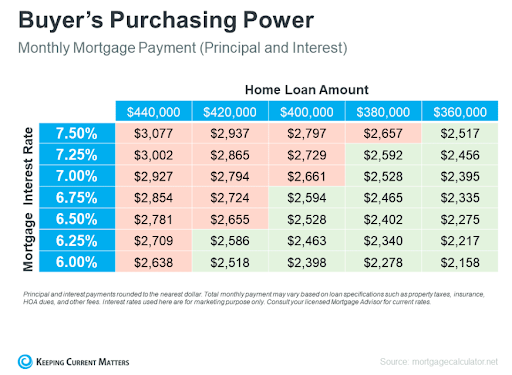

How Will Rising Mortgage Rates Impact a Home Buyer’s Purchasing Power?

Let's say you want to purchase a property for $400,000, and you want to keep your monthly payment at or below $2600. Here is how your spending power may alter if mortgage rates rise, see the chart below.

Are Mortgage Interest Rates Going to Continue to Rise or Go Back Down?

The short answer is that the direction interest rates will go is nearly impossible to predict. According to most experts on the subject, rates may continue to rise for a while as the FED attempts to get inflation under control. However, if we see the rising interest rates start to cause a recession, they might lower. Again, nothing is certain on this front and the rates are dependent on too many frequently changing factors to have a guaranteed prediction.

Conclusion: Should you wait for mortgage rates to go back down before purchasing a home?

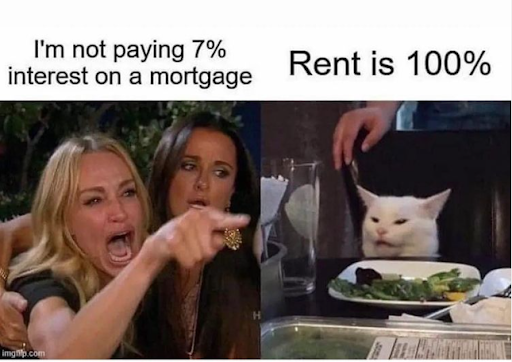

If you are a renter who is currently trying to decide if you want to purchase a home or wait on changing rates, I just want to share one image with you:

In essence, it is accurate to say that the cost of purchasing a property has increased since last year. The distinction is that homeownership also involves building equity over time, which will increase your net worth.

It makes little sense for a borrower to attempt to time their purchase based solely on interest rates in this market. Regardless of current interest rates, our best recommendation is to wait to purchase until you are financially prepared and able to afford the property you desire.

Keep in mind that your mortgage rate won't be fixed in stone. Homeowners can always refinance later if rates drop sufficiently to reduce costs.

Final Thoughts:

Situations vary from person to person. Working with a real estate adviser to weigh your options is what can help you make the best choice possible, and it just so happens we have an office full of highly trained real estate professionals. Don’t hesitate to reach out if you have any questions about the buying or selling process.

Article contributed by: