The Federal Reserve Bank of New York just released their 2023 Housing Survey, which shows how the U.S. population feels about the housing market. Windermere Chief Economist Matthew Gardner digs into the mortgage rate predictions, showing how demographics played a role in the results.

This video on mortgage rate predictions is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Mortgage Rate Predictions

Hello there! I’m Windermere Real Estate’s Chief Economist Matthew Gardner. This month we’re going to take a look at the latest SCE Housing Survey, which gives us a really detailed look at consumers’ psyche in regard to the housing market.

I’ve always been fascinated by surveys, as they frequently give me insights that I simply don’t get from just looking at raw data and, as luck would have it, the New York Fed just released its 2023 Consumer Expectations Housing Survey. Now, this particular survey has always given me some great and often surprising insights as to how the U.S. population views the overall housing market. We certainly don’t have time to cover all of the questions that the survey poses, but there was one section I wanted to share with you today as it really resonated with me, and it relates to mortgage rates.

Will mortgage rates continue to rise?

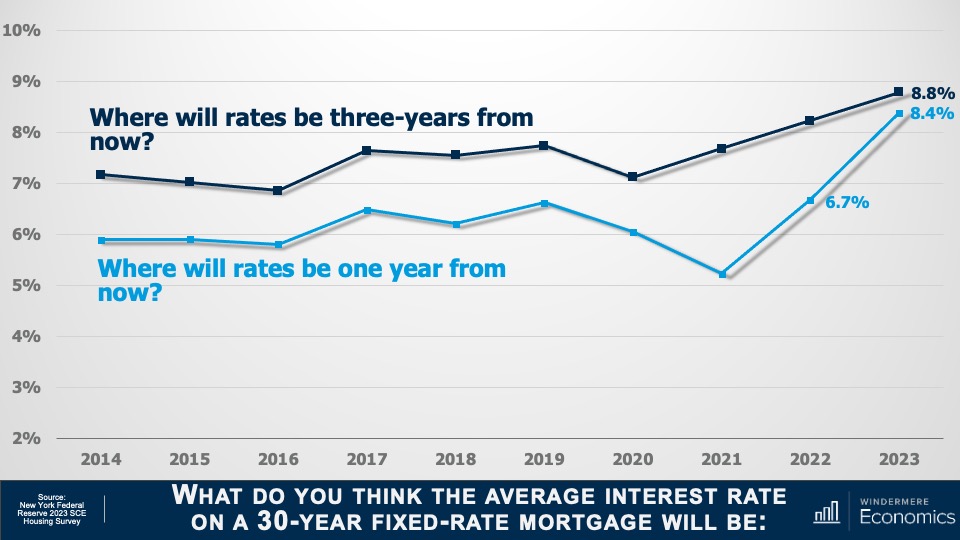

The first question asked was where they expected mortgage rates to be one year from now. And as you see here that, on average, households expected rates to rise all the way up to 8.4%. Although some may see this as extreme, you can see that in the 2022 survey respondents predicted rates would hit 6.7%, almost exactly where they were at the beginning of this March.

And when asked where they thought rates would be three years from now, on average, households expected to see them climb to 8.8%. Now, that’s a rate we haven’t seen since early 1995!

Well, I’m not sure about you, but I was very surprised by these results as they counter just about every analyst’s expectation regarding where rates will be over the next few years. In fact, myself and every economist I know believes that rates will slowly pull back as we move through this year. I haven’t seen a single forecast suggesting that mortgage rates will rise to a level this country hasn’t seen in decades.

But as they say, the devil’s in the details. When I dug deeper into the numbers, it became very clear to me that demographics played a pretty big part in guiding people’s answers. Let me explain.

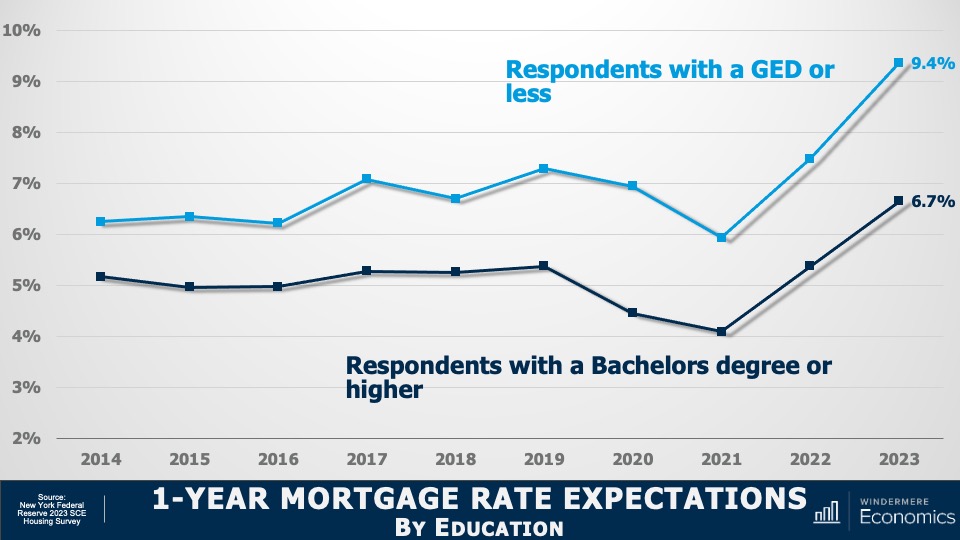

1-Year Mortgage Rate Expectations by Education

Here the data is broken down by educational achievement. You can see that survey respondents who didn’t have a college degree thought that mortgage rates would rise to 9.4% within a year. But college graduates were far more optimistic, and they expected rates to be in the high 6’s.

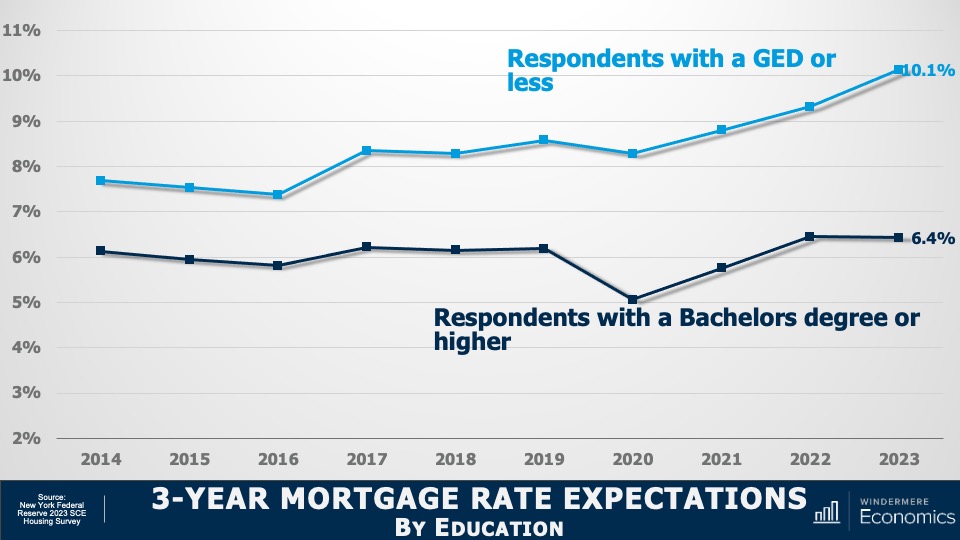

3-Year Mortgage Rate Expectations by Education

And when asked to look three years out, respondents without degrees expected rates to break above 10%. While college graduates saw them pulling back a little from their one-year expectations of 6.7%, down to 6.4%.

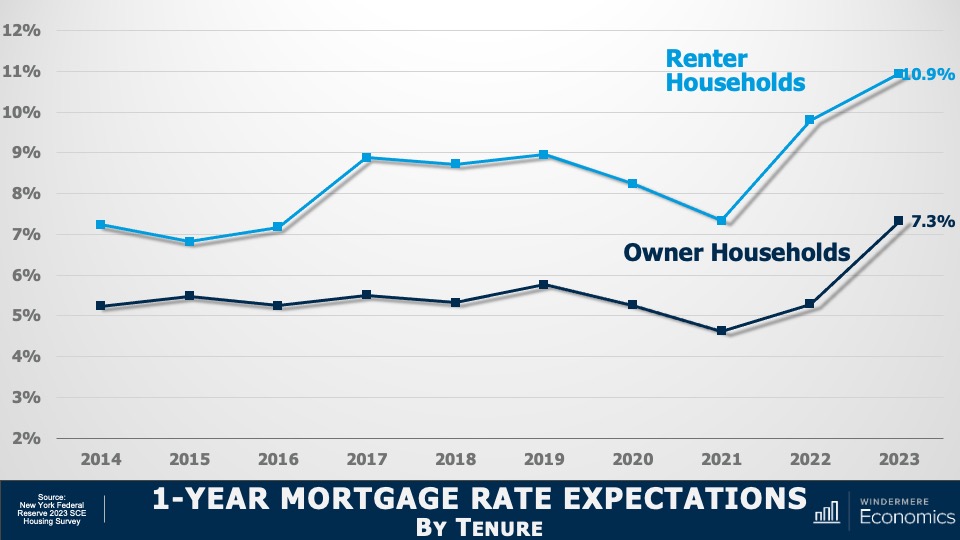

Now we are going to look at the survey results broken down by housing tenure.

1-Year Mortgage Rate Expectations by Tenure

And here you see that renters expect mortgage rates to be at almost 11% within a year. And homeowners also saw them rising, but only up to 7.3%.

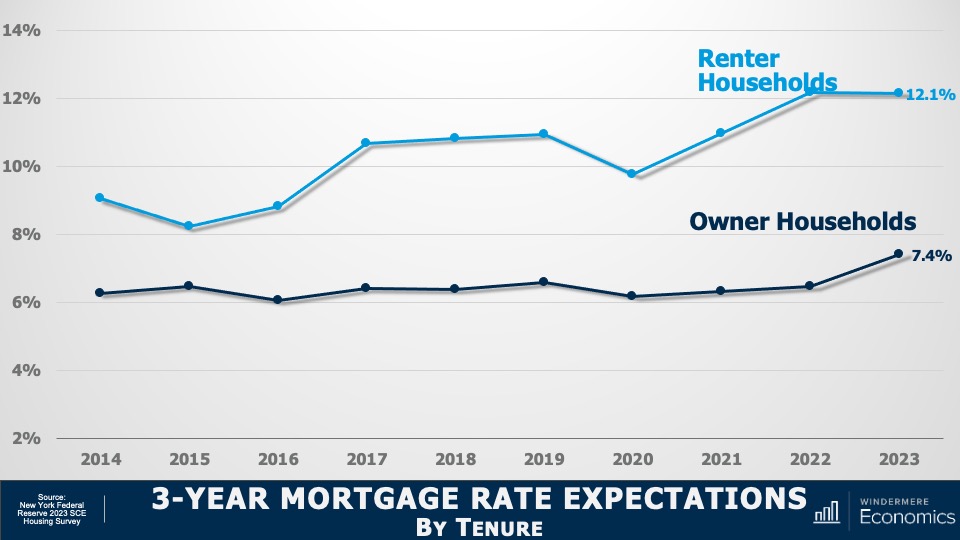

3-Year Mortgage Rate Expectations by Tenure

And over the next three years, renters expected rates to break above 12%. That’s a level not seen since the fall of 1985. But homeowners expected to see rates at a somewhat more modest 7.4%.

So, what does this tell us? I see two things.

Firstly, the rapid increase in mortgage rates that we all saw starting in early 2022 has a lot of people believing that we will see rates continuing to rise, sometimes at a very fast pace, over the next few years. I mean, if it happened before, why can’t it happen again? And this mindset leads me to my second point, which is that it’s very clear that a lot of would-be home buyers just don’t understand how mortgage rates are calculated.

The bottom line here is that I see a potential buyer pool out there that needs educating and that can give an opportunity to brokers to discuss how rates are set and where the market is expecting to see them going forward.

This may alleviate the concerns that many households have who may be thinking that they will never be able to afford to buy a home because of where they expect borrowing costs to be in the future. Education is everything, don’t you agree?

As always, I’d love to get your thoughts on this topic so please comment below! Until next month, take care and I will see you all soon. Bye now.

To see the latest housing data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.