Why So Many Whidbey Island Homeowners Are Downsizing Right Now

If you’ve lived on Whidbey for a while, you know the feeling: the view is still spectacular, but the acreage that used to be a joyful hobby is starting to feel like a full-time job. You aren’t alone. For many homeowners in our community, retirement isn’t just a distant date on the calendar anymore—it’s happening right now.

And with that transition comes a big question: Is this the right home for my next chapter?

A wave of homeowners is choosing to “right-size” this year. They aren’t just moving to smaller spaces; they are moving to better lifestyles. Here is why so many of your neighbors are deciding that 2026 is the year to make a move, and why it might be the perfect time for you, too.

It’s Not About Living with Less—It’s About Living with Ease

The word “downsizing” often sounds like you are giving something up. But on Whidbey Island, it’s usually the opposite. It’s about trading a riding mower for a kayak, or swapping a weekend of preparing your home for repairs for a Saturday afternoon browsing the galleries in Langley.

The National Association of Realtors (NAR) recently identified the top reasons people over 60 are moving, and they almost all point to one thing: Lifestyle Quality.

1. Being Closer to What Matters

For many islanders, “downsizing” often means moving closer to the ferry in Clinton or the bridge in Oak Harbor to make those trips to see grandkids in Seattle or Everett easier. It’s about reducing the friction between you and the people you love.

2. Eliminating the “Chore Tax”

We love our forests and green spaces, but maintaining a large property on Whidbey requires serious effort. Many sellers are looking for single-level homes in communities like Bayview Corner or Greenbank where the yard work is minimal, the stairs are non-existent, and the floor plan is designed for the future, not the past.

3. Financial Freedom

Utilities, insurance, and maintenance costs on older, larger island homes have risen. Moving to a smaller, more energy-efficient home in town—whether that’s Coupeville, Freeland, or Oak Harbor—can significantly reduce those monthly expenses. This leaves more budget for travel and fun, especially when you have a solid financial plan for buying.

The “Equity Advantage” for Whidbey Homeowners

If the lifestyle benefits are the why, the financial landscape is the how.

According to recent data, the average homeowner with a mortgage has nearly $300,000 in equity. On Whidbey Island, where many residents have owned their homes for decades, that number is often much higher. To stay on top of these shifting values, we recommend subscribing to our Market Pulse reports.

When you decide to sell a long-held property here, two powerful things happen:

- You cash out on years of appreciation.

- You likely pay off your mortgage completely.

This combination puts you in a powerful position to buy your next home—often with a significant cash down payment or even an all-cash offer. This allows you to secure a smaller, more manageable property without the stress of a large monthly payment.

Is 2026 Your Year to Right-Size?

Downsizing on Whidbey Island isn’t about closing the book; it’s about starting a new, more exciting chapter. It’s about ensuring your home serves your life, rather than your life serving your home. Once you are ready to make the leap, our Moving Checklist can help you stay organized every step of the way.

If you are curious about how much equity you’re sitting on, or just want to chat about what “right-sizing” looks like in our current market, we are here to help.

Want a step-by-step roadmap before you list? Grab our Seller Resources guide and start planning with confidence.

- Curious about your home’s value? Get a complimentary home valuation here to see what your equity looks like today.

- Search Whidbey listings: Browse active listings across the island.

- Talk to a local specialist: Browse homes for sale in Langley or connect with a Windermere Whidbey agent.

Written by Si Fisher.

Local Look: Western Washington Housing Update – A Whidbey Island Perspective

Local Look: Western Washington Housing Update – A Whidbey Island Perspective

This report provides a Local Look at the June 2025 Northwest MLS data, with a keen eye on how it impacts the Whidbey Island real estate market. There have been interesting shifts, and this analysis aims to offer a straightforward perspective, blending broader market insights with our hyper-local reality. The primary focus for tracking market supply and demand includes closed and pending sales, reflecting demand, and new and active listings, indicating supply.

I. The Northwest MLS Residential Sales: A Broader View

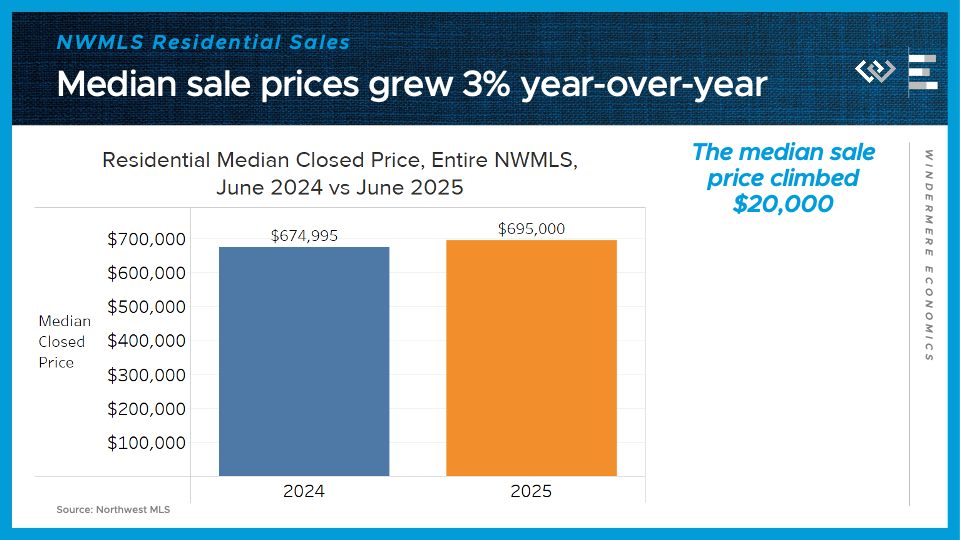

Following a dip in closed sales in May, which was attributed to fallout from stock market fluctuations and economic turmoil in April, the housing market has shown a rebound. June’s residential closed sales across the Northwest MLS were almost precisely at their year-ago level. Pending sales for single-family homes experienced a 3% year-over-year increase. On the supply side, new listings increased by approximately 12% this June, and the total of active listings at month-end was 37% higher than June 2024’s inventory. While this represents a significant increase in inventory, the pace of year-over-year growth has slightly decelerated from the 39% observed last month.

The median sale price for closed single-family home sales climbed 3% from last year, reaching $695,000. This reverses the 1% decline seen in May and establishes a new high-water mark for the year, exceeding the $680,000 price level in April. This indicates that buyers across Washington re-engaged with the market in June, driving both increased sales and higher prices. However, the current high level of inventory suggests that buyers will likely gain more negotiating power later this summer.

II. Whidbey Island Real Estate: Our Local Snapshot

Let's narrow our focus to our beloved Whidbey Island. While the broader Western Washington market provides context, a more precise understanding comes from examining our local communities. When it comes to Whidbey Island homes for sale, we track distinct trends, particularly in areas like Coupeville, Oak Harbor, Langley, Freeland, Clinton, and Greenbank.

Closed Sales: A Mixed Bag, Locally Speaking

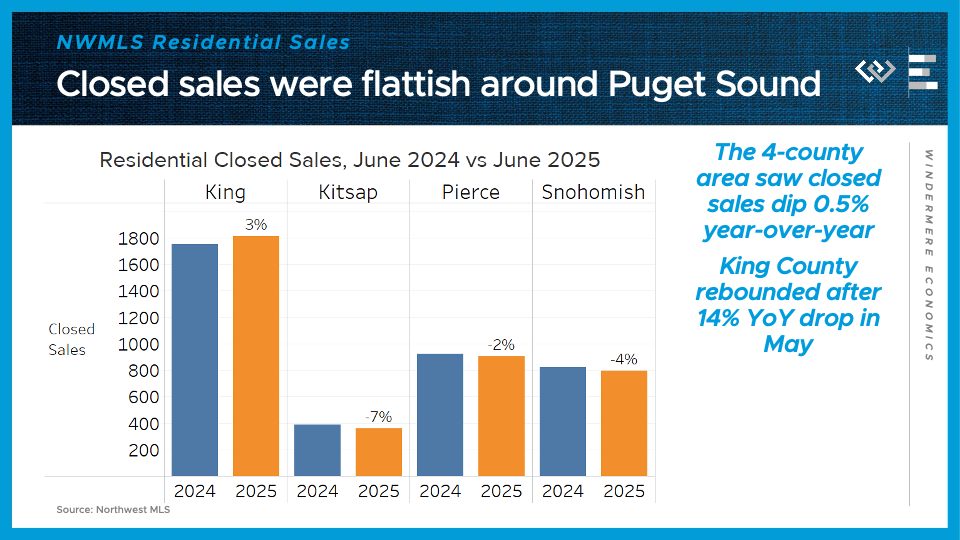

Residential closed sales in the four-county greater Seattle area saw a slight dip of just half a percent year-over-year. This was largely due to a 3% gain in King County offsetting minor declines in other counties. King County's recovery is particularly notable after its significant 14% year-over-year decline in May, suggesting that some buyers re-entered the market after an earlier pause.

On Whidbey Island, the latest data provides further insight into sales activity:

- For Coupeville & Oak Harbor, 382 homes have sold year-to-date, representing a notable 14% increase from 2024.

- In the combined South and Central Whidbey region (Clinton, Langley, Freeland & Greenbank), 143 homes have sold year-to-date, though this indicates an 11% decrease from 2024.

This demonstrates a clear divergence in sales volume across the island, with the northern part experiencing robust growth while the southern/central areas show a slight contraction. Understanding these hyper-local nuances is crucial, highlighting the benefit of partnering with a Whidbey Island Specialist.

Median Sales Prices: Whidbey Island's Upward Trajectory

While Snohomish County experienced a 2% decrease in median sale price, King County led with a 7% gain, surpassing the million-dollar mark once again. Kitsap and Pierce counties also saw price increases of 4% and 5%, respectively.

For Whidbey Island, median sales prices continue to show strength:

- In Coupeville & Oak Harbor, the median sales price over the last 30 days is $534,000, with an average sales price of $582,784. Homes in these areas are selling for an average of 97.5% of the list price.

- For Clinton, Langley, Freeland & Greenbank, the median sales price over the last 30 days stands at $806,250, with an average of $917,023. These properties are achieving an average of 97% of their list price.

These figures underscore the continued vitality of the Whidbey Island real estate market, reflecting consistent buyer demand.

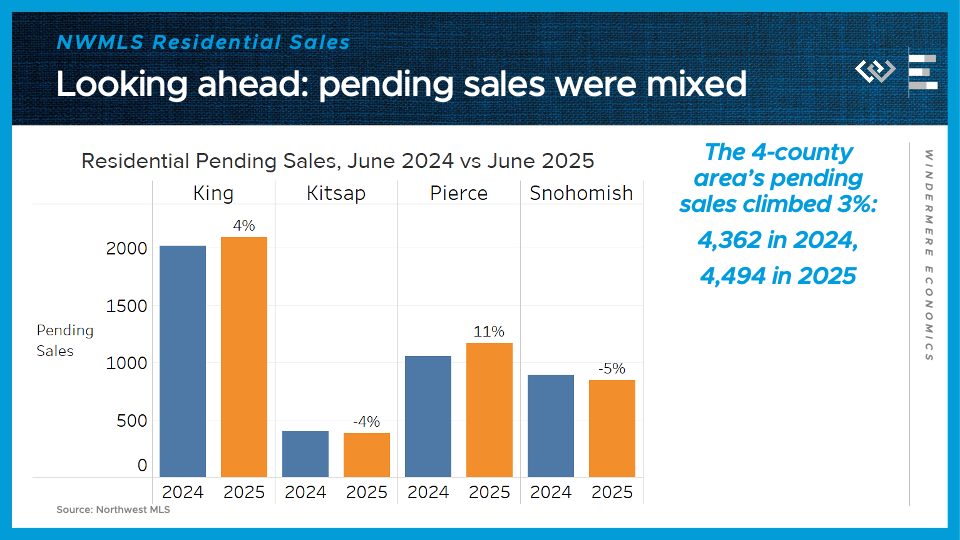

Pending Sales: Mixed Signals

Looking ahead, pending sales across the greater Seattle region returned to modest year-over-year increases, totaling 3%. This was led by an 11% rise in Pierce County and a 4% rise in King County, though partially offset by declines of 4% in Kitsap and 5% in Snohomish County.

For Whidbey Island, weekly reports indicate:

- In Coupeville & Oak Harbor, there are currently 19 pending homes, with 8 properties experiencing price reductions. Over recent weeks, pending sales have fluctuated, peaking at 43.

- The Clinton, Langley, Freeland & Greenbank region currently has 10 pending homes and 10 price reductions. This area recently saw a peak of 20 pending homes.

This mixed activity in pending sales suggests that while demand is present, buyers are becoming more discerning, a trend that active listings will further emphasize.

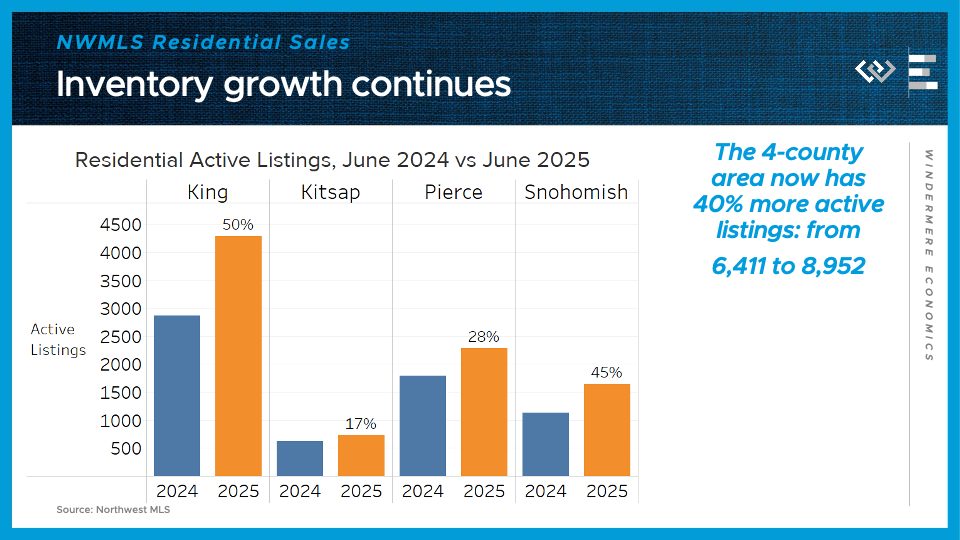

Inventory Growth: Opportunities for Buyers

On the supply side, the four-county greater Seattle area had nearly 9,000 active listings at the end of June, representing a 40% increase from the same time last year. While substantial, this gain is a smaller percentage than the 45% year-on-year growth observed in May, indicating a deceleration in the inventory buildup.

Here on Whidbey Island, inventory levels reveal an interesting narrative:

- For Coupeville & Oak Harbor, there are currently 169 homes for sale. This translates to 3.0 months of inventory based on solds and 2.9 months based on pendings. This suggests a market that is largely balanced, leaning slightly towards sellers.

- The Clinton, Langley, Freeland & Greenbank region has 141 homes for sale. This represents 5.1 months of inventory based on solds and 5.4 months based on pendings. This notably higher inventory level shifts the balance more towards buyers in these areas.

This increasing inventory is favorable for buyers, offering more choices and potentially greater negotiating power as the summer progresses. For sellers, it underscores the importance of a well-presented and effectively priced property from the outset. Explore available homes through our Our Active Listings page.

III. Looking Ahead for Whidbey Island

The June report confirmed that greater-Seattle-region buyers re-engaged with the market in June, marking a return to a "new normal" in sales activity after a pause in April. As the seasonal cooldown in demand is anticipated, coinciding with the peak of summer, the market dynamic is likely to favor buyers who continue their home search in the second half of the year. Furthermore, increased inventory is expected to introduce some competitive pressure on sellers who have yet to receive offers.

For those considering a move to our beautiful island, exploring our Explore Whidbey Island guides can provide invaluable insights into communities like Coupeville, Oak Harbor, Langley, Freeland, and Greenbank.

The Whidbey Island Advantage: Partnering with a Local Expert

Statistics only tell part of the story. The true value lies in understanding how these numbers apply to your specific real estate goals on Whidbey Island. Whether buying a piece of island paradise or selling a current home, partnering with a local expert is essential. Windermere brokers on Whidbey Island possess an intimate knowledge of its diverse neighborhoods, unique features, and evolving market dynamics. The focus extends beyond mere transactions to fostering connections and building community—a reflection of the "Human Algorithm" philosophy in action.

Don’t just navigate the Whidbey Island real estate market; master it. We are here to provide the insights, strategies, and local connections that make all the difference. Ready to make a move? Connect with us today.

Are you ready to make your real estate goals a reality?

Home Updates That Actually Pay You Back When You Sell in 2026

By Windermere Whidbey |

Mortgage Rates Are Moving in 2026: What Whidbey Island Buyers & Sellers Should Know

By Windermere Whidbey |

Whidbey Island Lender Pre-Approval: Why It Should Be Your First Step (Not an Afterthought)

By Windermere Whidbey |

3 Reasons to Be Optimistic About the Whidbey Island Housing Market in 2026

By Windermere Whidbey |

Headlines Have You Worried About Your Home’s Value? Read This.

By Windermere Whidbey |

Whidbey Island’s Ultimate Guide to Easter Egg Hunts

Whidbey Island's Ultimate Guide to Easter Egg Hunts

Contributed by Si Fisher

Easter on Whidbey Island is like opening a giant, community-wide Easter egg: filled with surprises, wrapped in the beautiful scenery of the Pacific Northwest, and, let's be honest, probably a bit more chocolate than anyone needs. This year, the island is hopping with activities for everyone from the tiniest of tots to adults who are kids at heart. Here's your golden egg of information on where to find the fun!

Holmes Harbor Rod & Gun Club: An Egg-ceptional Start

Kick-off your Easter weekend with a bang at the Holmes Harbor Rod & Gun Club on March 30, at noon. Kids 11 and under are invited to hunt for Easter treasures, enjoy prizes, and munch on hot dogs. And for a little extra magic, the local 4H group will introduce some adorable animals. Don't forget your basket, and try to hop in by 11:30 AM to catch all the fun.

Date & Time: March 30, Noon - 1:00 PM

Location: 3334 Brooks Hill Road, Langley, WA 98260

Clinton Easter Egg Event: Where Fun Meets Fizz

Prefer a hunt with a side of fizz? Head to The Thirsty Crab Brewery on March 30, from 10:00 AM to 12:00 PM, for an egg-stravaganza that includes more than just hunting for eggs. This event is bursting with activities – think Easter Bunny photos, a bouncy castle, and crafts, making it a perfect family outing. Plus, with age-appropriate hunts for those 12 and under, every child gets a fair crack at finding those hidden treasures.

Date & Time: March 30, 10:00 AM - 12:00 PM

Location: Thirsty Crab Brewery, 9000 SR 525, Clinton

Meerkerk Gardens: A Blooming Good Time

Hop your way to Meerkerk Gardens for an Easter Egg Hunt amidst flowers in peak bloom! On March 30, with hunts at 11 AM and again at 2 PM, children 10 & under can explore this botanical paradise for hidden eggs. Little explorers up to age 5 have their own special area near the Gazebo, while the 6-10-year-olds embark on their adventure in a separate spot. Don't miss the chance to meet the Meerkerk Bunny and experience the gardens during the most enchanting time of the year.

Date & Time: March 30, 11:00 AM - 2:30 PM

Location: 3531 Meerkerk Lane, Greenbank

Whidbey Farm & Market: Eggs, Candy Cannons, and Easter Bunnies, Oh My!

Next on the list, Whidbey Farm & Market is pulling out all the stops for their 2nd annual Easter event, happening on the last two weekends in March. Families can enjoy an egg hunt, a candy cannon, a bouncy house, and a meet-and-greet with the Easter Bunny. And for the adults? An Easter Egg Hunt under the stars on March 29th, with over $500 worth of prizes, games, bonfires, and music to keep the festive spirit alive.

Date & Time: March 30, 11:00 AM - 3:00 PM

Location: 1240 Arnold Road, Oak Harbor

Oak Harbor Easter Egg Hunt: Trees, Treats, and Treasures Galore!

Join the Oak Harbor Main Street Association for a cherished community event at Smith Park. On March 30, from 11:30 AM to 1:00 PM, families can enjoy a sensory-friendly hunt before the main event at 12:30 PM for kids up to age 10. It’s not just about the eggs; learn about the majestic Garry Oak trees and snag some free books in this educational and fun-filled outing.

Date & Time: March 30, 11:30 AM - 1:00 PM

Location: Smith Park, SE Midway Boulevard & SE 9th Avenue, Oak Harbor

The Hunt for the Perfect Home

Between the egg hunts and the Easter Bunny meet-and-greets, we're reminded of the joys of community and the warmth of coming home. In the spirit of new beginnings this Easter, why not consider finding your perfect nest on Whidbey Island? Working with a local broker who knows the island inside and out can crack open a world of opportunities, whether you're buying, selling, or just exploring your options. Remember, the best hunts end with finding exactly what you were looking for, and in real estate, it's no different.

Happy Easter!

Article contributed by:

Si Fisher

Contact a local expert to get expert advice about selling your home

Top 10 Housing Predictions for 2024

Matthew Gardner’s Top 10 Housing Predictions for 2024

This video shows Windermere Chief Economist Matthew Gardner’s Top 10 Predictions for 2024. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market. See more market insights on our blog here.

Matthew Gardner’s Top 10 Predictions for 2024

1. Still no housing bubble

This was number one on my list last year and, so far, my forecast was spot on. The reason why I’m calling it out again is because the market performed better in 2023 than I expected. Continued price growth, combined with significantly higher mortgage rates, might suggest to some that the market will implode in 2024, but I find this implausible.

2. Mortgage rates will drop, but not quickly

The U.S. economy has been remarkably resilient, which has led the Federal Reserve to indicate that they will keep mortgage rates higher for longer to tame inflation. But data shows inflation and the broader economy are starting to slow, which should allow mortgage rates to ease in 2024. That said, I think rates will only fall to around 6% by the end of the year.

3. Listing activity will rise modestly

Although I expect a modest increase in listing activity in 2024, many homeowners will be hesitant to sell and lose their current mortgage rate. The latest data shows 80% of mortgaged homeowners in the U.S. have rates at or below 5%. Although they may not be inclined to sell right now, when rates fall to within 1.5% of their current rate, some will be motivated to move.

4.Home prices will rise, but not much

While many forecasters said home prices would fall in 2023, that was not the case, as the lack of inventory propped up home values. Given that it’s unlikely that there will be a significant increase in the number of homes for sale, I don’t expect prices to drop in 2024. However, growth will be a very modest 1%, which is the lowest pace seen for many years, but growth all the same.

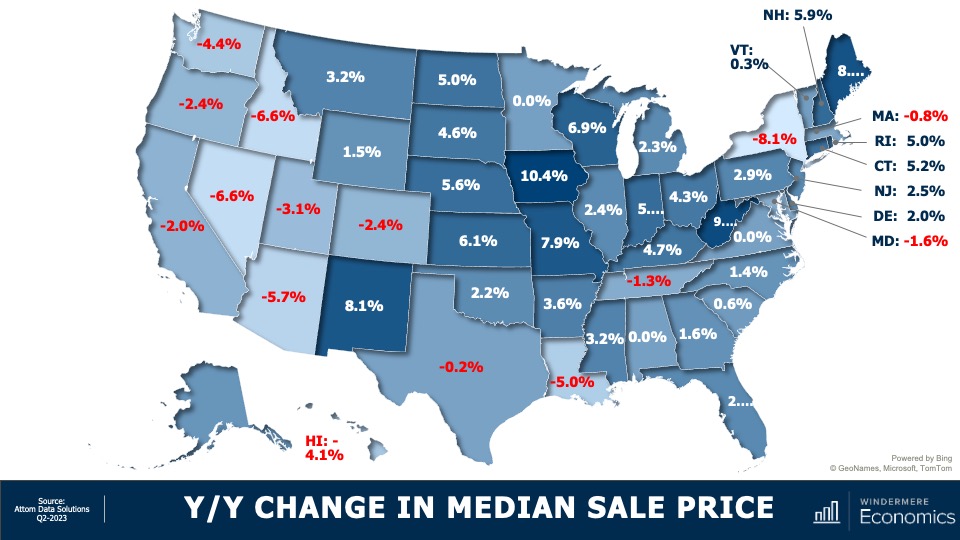

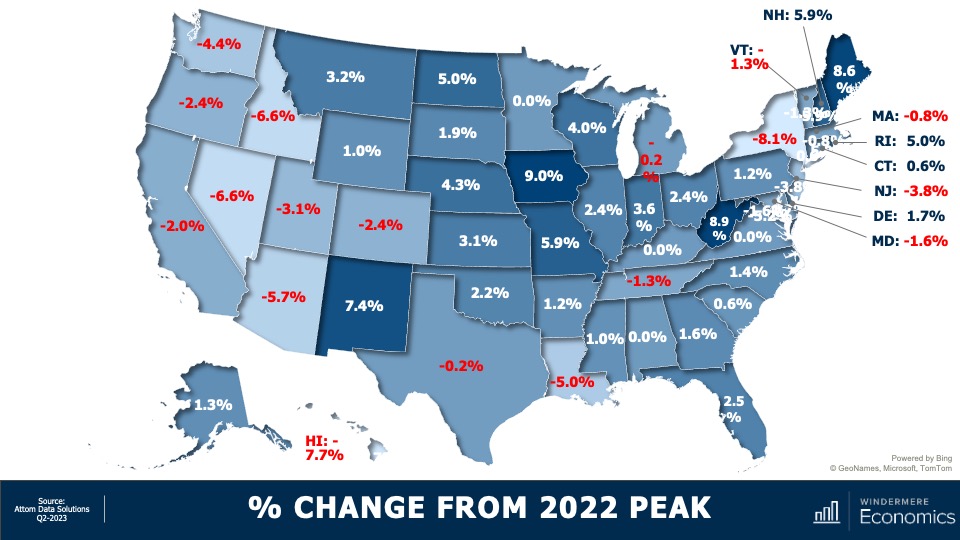

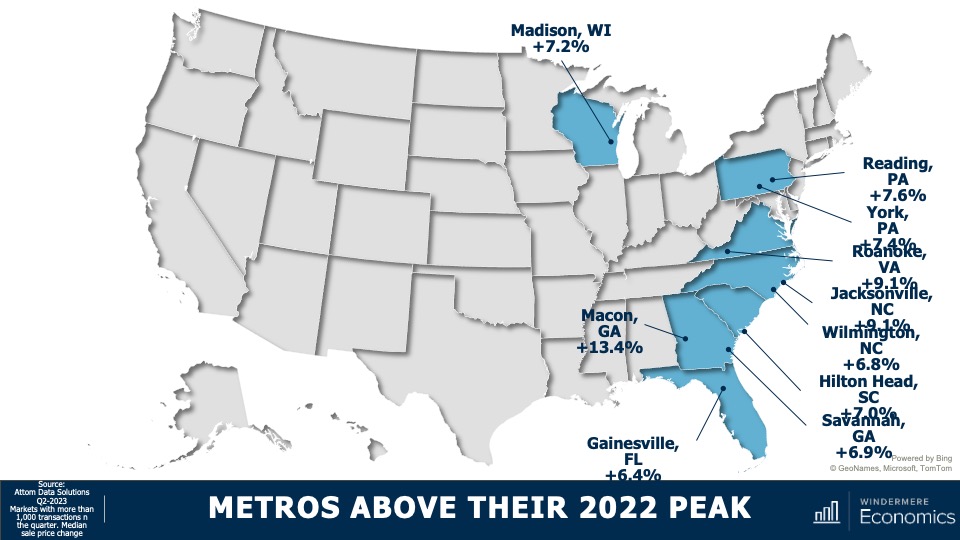

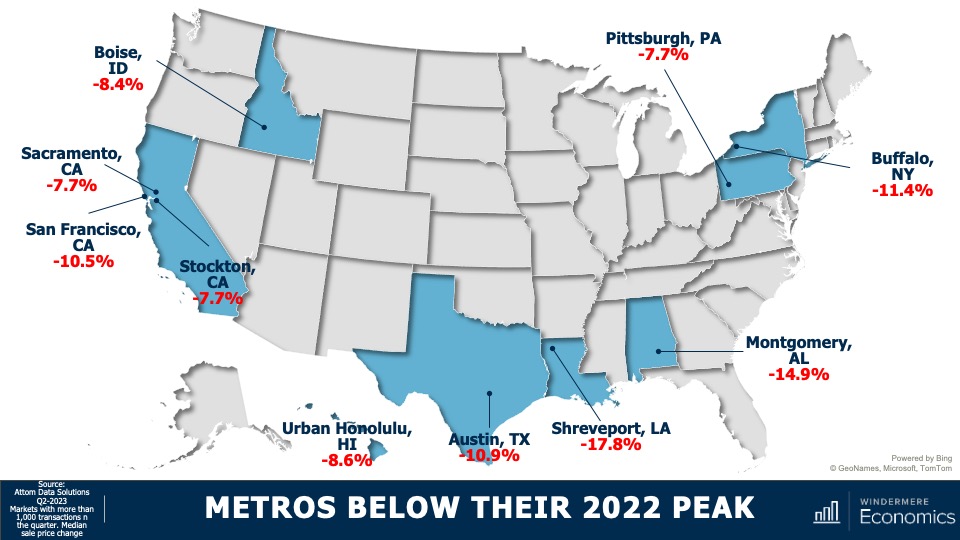

5. Home values in markets that crashed will recover

During the pandemic there were a number of more affordable markets across the country that experienced significant price increases, followed by price declines post-pandemic. I expected home prices in those areas to take longer to recover than the rest of the nation, but I’m surprised by how quickly they have started to grow, with most markets having either matched their historic highs or getting close to it – even in the face of very high borrowing costs. In 2024, I expect prices to match or exceed their 2022 highs in the vast majority of metro areas across the country.

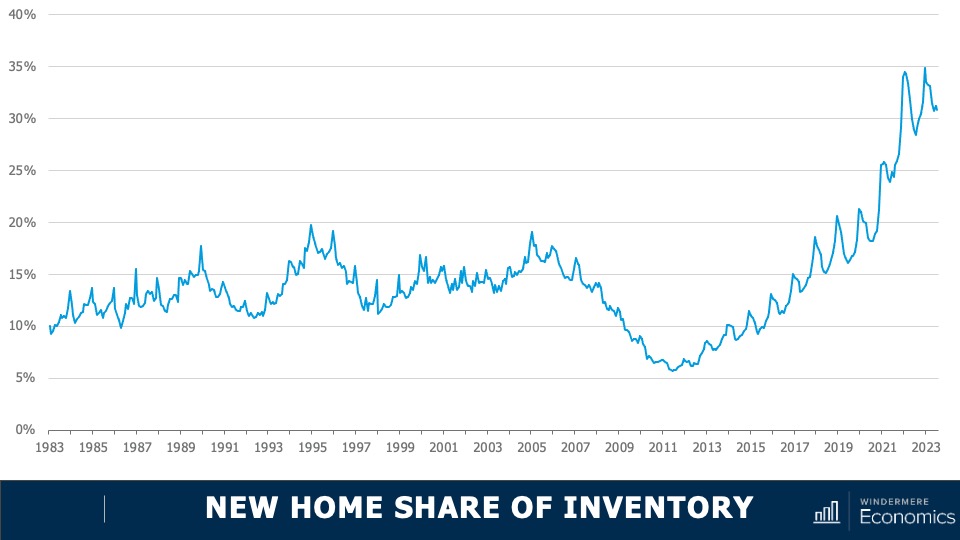

6. New construction will gain market share

Although new construction remains tepid, builders are benefiting from the lack of supply in the resale market and are taking a greater share of listings. While this might sound like a positive for builders, it’s coming at a cost through lower list prices and increased incentives such as mortgage rate buy downs. Although material costs have softened, it will remain very hard for builders to deliver enough housing to meet the demand.

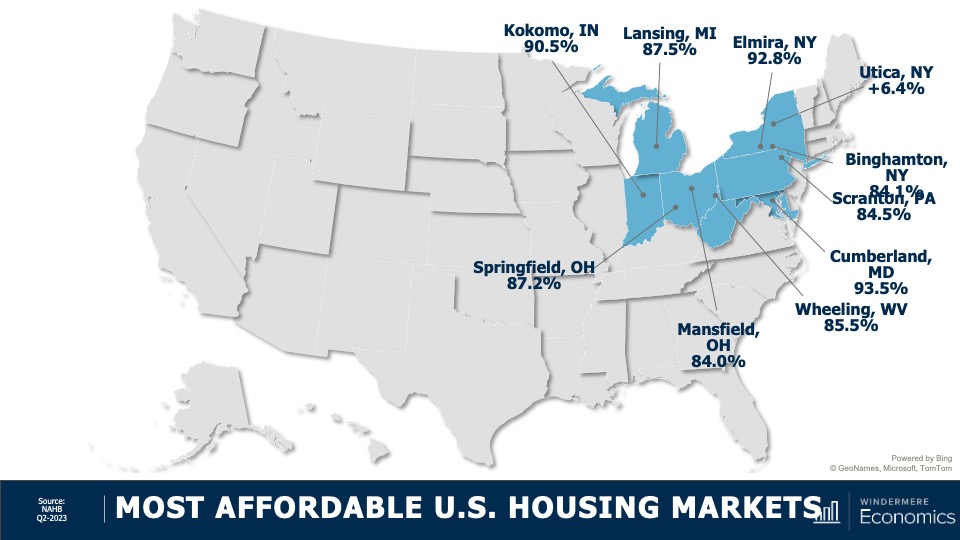

7. Housing affordability will get worse

With home prices continuing to rise and the pace of borrowing costs far exceeding income growth, affordability will likely erode further in 2024. For affordability to improve, it would require either a significant drop in home values, a significant drop in mortgage rates, a significant increase in household incomes, or some combination of the three. But I’m afraid this is very unlikely. First-time home buyers will be the hardest hit by this continued lack of affordable housing.

8. Government needs to continue taking housing seriously

The government has started to take housing and affordability more seriously, with several states already having adopted new land use policies aimed at releasing developable land. In 2024, I hope cities and counties will continue to ease their restrictive land use policies. I also hope they’ll continue to streamline the permitting process and reduce the fees that are charged to builders, as these costs are passed directly onto the home buyer, which further impacts affordability.

9. Foreclosure activity won’t impact the market

Many expected that the end of forbearance would bring a veritable tsunami of homes to market, but that didn’t happen. At its peak, almost 1-in-10 homes in America were in the program, but that has fallen to below 1%. That said, foreclosure starts have picked up, but still remain well below pre-pandemic levels. Look for delinquency levels to continue rising in 2024, but they will only be returning to the long-term average and are not a cause for concern.

10. Sales will rise but remain the lowest in 15 years

2023 will likely be remembered as the year when home sales were the lowest since the housing bubble burst in 2008. I expect the number of homes for sale to improve modestly in 2024 which, combined with mortgage rates trending lower, should result in about 4.4 million home sales. Ultimately though, demand exceeding supply will mean that sellers will still have the upper hand.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Western Washington Real Estate Market Update – Q3 2023

Q3 2023 Western Washington Real Estate Market

By Windermere Economics

The following analysis of select counties of the Western Washington real estate market is provided by Windermere Real Estate. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The pace of job growth continues to slow in Western Washington, as the region added only 21,907 new positions over the past 12 months. This represented a growth rate of 1.4%, which was the lowest pace of new jobs added since the pandemic ended.

The regional unemployment rate in August was 5.8%, which was marginally below the 6% rate we saw in the same quarter in 2022. A few smaller counties lost jobs over the past 12 months while King County’s employment levels rose a meager .4%, mainly due to job losses in the technology sector. I’ve said before that I’m not convinced that the U.S. is going to enter a recession; I still stand by that theory. Slowing job growth does not necessarily need to be a precursor to a recession, but I expect that we will see lackluster growth until next spring at the earliest.

Western Washington Home Sales

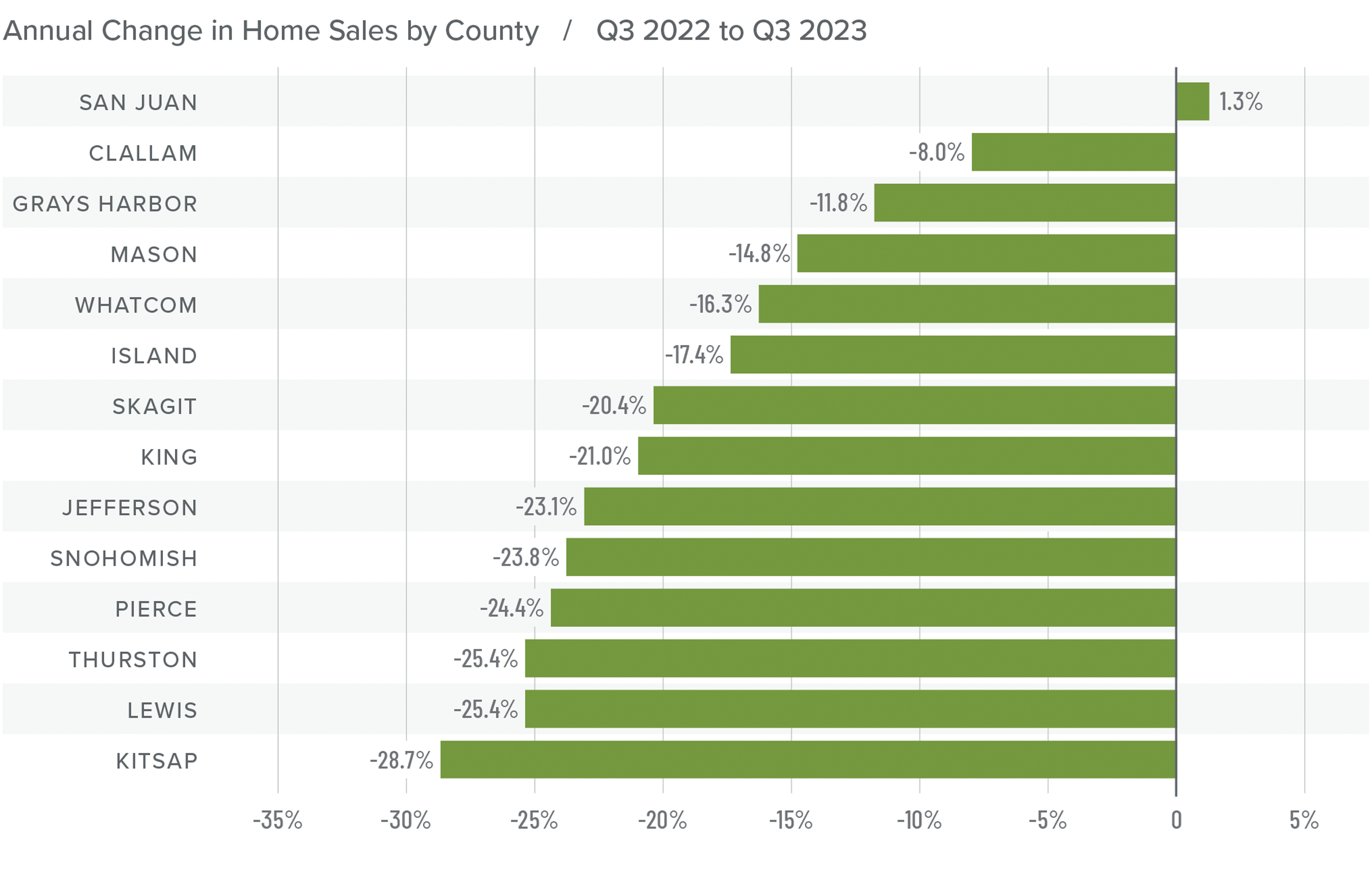

❱ In the third quarter of 2023, 14,970 homes sold. This was down 22% from the third quarter of 2022 and 1% lower than in the second quarter of this year.

❱ Sales fell even as the average number of homes for sale increased 29.5% from the second quarter. This is clearly a sign that significantly higher mortgage rates are having an impact on the market.

❱ Sales fell in all counties except San Juan compared to the third quarter of 2022. They were up in 9 of the 14 counties covered in this report compared to the second quarter of 2023. San Juan, Mason, Grays Harbor, and Whatcom counties saw significant increases.

❱ Pending sales fell 6% compared to the second quarter of this year, suggesting that closings in the upcoming quarter may be lackluster unless mortgage rates fall, which I think is highly unlikely.

Western Washington Home Prices

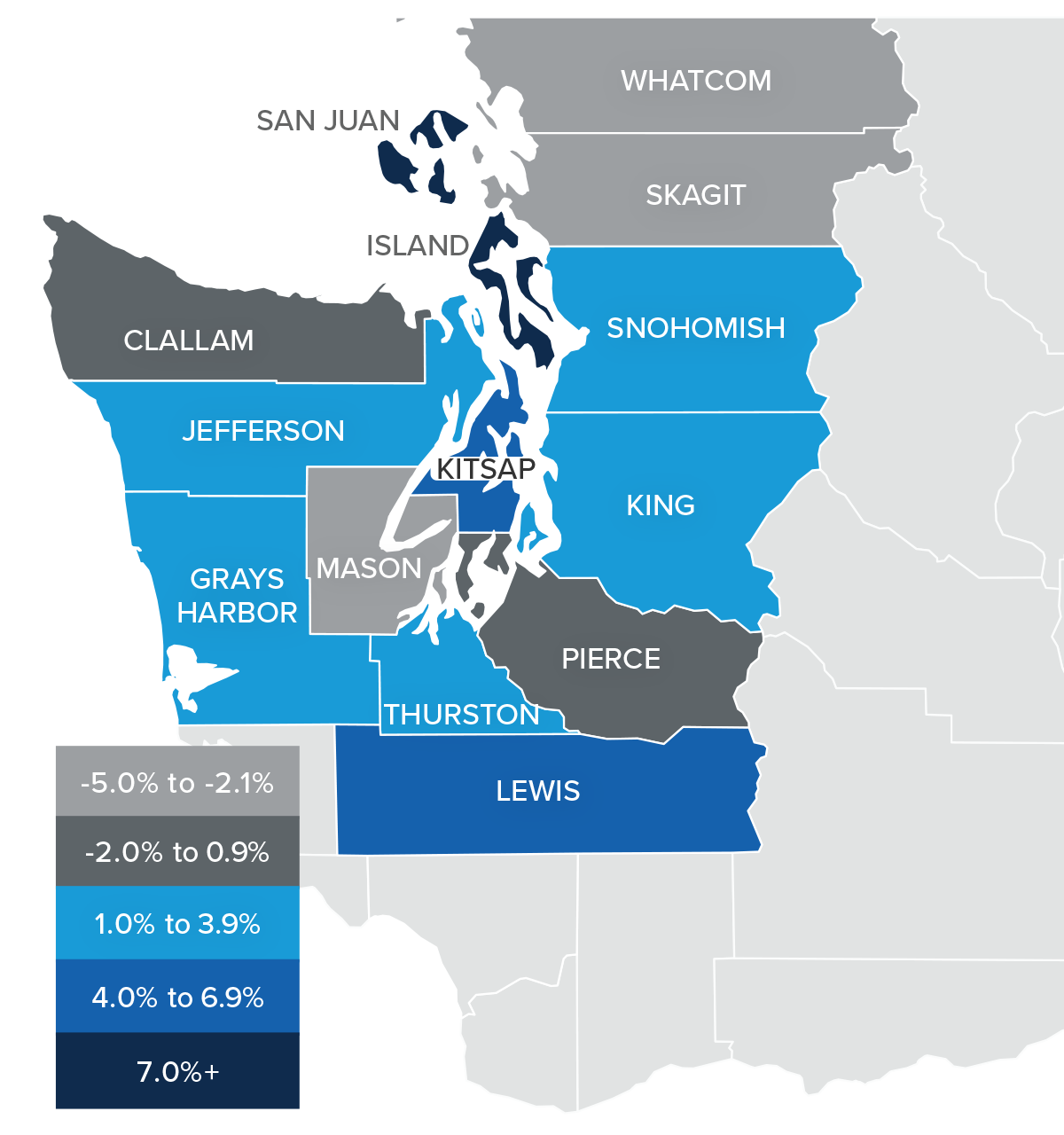

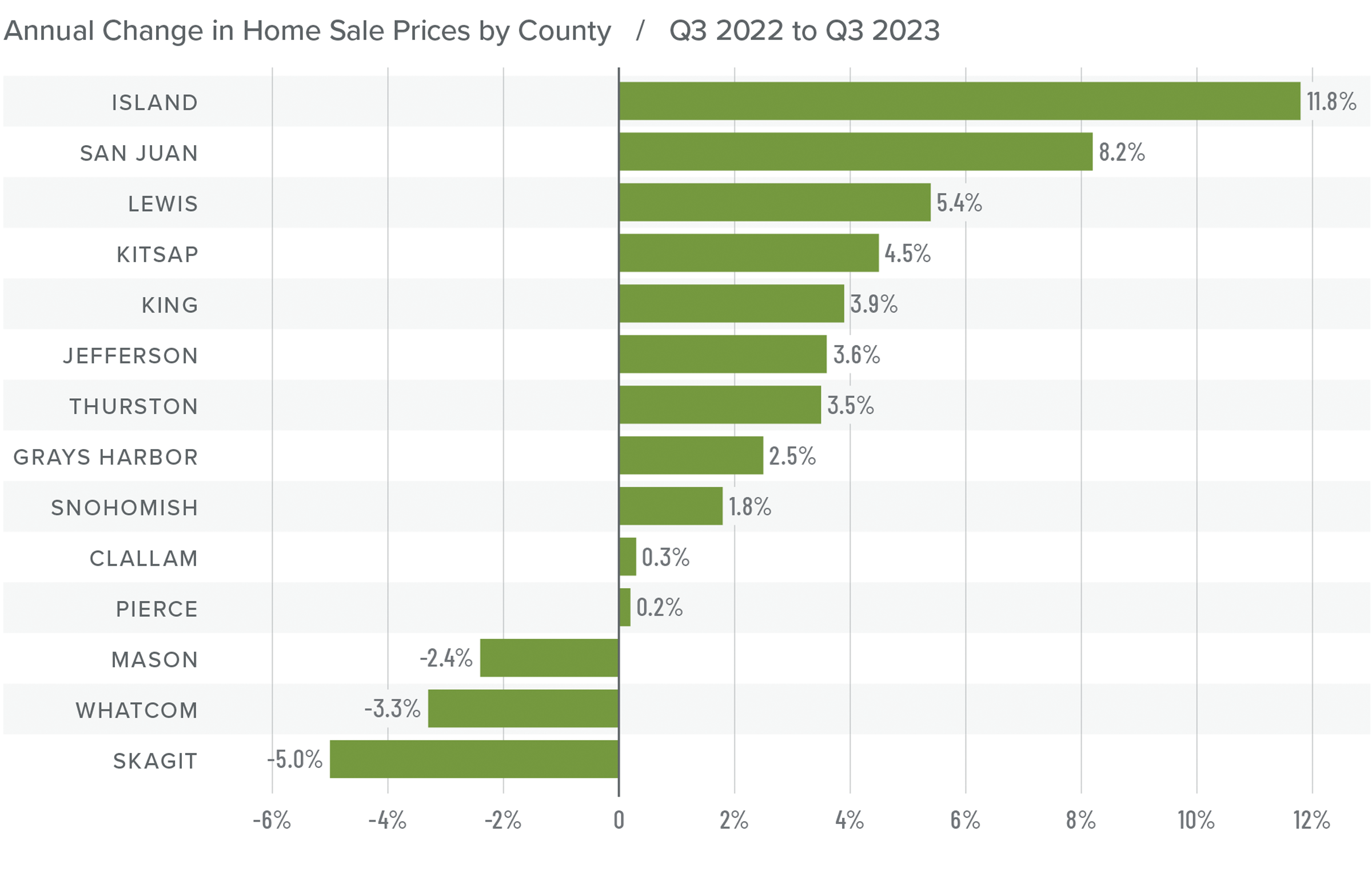

❱ Prices rose 2.8% compared to the third quarter of 2022 and were .6% higher than in the second quarter of this year. The average home sale price was $776,205.

❱ Compared to the second quarter of this year, sale prices were higher in all counties except Grays Harbor (-.5%), Kitsap (-1.5%), Clallam (-1.6%), Whatcom (-2.6%), and Skagit (-3%).

❱ Compared to the prior year, the pace of price growth slowed in the third quarter. This wasn’t too surprising given that the market was coming off record high prices in the summer of 2022. But what was surprising was that prices rose over the previous quarter despite the fact that mortgage rates were above 7% for almost the entire quarter.

❱ I don’t expect prices to move far from current levels in the coming months, and they likely won’t rise again until mortgage rates start to fall. When prices do rise, I anticipate that the pace of growth will be far more modest than we have become accustomed to.

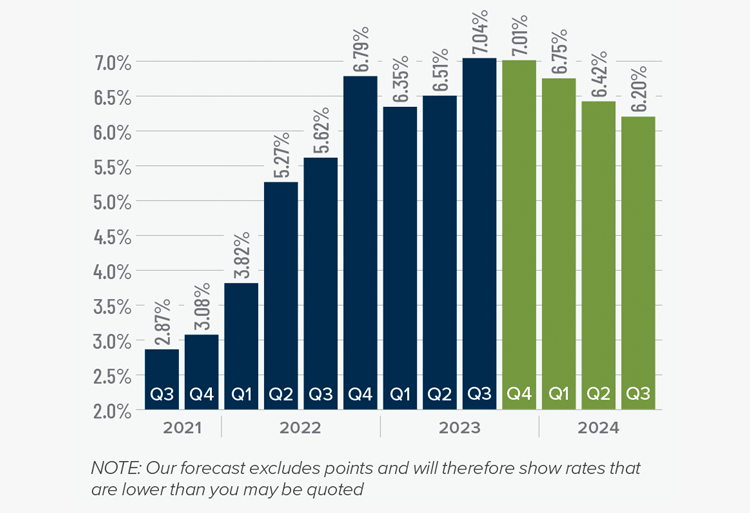

Mortgage Rates

Mortgage rates continued trending higher in the third quarter of 2023 and are now at levels we have not seen since the fall of 2000. Mortgage rates are tied to the interest rate (yield) on 10-year treasuries, and they move in the opposite direction of the economy. Unfortunately for mortgage rates, the economy remains relatively buoyant, and though inflation is down significantly from its high, it is still elevated. These major factors and many minor ones are pushing Treasury yields higher, which is pushing mortgage rates up. Given the current position of the Federal Reserve, which intends to keep rates “higher for longer,” it is unlikely that home buyers will get much reprieve when it comes to borrowing costs any time soon.

With such a persistently positive economy, I have had to revise my forecast yet again. I now believe rates will hold at current levels before starting to trend down in the spring of next year.

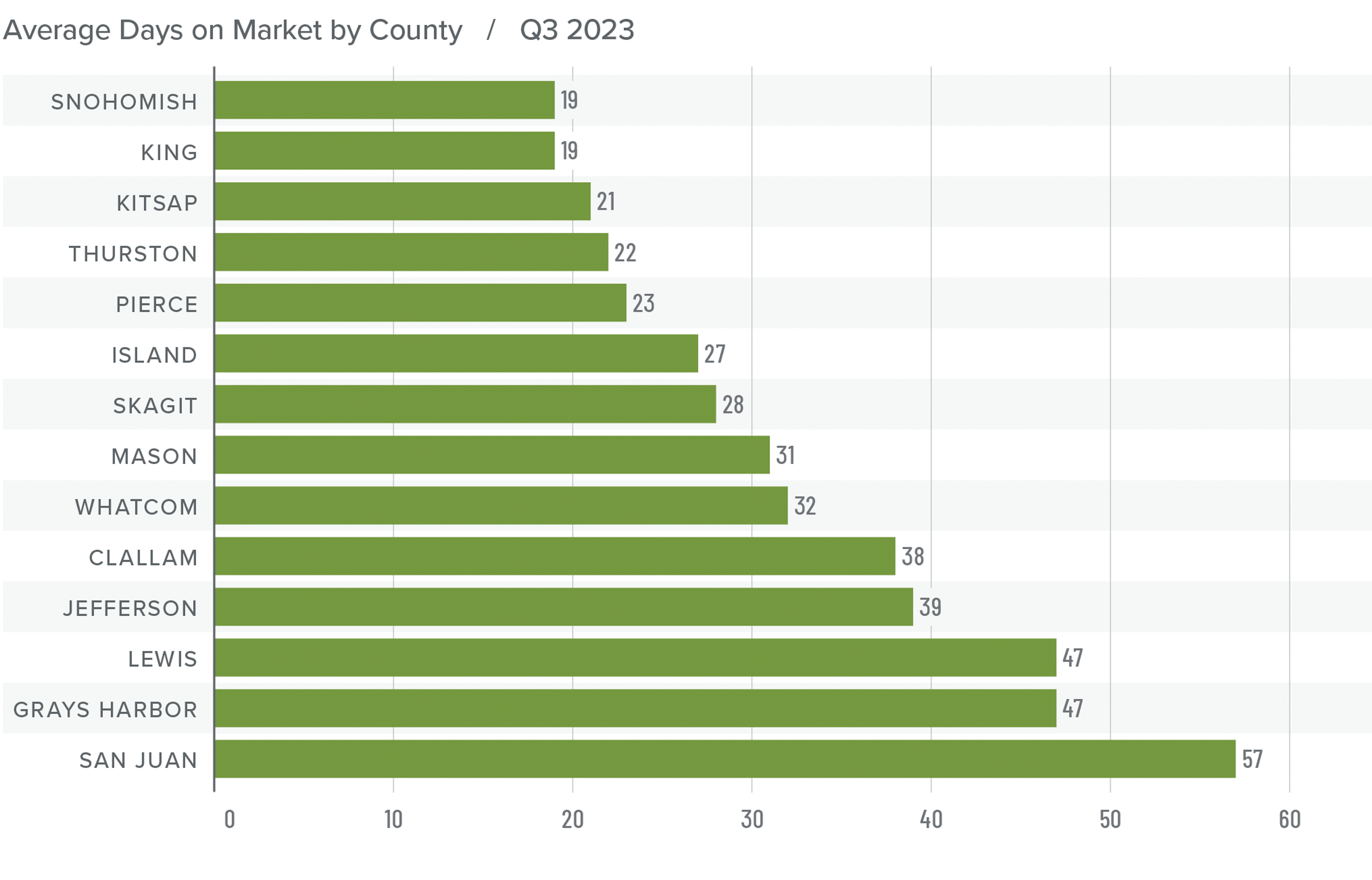

Western Washington Days on Market

❱ It took an average of 32 days for homes to sell in the third quarter of 2023. This was 8 more days than in the same quarter of 2022, but 3 fewer days compared to the second quarter of this year.

❱ Snohomish and King counties were the tightest markets in Western Washington, with homes taking an average of only 19 days to find a buyer. Homes for sale in San Juan County took the longest time to find a buyer (57 days).

❱ All counties except Snohomish saw average days on market rise from the same period in 2022. Market time fell in 9 of the 14 counties compared to the prior quarter.

❱ The greatest fall in market time compared to the second quarter was in San Juan County, where market time fell 23 days.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although it was good that listing activity rose in the third quarter, it still remains well below levels that can be considered normal. This is unlikely to change anytime soon given that over 86% of Washington homeowners with mortgages have an interest rate below 5% and more than a quarter have rates at or below 3%. There is little incentive for them to sell if they don’t have to.

More germane is the disconnect between what homeowners believe their homes are worth and what buyers can afford with mortgage rates in the mid-7% range. Most sellers appear to be getting their asking prices, or very close to it, which reflects their confidence in the market. However, home buyers are being squeezed by multi-decade high borrowing costs.

It is all quite a quandary. However, taking all the factors into consideration, sellers still have the upper hand but not enough to move the needle from the position it was in last quarter

Given all the factors discussed above, the needle stays in the same position as the last quarter. The market still heavily favors sellers, but if rates rise much further, headwinds will likely increase.

Given all the factors discussed above, the needle stays in the same position as the last quarter. The market still heavily favors sellers, but if rates rise much further, headwinds will likely increase.

U.S. Housing Market 2023: Updated Analysis

U.S. Housing Market 2023: Updated Analysis

Windermere Chief Economist Matthew Gardner gives an updated analysis of the U.S. housing market in 2023, using data released by The National Association of REALTORS® on listing activity, home sales, price growth, and more.

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

U.S. Housing Market 2023

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner and welcome to this month’s episode of Monday with Matthew. The National Association of REALTORS® released their data on the U.S. housing market in August, and it contained a few things which I found interesting and wanted to share with you.

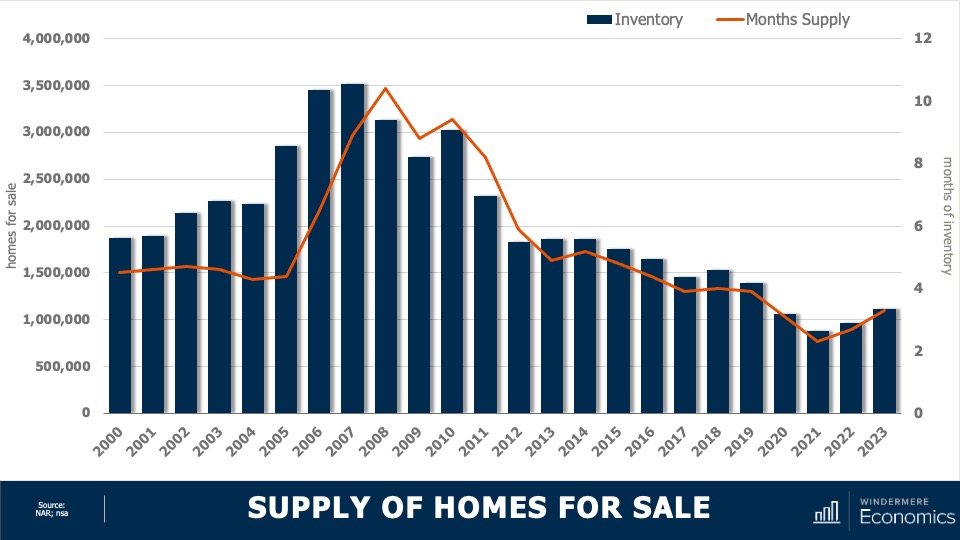

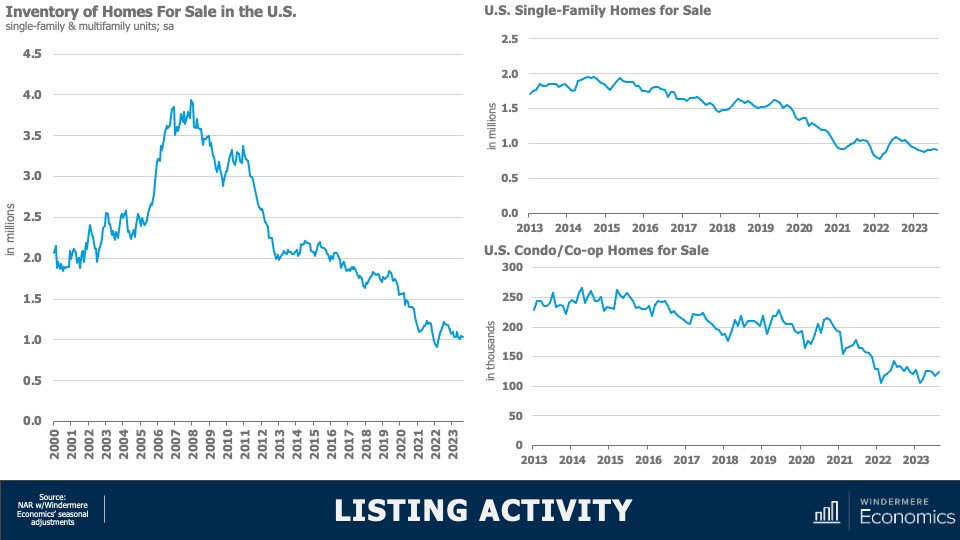

Listing Activity

As you can clearly see here, the number of homes for sale remains at close to historic lows. When adjusted for seasonality, there were just 1.03 million single-family and condominium homes for sale in the month of August, and that’s down 8.3% from a year ago and the second lowest level in 2023. When adjusted for seasonal variations, there were just over 911,000 single-family homes for sale in the month, that’s 15% lower than a year ago and 36% below August of 2019. And the condominium market is not faring any better with just over 123,000 units available for purchase, listing activity was down year-over-year by just over 9%.

Homes for Sale August 2023

And to give you a little different perspective, this chart shows you the total number of units for sale in the month of August going back more than 20 years and I think it gives a pretty good indication as to how tight the U.S. housing market really is.

Now, we’ve talked before about the reasons why supply is so limited, and the blame is almost totally attributable to mortgage rates with sellers remarkably reluctant to move because that would mean losing the historically low mortgage rate that they currently benefit from. And as the old saying goes, “you can’t buy what’s not for sale,” and this is certainly true in the housing market today.

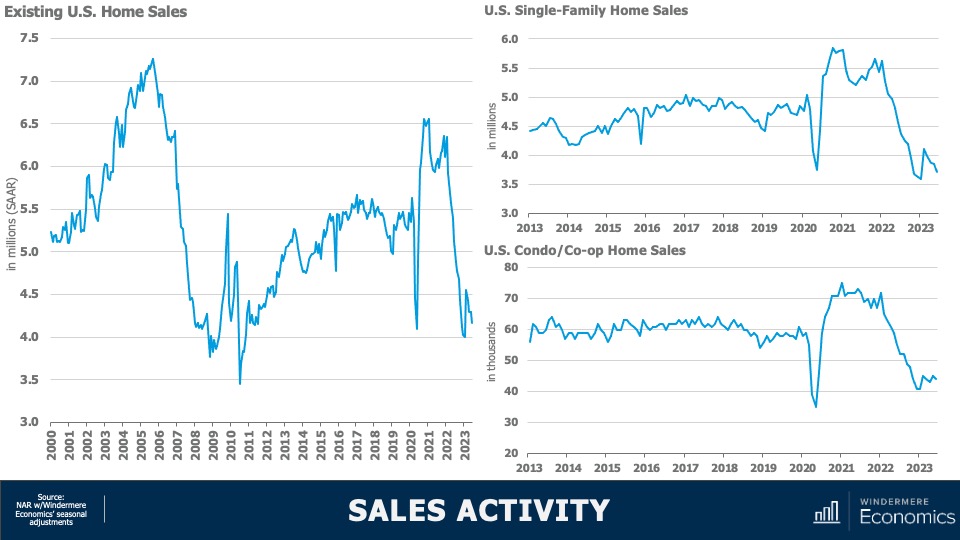

U.S. Housing Market 2023: Sales Activity

With such limited choice in the marketplace, it’s unsurprising to see home sales having plummeted following the pandemic induced surge we saw in 2021. At an annual sales rate of 4.04 million units, that is only 40,000 more than the low seen this January and we are now holding at levels we haven’t seen since 2010. Interestingly, single-family sales did see a little jump at the start of this year, but they have since pulled back—likely a function of rising financing costs, which were getting close to 7% in June.

But the condominium market, while certainly down significantly, appears to be somewhat more resilient. I find this interesting as we have not seen any palpable increase in listing activity for multifamily units.

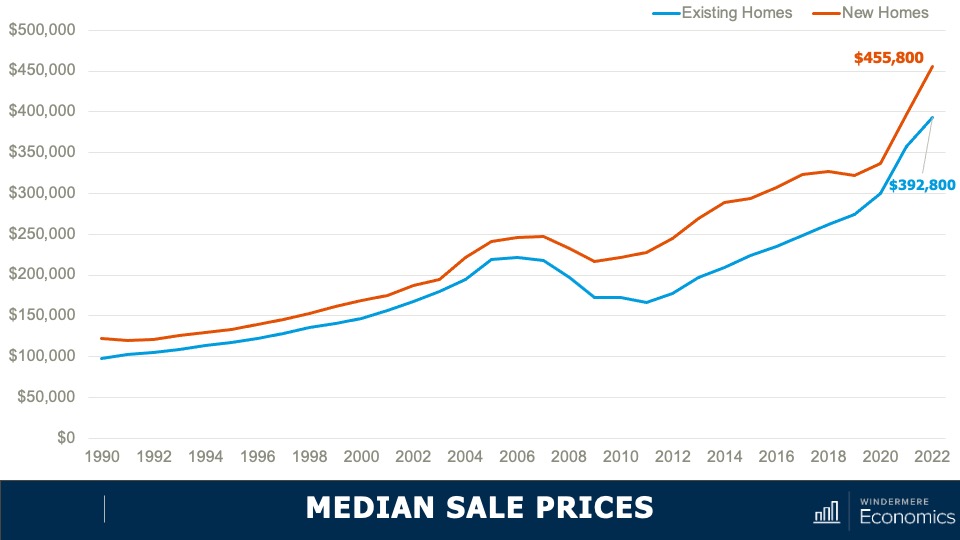

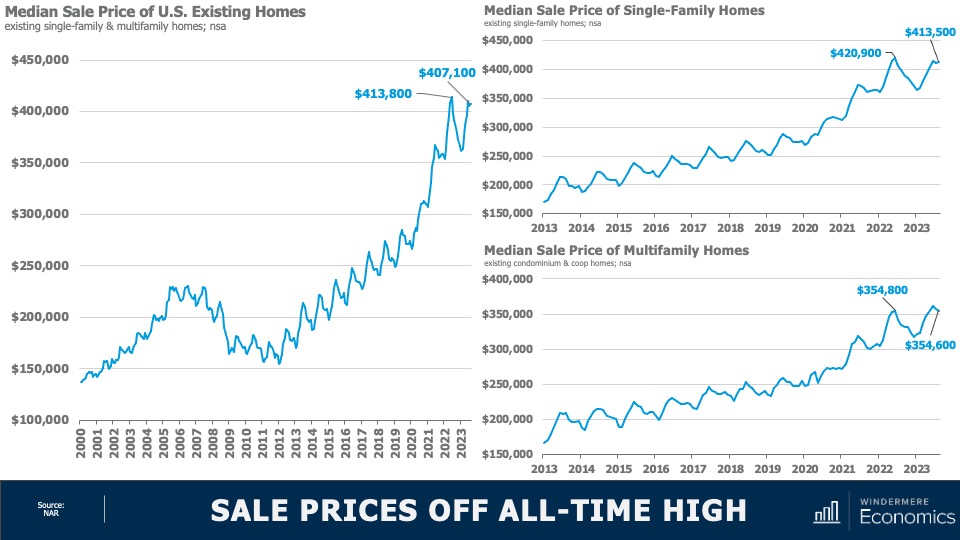

Home Sale Prices Off All-Time High

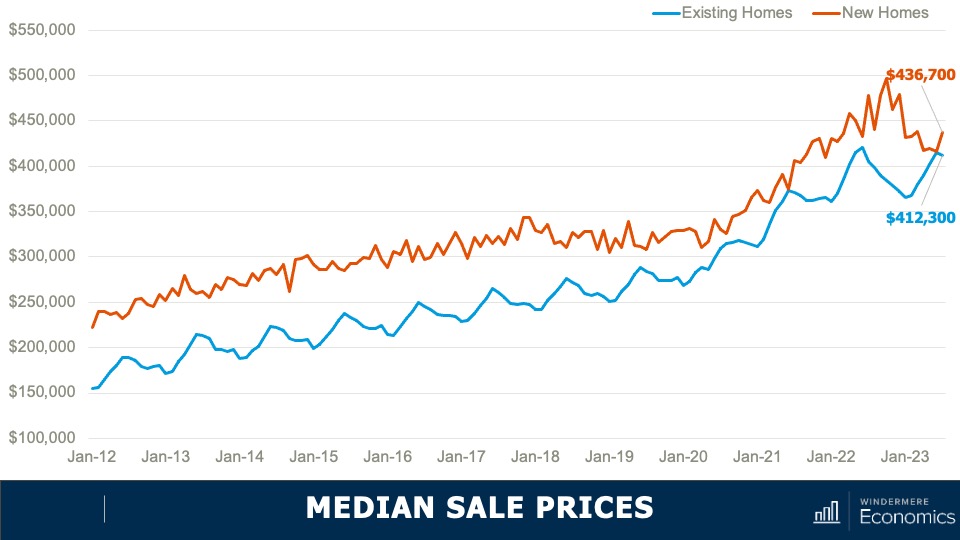

When prices started to fall in the summer of 2022, many expected to see them continue to plunge in a manner similar to that seen following 2007 collapse, but that has certainly not been the case. Sale prices have rebounded and remain remarkably resilient—especially given significantly higher financing costs.

- Although we did see a small drop in home prices between June and July of this year, U.S. home prices are only 1.6% below their 2022 peak; they’re up 3.9% year over year; and up by 11.1% from the start of 2023.

Single-family home prices paint a similar picture with prices down by 1.8% from peak; but up 3.7% year over year, and up 11.2% from the start of the year. Interestingly, sale prices in the Northeast were actually 3.5% higher in August than their 2022 peak. And condominium prices are just 0.1% below the high seen in June of last year. Prices are now up 6.2% year over year and are 11.6% higher than we saw at the end of 2022.

Now, of course the data shown here is unlikely to reflect the recent surge in mortgage rates so it will be interesting to see what impact that has not just on sales but sale prices when the September and October data is published.

My intuition suggests that—even with mortgage rates where they are today—as long as they don’t move significantly higher, prices at the national level are unlikely to collapse. But I do see sales volumes pulling back further as listing activity remains very constrained.

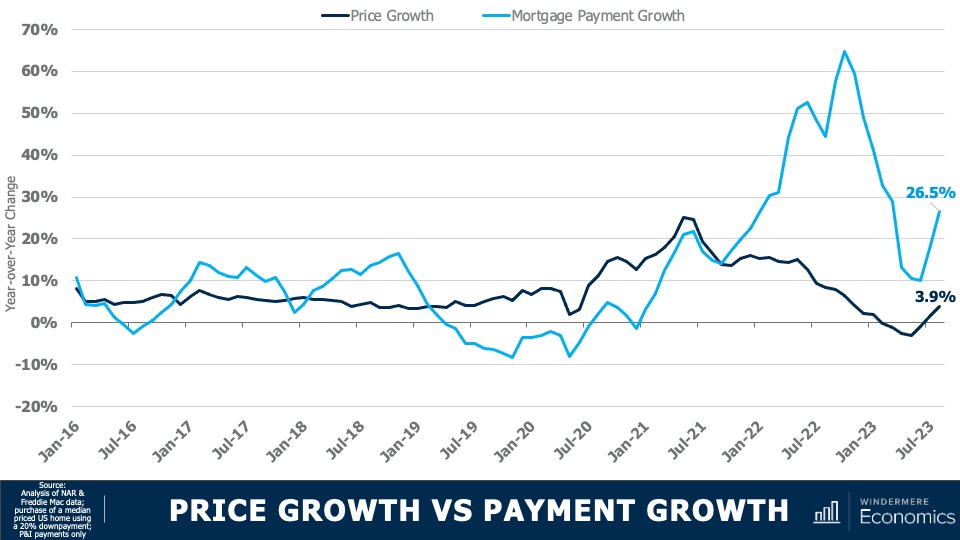

Price Growth vs Payment Growth

This chart shows a different way to look at the impact that mortgage rates are having on the market. The dark blue line shows year-over-year home price growth, and the light blue line shows the 12-month change in average mortgage payments.

Although we did see that annual growth in mortgage payments fall to just 10% in June of this year—the first time we have seen that since 2021—it has subsequently jumped back up. This means that a buyer of a median priced house in the U.S. is faced with payments that are 26 and a half percent higher than they were 12 months ago. At the same time, home price growth has stalled.

As I’ve mentioned in several past videos, I find it unlikely that inventory levels will increase significantly in 2023, and I also believe that supply will be constrained next year as well as rates remain at elevated levels.

As we know, it is this lack of inventory that has helped to support home prices; however, there is a breaking point. 10-year bond yields are holding at multi-year highs and do not appear to be thinking of pulling back at any time soon—especially given new bond issuances that the country is going bring to market in order to address our burgeoning debt levels.

And it’s because of this that I now expect to see rates remaining higher for longer, and the question then becomes how much tolerance will buyers have if mortgage rates hold where they are today or if they head closer to 8%.

Although I am not expecting this to happen, it is possible. And if it does, then sales will fall further and the underpinning of price stability will certainly be eroded. And there you have it. As always, I’d love to hear your thoughts on this subject so feel free to leave your comments below. Until next month, stay safe out there and I’ll see you soon. Bye now.

To see the latest housing data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Coats for Kids Whidbey Island Charity Drive 2023

❄️ Windermere Whidbey’s Coats for Kids Drive is BACK!

We are proud to announce our sponsorship for another year of Coats for Kids!

This Charity is being spearheaded by Paula Peters from our property management division in partnership with the Readiness to Learn Foundation. We are on a mission to ensure no child goes cold this winter on Whidbey Island.

📆 Date: Now through mid-November

Key Highlights:

🌟 Six Glorious Years: This marks our sixth annual Coats for Kids drive. Over the past years, we’ve donated an astounding 1,200+ pieces of cold-weather clothing, with a significant majority being essential coats and jackets!

📦 Donation Boxes: If you would like to HELP, please drop off NEW coats and boots at our offices in Freeland or Langley through mid November

Freeland Office

360/331-6636 5531

5531 Freeland Avenue

Langley Office

360/221-8898

223 Second Street

💌 Distance No Bar: Purchase items online and have items shipped to our offices! Heartwarming support pours in from all corners, including a recent kind donation from a continued supporter in Florida!

💵 Monetary Donations: If you’re considering a monetary contribution, please write checks payable to “Readiness to Learn”.

Our 2023 Goal:

🎯 100 Coats/Jackets! Alongside, we’ll happily accept rain boots, cozy hats, mittens, gloves, and warm socks.

📲 For our tech-savvy supporters, keep an eye out for our Amazon Wish List. After its success last year, it’s making a comeback!

🙏 When you donate, do let Paula know. Every contributor deserves a heartfelt acknowledgment!

🌈 Donations can range from toddler sizes to adult, and any color is welcome. Just a small reminder, please ensure all donated items are BRAND NEW WITH TAGS.

Spread the Word:

🔊 Let’s amplify our reach! Inform your clients, chat with your family, call up your friends, and let’s come together as a community for this noble cause.

Warm Hearts Make Warm Kids! Join us in this heartwarming endeavor and ensure every child on Whidbey Island experiences a cozy winter. Your contribution can make a world of difference! 🧡

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link