How to save $100s on your monthly mortgage payment

When buying a home on Whidbey Island

Contributed by Si Fisher

As a Whidbey Island homebuyer, you may be searching for affordable housing and having a rough go at it. Mortgage rates are much higher now than they were last year, and this could mean several hundred dollars more a month when looking at a potential mortgage in your desired price point.

Luckily, today I am going to share with you a program that can help reduce your monthly mortgage payment by hundreds of dollars.

At this point you are probably thinking, “What wizardry is this?” Well, the magic all has to do with mortgage buydowns, and more specifically I want to talk about what some sellers are doing to make their homes more appealing and affordable to potential buyers looking on Whidbey Island.

What Is A Buydown On A Mortgage?

Most lenders when originating a loan will have an option for the borrower to purchase something called discount points (also referred to as mortgage points, or prepaid interest points). Essentially it is a prepaid fee that allows you to buy down the interest rate on your loan and thereby lower your monthly payment for the entire duration of the loan.

In a different type of buydown, the points purchased at the start of the loan lower the interest rate for a specific period of time. As mentioned above we are now seeing sellers offer to pay for these shorter term buydowns to make their home more affordable to a larger number of buyers. The most common one we are seeing now is called the 2/1 buydown.

Contact a local expert about financing your next home

The 2/1 Mortgage Buydown Program

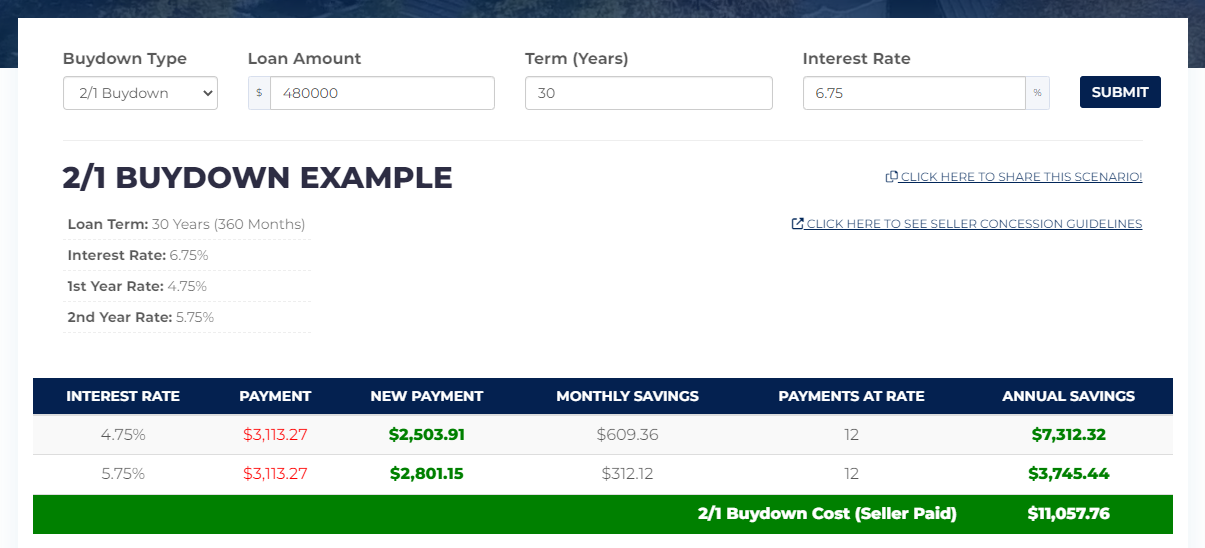

The 2/1 Mortgage Buydown allows a borrower to lock in an interest rate 2% lower than the current rate for the first year, and then 1% lower for the second year of the loan. After that the loan defaults back to what the current rate was at the time of the loan origination. Let’s look at an example of how this works.

Let’s say you are looking at a home for $600,000. You plan on making a 20% down payment, leaving $480,000 that needs to be financed. Observe the chart below:

$609 dollars/month savings for the borrower during the first year!!!

Okay let’s break it down. If a borrower was financing their $480K loan at today’s rate of about 6.75% their monthly payment would be $3,113.27/month. When using this 2/1 buydown program their rate drops to 4.75% for the first year, and 5.75% for the second year. This lowers the monthly payments during that time to $2,503.91 and $2,801.15 respectively. After that point your loan goes back to what the original rate would have been if you were not taking advantage of this program. AND, should the interest rates fall during the course of the first two years, you can always refinance to the new lower rate after the buydown period ends.

One additional thing to note is that the borrower would still need to qualify for the loan at the current interest rate, not the buydown rate.

The best part about this is that everybody wins! The seller gets more potential buyers interested in their home (this can be a lot more enticing and more cost effective than a price reduction), and the buyer gets two years of reduced monthly payments. If both parties agree, the seller would then pay for the buydown through escrow when the home sale closes. In the example above the seller would pay around $10K depending on a variety of factors. Presto chango!

This is just another tool to put in your tool kit and another reason to work with a professional who has a full set of tools!

Article contributed by: