Local Look: Western Washington Housing Update – A Whidbey Island Perspective

This report provides a Local Look at the June 2025 Northwest MLS data, with a keen eye on how it impacts the Whidbey Island real estate market. There have been interesting shifts, and this analysis aims to offer a straightforward perspective, blending broader market insights with our hyper-local reality. The primary focus for tracking market supply and demand includes closed and pending sales, reflecting demand, and new and active listings, indicating supply.

I. The Northwest MLS Residential Sales: A Broader View

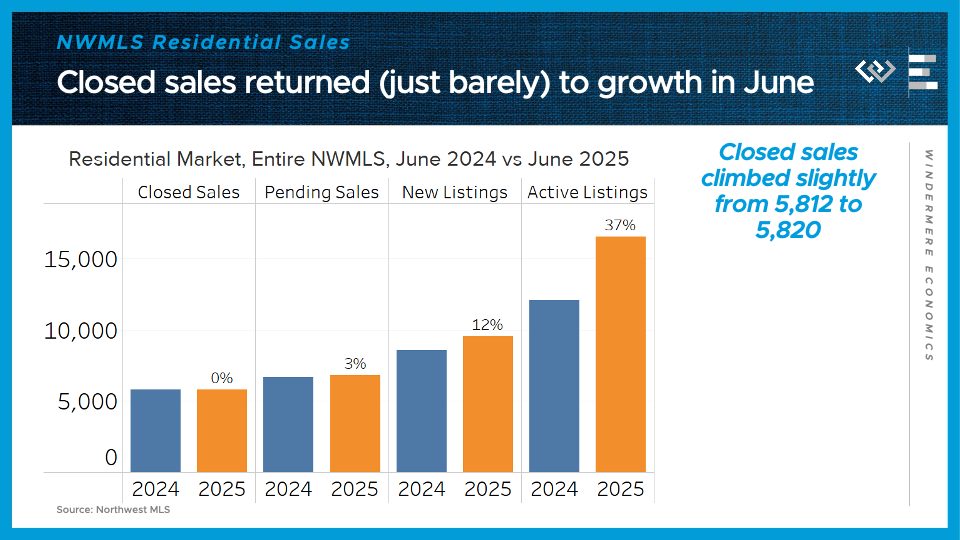

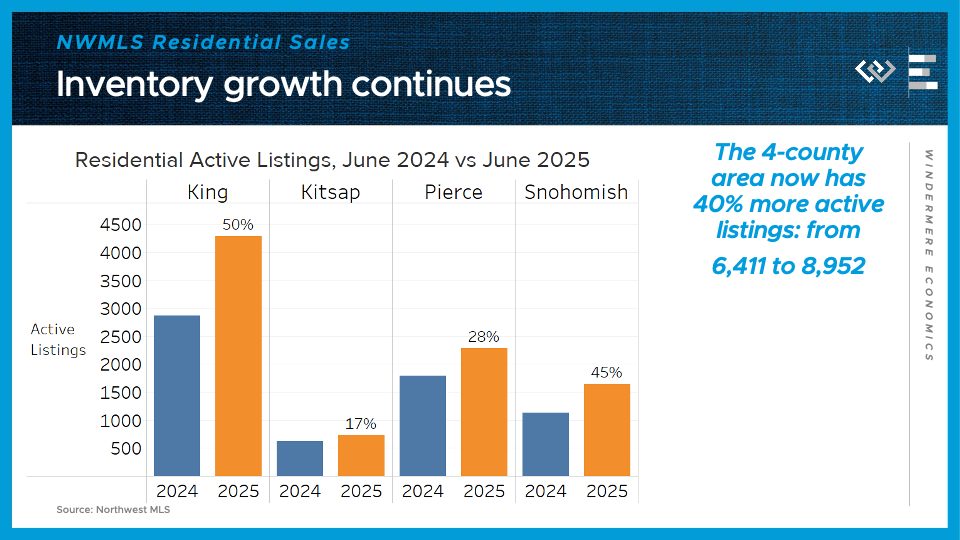

Following a dip in closed sales in May, which was attributed to fallout from stock market fluctuations and economic turmoil in April, the housing market has shown a rebound. June’s residential closed sales across the Northwest MLS were almost precisely at their year-ago level. Pending sales for single-family homes experienced a 3% year-over-year increase. On the supply side, new listings increased by approximately 12% this June, and the total of active listings at month-end was 37% higher than June 2024’s inventory. While this represents a significant increase in inventory, the pace of year-over-year growth has slightly decelerated from the 39% observed last month.

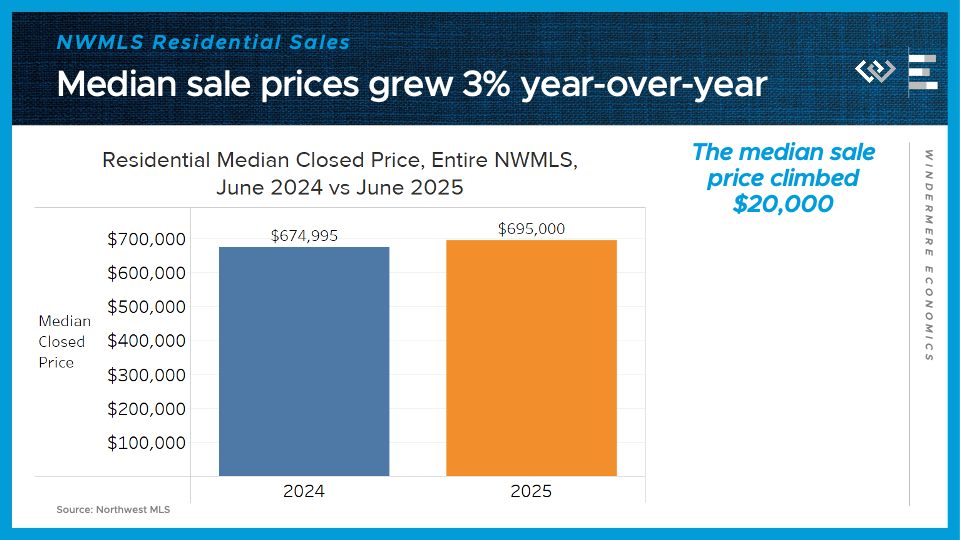

The median sale price for closed single-family home sales climbed 3% from last year, reaching $695,000. This reverses the 1% decline seen in May and establishes a new high-water mark for the year, exceeding the $680,000 price level in April. This indicates that buyers across Washington re-engaged with the market in June, driving both increased sales and higher prices. However, the current high level of inventory suggests that buyers will likely gain more negotiating power later this summer.

II. Whidbey Island Real Estate: Our Local Snapshot

Let's narrow our focus to our beloved Whidbey Island. While the broader Western Washington market provides context, a more precise understanding comes from examining our local communities. When it comes to Whidbey Island homes for sale, we track distinct trends, particularly in areas like Coupeville, Oak Harbor, Langley, Freeland, Clinton, and Greenbank.

Closed Sales: A Mixed Bag, Locally Speaking

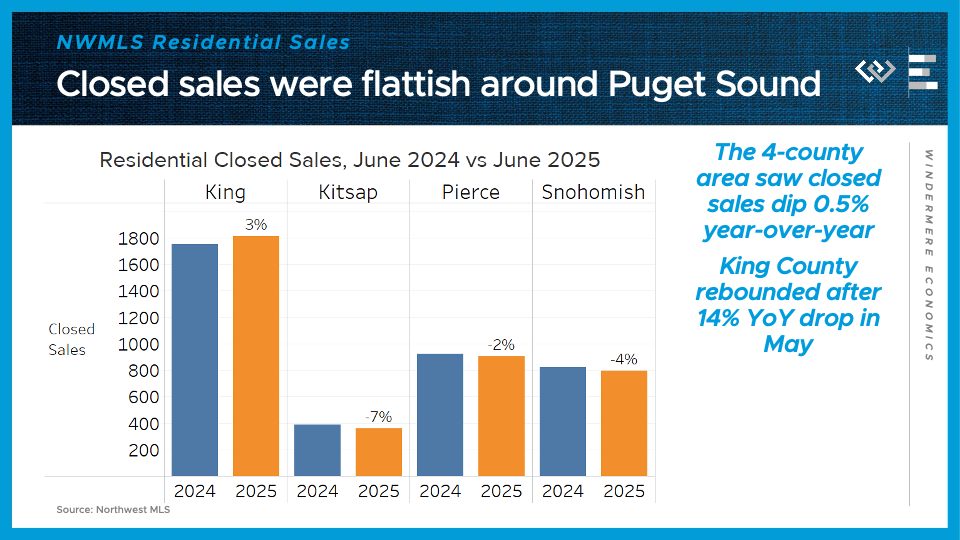

Residential closed sales in the four-county greater Seattle area saw a slight dip of just half a percent year-over-year. This was largely due to a 3% gain in King County offsetting minor declines in other counties. King County's recovery is particularly notable after its significant 14% year-over-year decline in May, suggesting that some buyers re-entered the market after an earlier pause.

On Whidbey Island, the latest data provides further insight into sales activity:

- For Coupeville & Oak Harbor, 382 homes have sold year-to-date, representing a notable 14% increase from 2024.

- In the combined South and Central Whidbey region (Clinton, Langley, Freeland & Greenbank), 143 homes have sold year-to-date, though this indicates an 11% decrease from 2024.

This demonstrates a clear divergence in sales volume across the island, with the northern part experiencing robust growth while the southern/central areas show a slight contraction. Understanding these hyper-local nuances is crucial, highlighting the benefit of partnering with a Whidbey Island Specialist.

Median Sales Prices: Whidbey Island's Upward Trajectory

While Snohomish County experienced a 2% decrease in median sale price, King County led with a 7% gain, surpassing the million-dollar mark once again. Kitsap and Pierce counties also saw price increases of 4% and 5%, respectively.

For Whidbey Island, median sales prices continue to show strength:

- In Coupeville & Oak Harbor, the median sales price over the last 30 days is $534,000, with an average sales price of $582,784. Homes in these areas are selling for an average of 97.5% of the list price.

- For Clinton, Langley, Freeland & Greenbank, the median sales price over the last 30 days stands at $806,250, with an average of $917,023. These properties are achieving an average of 97% of their list price.

These figures underscore the continued vitality of the Whidbey Island real estate market, reflecting consistent buyer demand.

Pending Sales: Mixed Signals

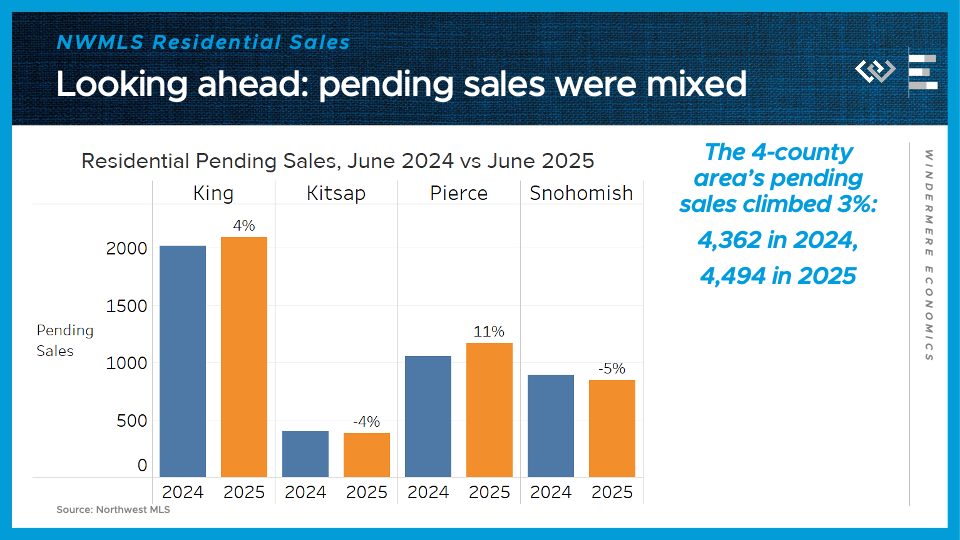

Looking ahead, pending sales across the greater Seattle region returned to modest year-over-year increases, totaling 3%. This was led by an 11% rise in Pierce County and a 4% rise in King County, though partially offset by declines of 4% in Kitsap and 5% in Snohomish County.

For Whidbey Island, weekly reports indicate:

- In Coupeville & Oak Harbor, there are currently 19 pending homes, with 8 properties experiencing price reductions. Over recent weeks, pending sales have fluctuated, peaking at 43.

- The Clinton, Langley, Freeland & Greenbank region currently has 10 pending homes and 10 price reductions. This area recently saw a peak of 20 pending homes.

This mixed activity in pending sales suggests that while demand is present, buyers are becoming more discerning, a trend that active listings will further emphasize.

Inventory Growth: Opportunities for Buyers

On the supply side, the four-county greater Seattle area had nearly 9,000 active listings at the end of June, representing a 40% increase from the same time last year. While substantial, this gain is a smaller percentage than the 45% year-on-year growth observed in May, indicating a deceleration in the inventory buildup.

Here on Whidbey Island, inventory levels reveal an interesting narrative:

- For Coupeville & Oak Harbor, there are currently 169 homes for sale. This translates to 3.0 months of inventory based on solds and 2.9 months based on pendings. This suggests a market that is largely balanced, leaning slightly towards sellers.

- The Clinton, Langley, Freeland & Greenbank region has 141 homes for sale. This represents 5.1 months of inventory based on solds and 5.4 months based on pendings. This notably higher inventory level shifts the balance more towards buyers in these areas.

This increasing inventory is favorable for buyers, offering more choices and potentially greater negotiating power as the summer progresses. For sellers, it underscores the importance of a well-presented and effectively priced property from the outset. Explore available homes through our Our Active Listings page.

III. Looking Ahead for Whidbey Island

The June report confirmed that greater-Seattle-region buyers re-engaged with the market in June, marking a return to a "new normal" in sales activity after a pause in April. As the seasonal cooldown in demand is anticipated, coinciding with the peak of summer, the market dynamic is likely to favor buyers who continue their home search in the second half of the year. Furthermore, increased inventory is expected to introduce some competitive pressure on sellers who have yet to receive offers.

For those considering a move to our beautiful island, exploring our Explore Whidbey Island guides can provide invaluable insights into communities like Coupeville, Oak Harbor, Langley, Freeland, and Greenbank.

The Whidbey Island Advantage: Partnering with a Local Expert

Statistics only tell part of the story. The true value lies in understanding how these numbers apply to your specific real estate goals on Whidbey Island. Whether buying a piece of island paradise or selling a current home, partnering with a local expert is essential. Windermere brokers on Whidbey Island possess an intimate knowledge of its diverse neighborhoods, unique features, and evolving market dynamics. The focus extends beyond mere transactions to fostering connections and building community—a reflection of the "Human Algorithm" philosophy in action.

Don’t just navigate the Whidbey Island real estate market; master it. We are here to provide the insights, strategies, and local connections that make all the difference. Ready to make a move? Connect with us today.

Are you ready to make your real estate goals a reality?

Local Look: Western Washington Housing Update – A Whidbey Island Perspective

By Windermere Whidbey |

3 Reasons To Buy a Home This Summer on Whidbey Island

By Windermere Whidbey |

A Whidbey Island Look: Making Sense of the Shifting Real Estate Market

By Windermere Whidbey |

Whidbey Island’s Ultimate Guide to Easter Egg Hunts

By Windermere Whidbey |

Top 10 Housing Predictions for 2024

By Windermere Whidbey |

Matthew Gardner’s Top 10 Housing Predictions for 2024

This video shows Windermere Chief Economist Matthew Gardner’s Top 10 Predictions for 2024. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market. See more market insights on our blog here.

Matthew Gardner’s Top 10 Predictions for 2024

1. Still no housing bubble

This was number one on my list last year and, so far, my forecast was spot on. The reason why I’m calling it out again is because the market performed better in 2023 than I expected. Continued price growth, combined with significantly higher mortgage rates, might suggest to some that the market will implode in 2024, but I find this implausible.

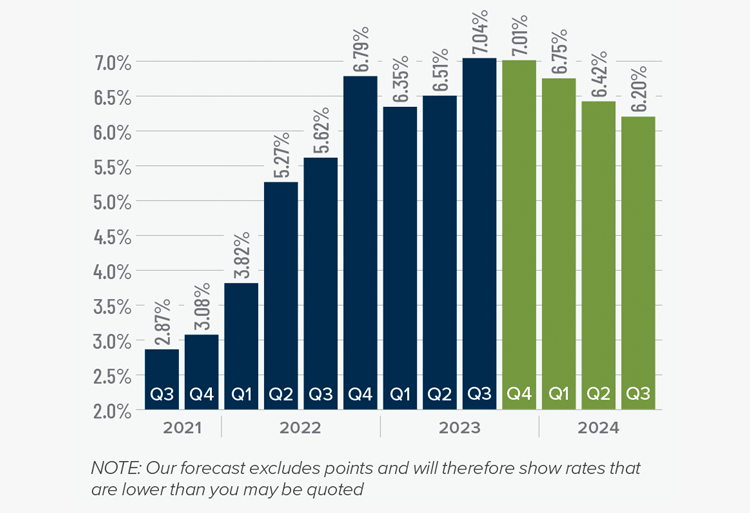

2. Mortgage rates will drop, but not quickly

The U.S. economy has been remarkably resilient, which has led the Federal Reserve to indicate that they will keep mortgage rates higher for longer to tame inflation. But data shows inflation and the broader economy are starting to slow, which should allow mortgage rates to ease in 2024. That said, I think rates will only fall to around 6% by the end of the year.

3. Listing activity will rise modestly

Although I expect a modest increase in listing activity in 2024, many homeowners will be hesitant to sell and lose their current mortgage rate. The latest data shows 80% of mortgaged homeowners in the U.S. have rates at or below 5%. Although they may not be inclined to sell right now, when rates fall to within 1.5% of their current rate, some will be motivated to move.

4.Home prices will rise, but not much

While many forecasters said home prices would fall in 2023, that was not the case, as the lack of inventory propped up home values. Given that it’s unlikely that there will be a significant increase in the number of homes for sale, I don’t expect prices to drop in 2024. However, growth will be a very modest 1%, which is the lowest pace seen for many years, but growth all the same.

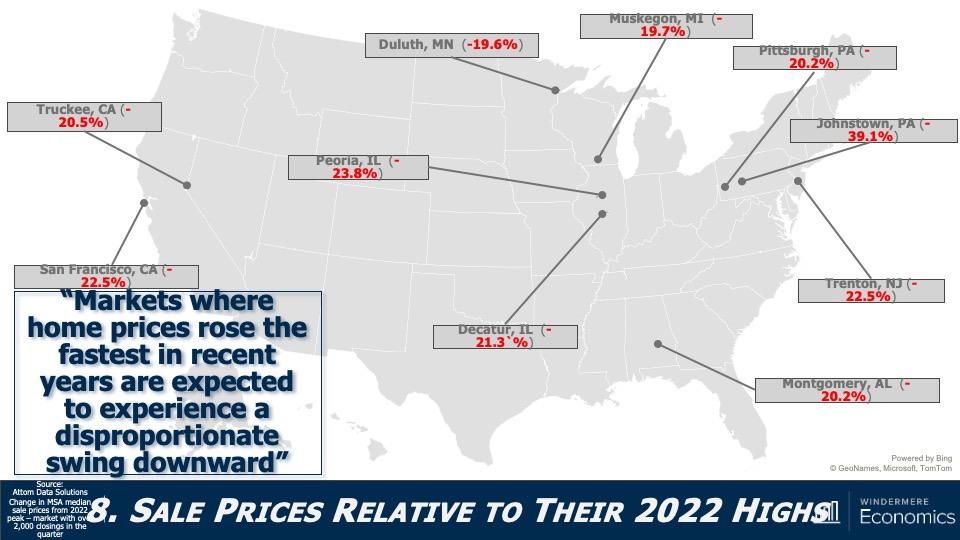

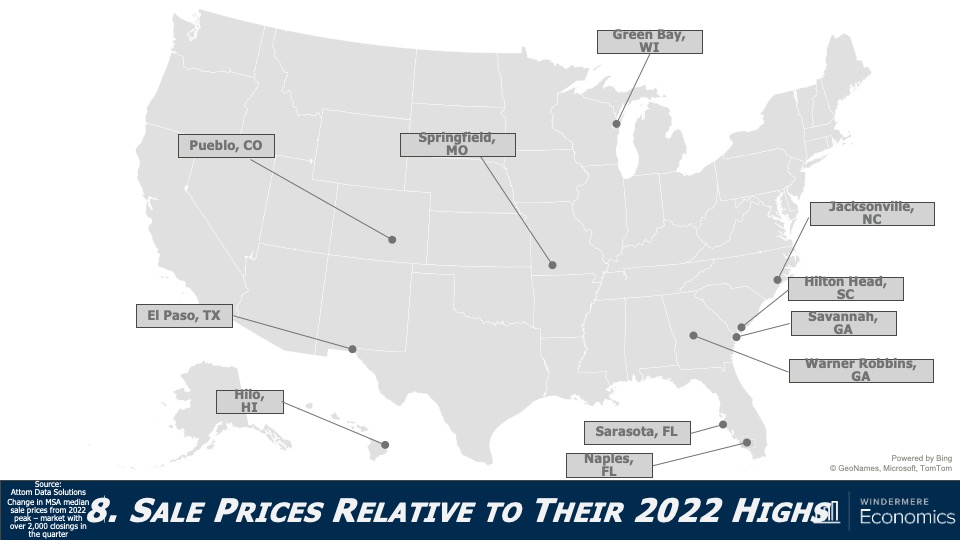

5. Home values in markets that crashed will recover

During the pandemic there were a number of more affordable markets across the country that experienced significant price increases, followed by price declines post-pandemic. I expected home prices in those areas to take longer to recover than the rest of the nation, but I’m surprised by how quickly they have started to grow, with most markets having either matched their historic highs or getting close to it – even in the face of very high borrowing costs. In 2024, I expect prices to match or exceed their 2022 highs in the vast majority of metro areas across the country.

6. New construction will gain market share

Although new construction remains tepid, builders are benefiting from the lack of supply in the resale market and are taking a greater share of listings. While this might sound like a positive for builders, it’s coming at a cost through lower list prices and increased incentives such as mortgage rate buy downs. Although material costs have softened, it will remain very hard for builders to deliver enough housing to meet the demand.

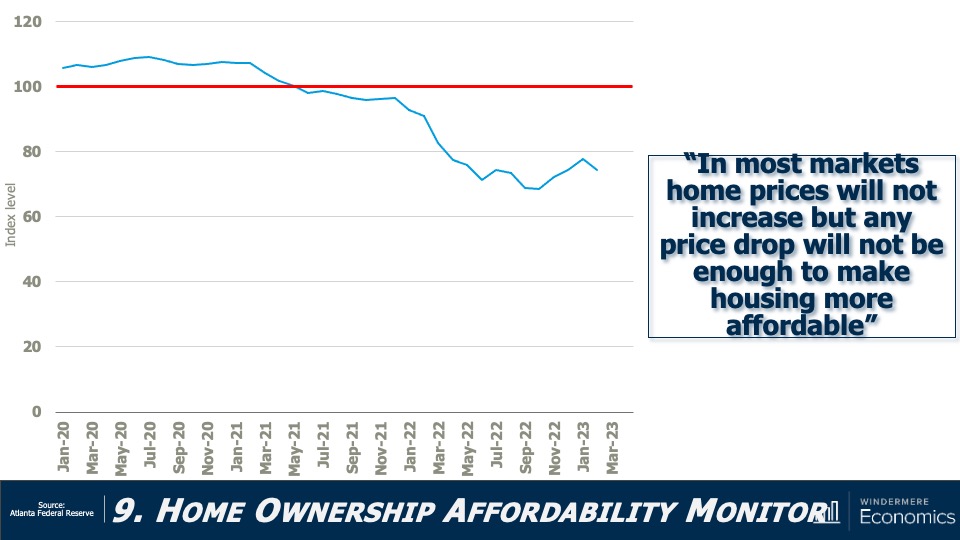

7. Housing affordability will get worse

With home prices continuing to rise and the pace of borrowing costs far exceeding income growth, affordability will likely erode further in 2024. For affordability to improve, it would require either a significant drop in home values, a significant drop in mortgage rates, a significant increase in household incomes, or some combination of the three. But I’m afraid this is very unlikely. First-time home buyers will be the hardest hit by this continued lack of affordable housing.

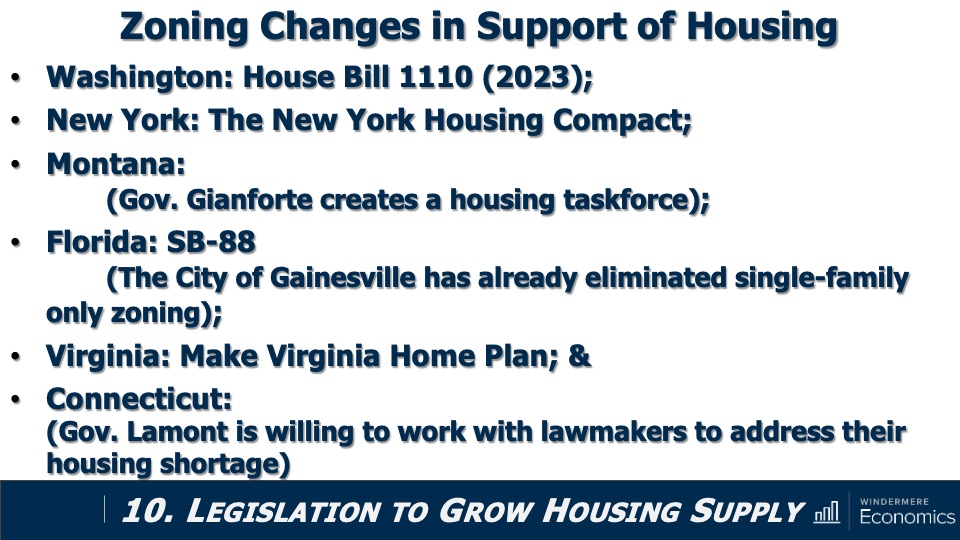

8. Government needs to continue taking housing seriously

The government has started to take housing and affordability more seriously, with several states already having adopted new land use policies aimed at releasing developable land. In 2024, I hope cities and counties will continue to ease their restrictive land use policies. I also hope they’ll continue to streamline the permitting process and reduce the fees that are charged to builders, as these costs are passed directly onto the home buyer, which further impacts affordability.

9. Foreclosure activity won’t impact the market

Many expected that the end of forbearance would bring a veritable tsunami of homes to market, but that didn’t happen. At its peak, almost 1-in-10 homes in America were in the program, but that has fallen to below 1%. That said, foreclosure starts have picked up, but still remain well below pre-pandemic levels. Look for delinquency levels to continue rising in 2024, but they will only be returning to the long-term average and are not a cause for concern.

10. Sales will rise but remain the lowest in 15 years

2023 will likely be remembered as the year when home sales were the lowest since the housing bubble burst in 2008. I expect the number of homes for sale to improve modestly in 2024 which, combined with mortgage rates trending lower, should result in about 4.4 million home sales. Ultimately though, demand exceeding supply will mean that sellers will still have the upper hand.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q3 2023 Western Washington Real Estate Market

By Windermere Economics

The following analysis of select counties of the Western Washington real estate market is provided by Windermere Real Estate. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The pace of job growth continues to slow in Western Washington, as the region added only 21,907 new positions over the past 12 months. This represented a growth rate of 1.4%, which was the lowest pace of new jobs added since the pandemic ended.

The regional unemployment rate in August was 5.8%, which was marginally below the 6% rate we saw in the same quarter in 2022. A few smaller counties lost jobs over the past 12 months while King County’s employment levels rose a meager .4%, mainly due to job losses in the technology sector. I’ve said before that I’m not convinced that the U.S. is going to enter a recession; I still stand by that theory. Slowing job growth does not necessarily need to be a precursor to a recession, but I expect that we will see lackluster growth until next spring at the earliest.

Western Washington Home Sales

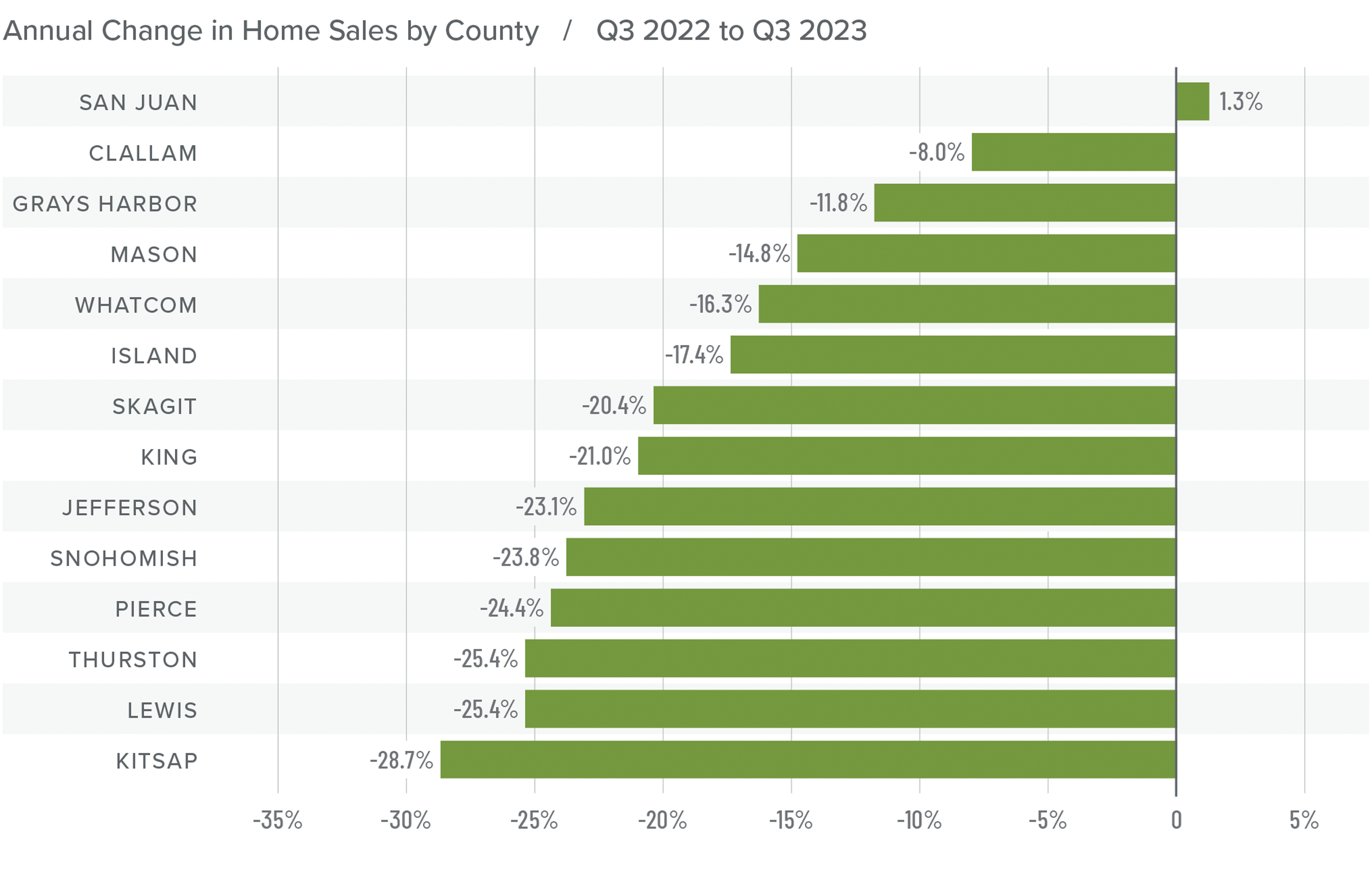

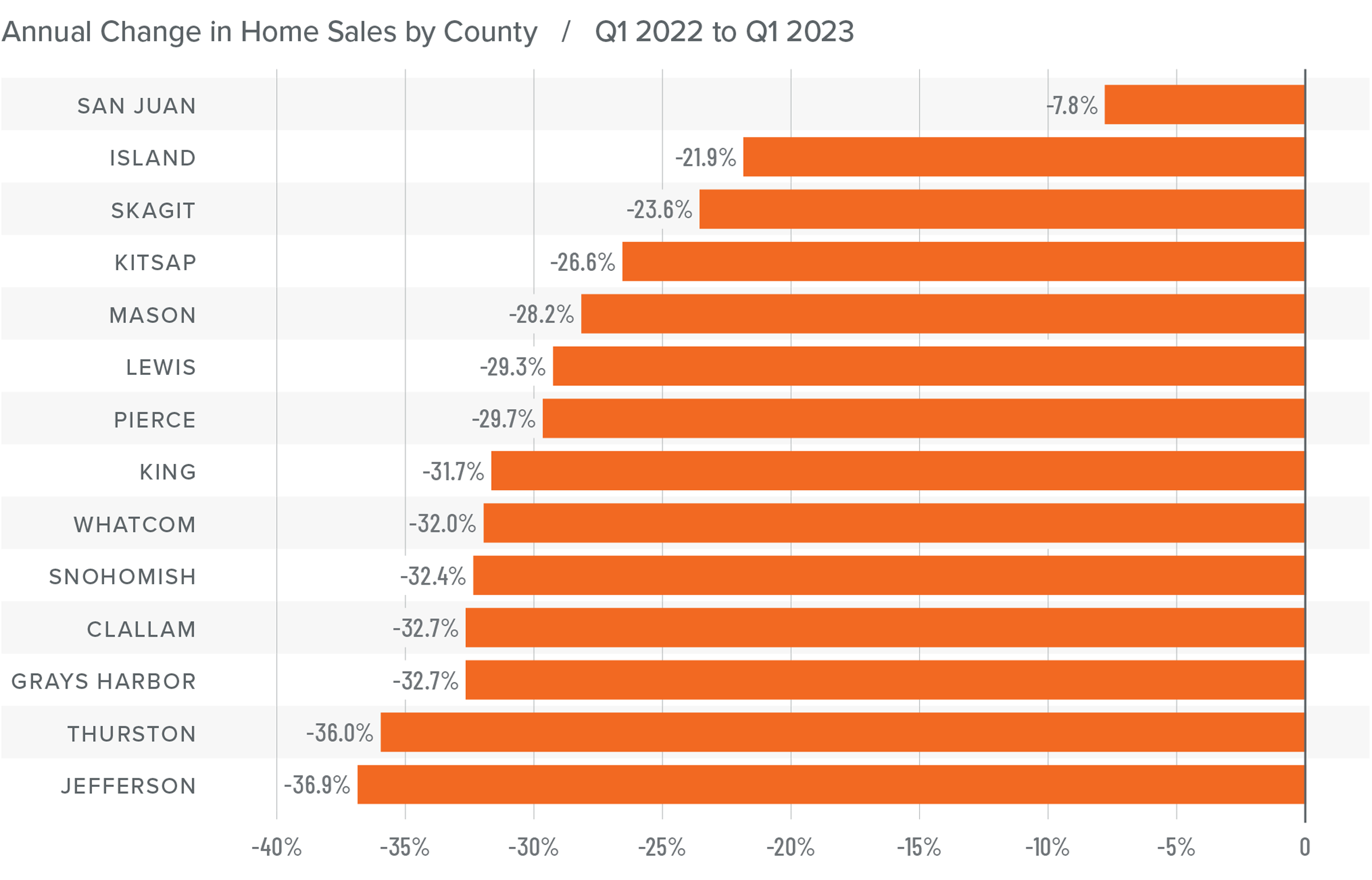

❱ In the third quarter of 2023, 14,970 homes sold. This was down 22% from the third quarter of 2022 and 1% lower than in the second quarter of this year.

❱ Sales fell even as the average number of homes for sale increased 29.5% from the second quarter. This is clearly a sign that significantly higher mortgage rates are having an impact on the market.

❱ Sales fell in all counties except San Juan compared to the third quarter of 2022. They were up in 9 of the 14 counties covered in this report compared to the second quarter of 2023. San Juan, Mason, Grays Harbor, and Whatcom counties saw significant increases.

❱ Pending sales fell 6% compared to the second quarter of this year, suggesting that closings in the upcoming quarter may be lackluster unless mortgage rates fall, which I think is highly unlikely.

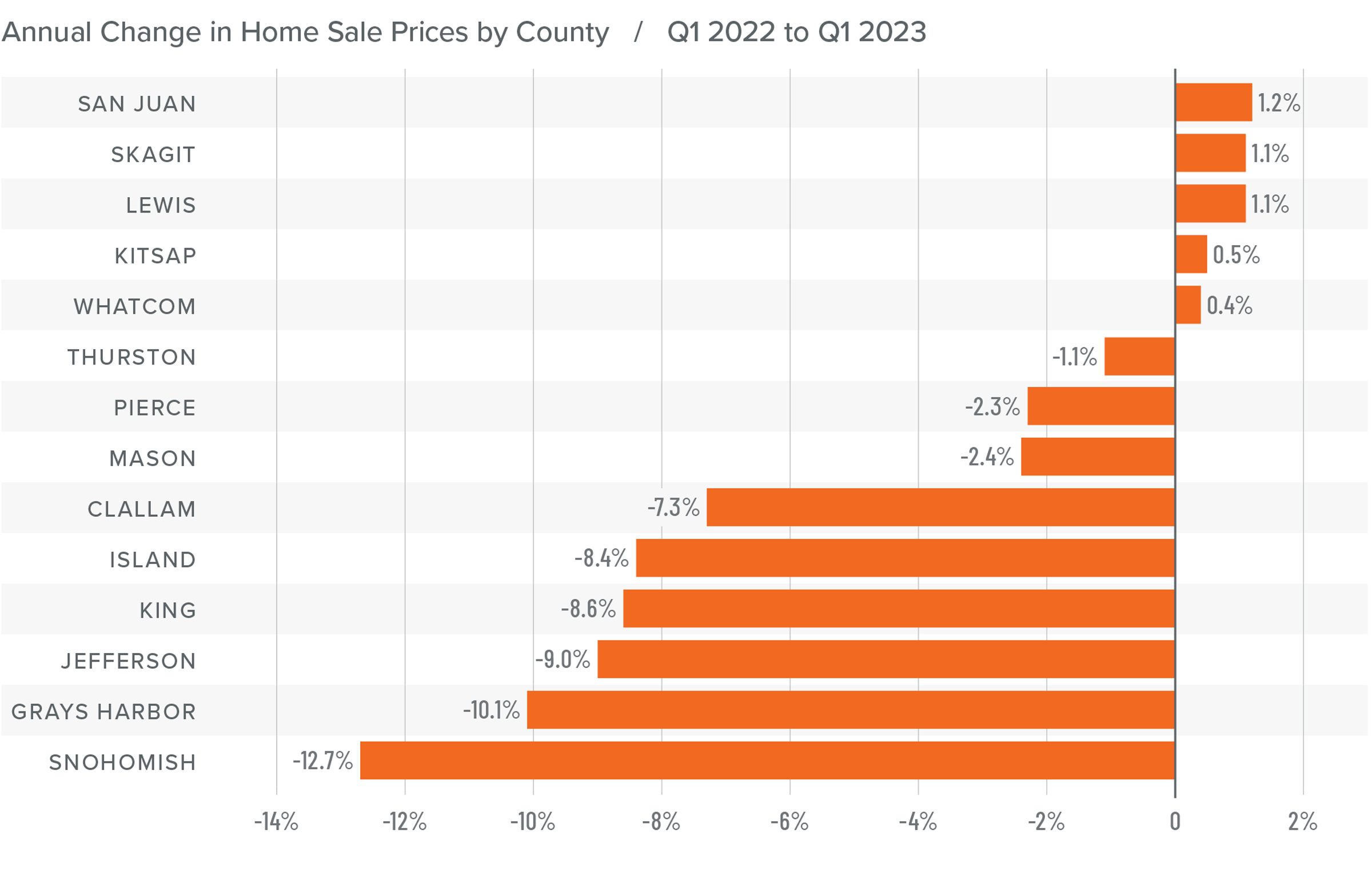

Western Washington Home Prices

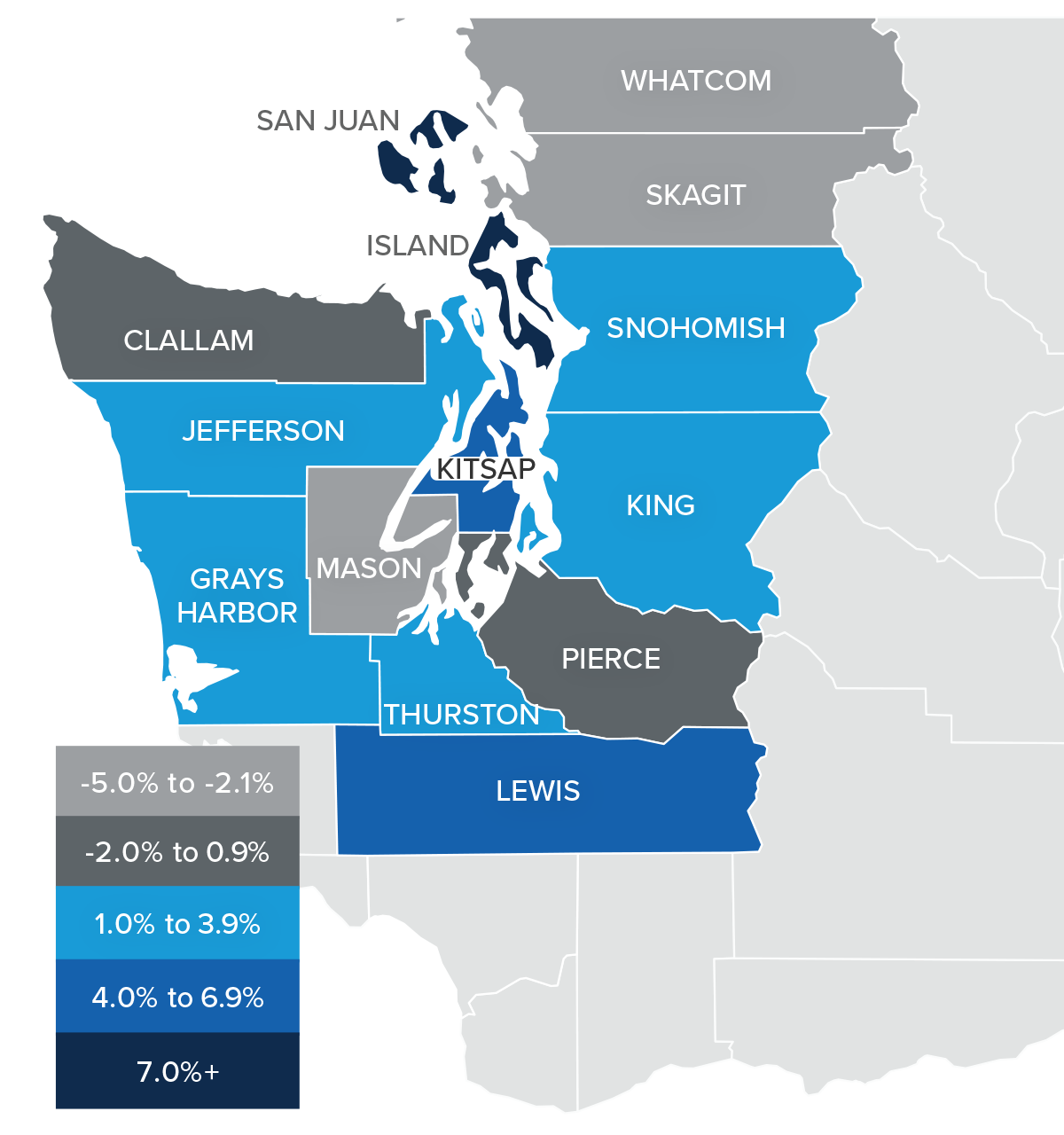

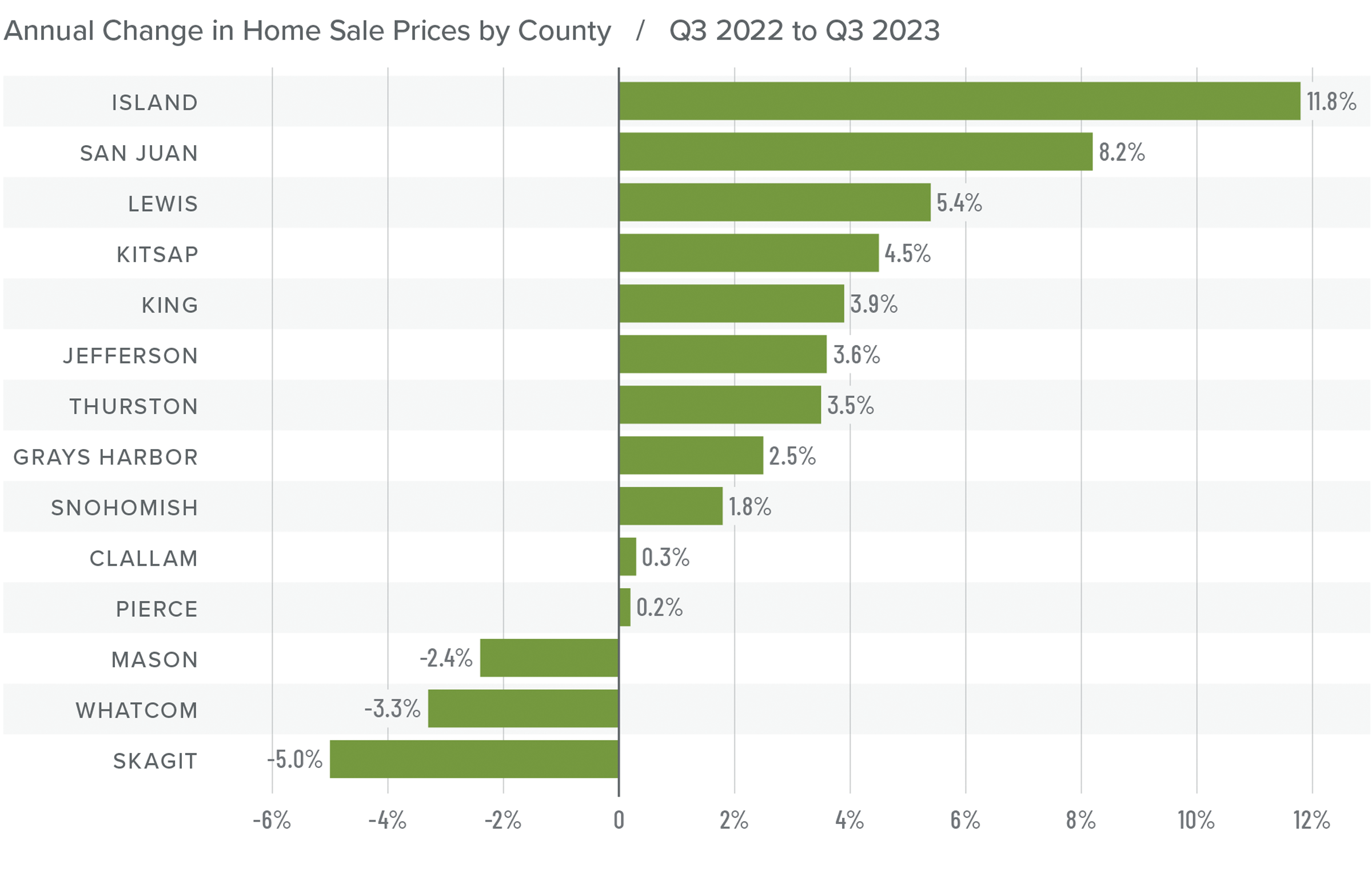

❱ Prices rose 2.8% compared to the third quarter of 2022 and were .6% higher than in the second quarter of this year. The average home sale price was $776,205.

❱ Compared to the second quarter of this year, sale prices were higher in all counties except Grays Harbor (-.5%), Kitsap (-1.5%), Clallam (-1.6%), Whatcom (-2.6%), and Skagit (-3%).

❱ Compared to the prior year, the pace of price growth slowed in the third quarter. This wasn’t too surprising given that the market was coming off record high prices in the summer of 2022. But what was surprising was that prices rose over the previous quarter despite the fact that mortgage rates were above 7% for almost the entire quarter.

❱ I don’t expect prices to move far from current levels in the coming months, and they likely won’t rise again until mortgage rates start to fall. When prices do rise, I anticipate that the pace of growth will be far more modest than we have become accustomed to.

Mortgage Rates

Mortgage rates continued trending higher in the third quarter of 2023 and are now at levels we have not seen since the fall of 2000. Mortgage rates are tied to the interest rate (yield) on 10-year treasuries, and they move in the opposite direction of the economy. Unfortunately for mortgage rates, the economy remains relatively buoyant, and though inflation is down significantly from its high, it is still elevated. These major factors and many minor ones are pushing Treasury yields higher, which is pushing mortgage rates up. Given the current position of the Federal Reserve, which intends to keep rates “higher for longer,” it is unlikely that home buyers will get much reprieve when it comes to borrowing costs any time soon.

With such a persistently positive economy, I have had to revise my forecast yet again. I now believe rates will hold at current levels before starting to trend down in the spring of next year.

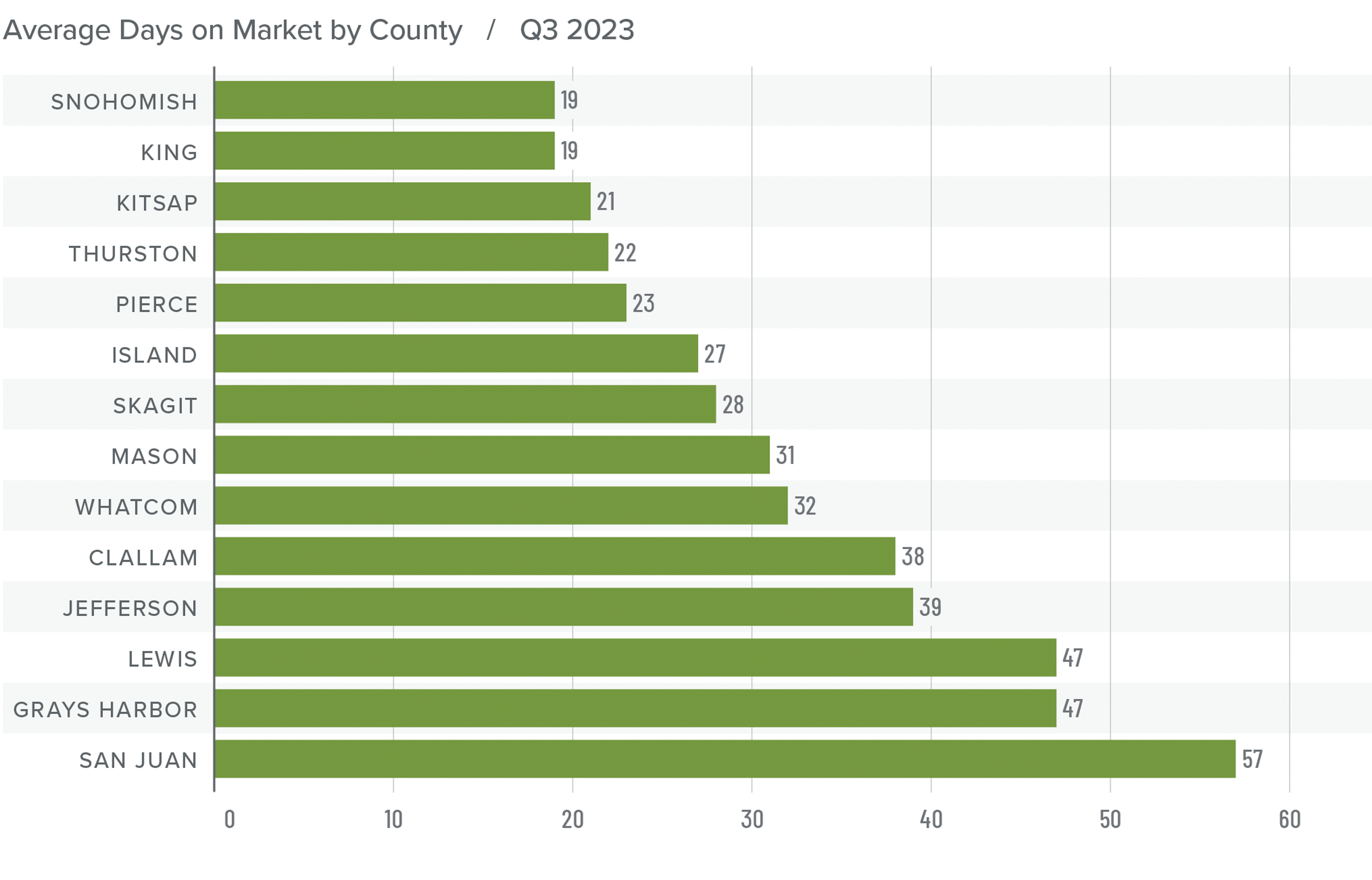

Western Washington Days on Market

❱ It took an average of 32 days for homes to sell in the third quarter of 2023. This was 8 more days than in the same quarter of 2022, but 3 fewer days compared to the second quarter of this year.

❱ Snohomish and King counties were the tightest markets in Western Washington, with homes taking an average of only 19 days to find a buyer. Homes for sale in San Juan County took the longest time to find a buyer (57 days).

❱ All counties except Snohomish saw average days on market rise from the same period in 2022. Market time fell in 9 of the 14 counties compared to the prior quarter.

❱ The greatest fall in market time compared to the second quarter was in San Juan County, where market time fell 23 days.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although it was good that listing activity rose in the third quarter, it still remains well below levels that can be considered normal. This is unlikely to change anytime soon given that over 86% of Washington homeowners with mortgages have an interest rate below 5% and more than a quarter have rates at or below 3%. There is little incentive for them to sell if they don’t have to.

More germane is the disconnect between what homeowners believe their homes are worth and what buyers can afford with mortgage rates in the mid-7% range. Most sellers appear to be getting their asking prices, or very close to it, which reflects their confidence in the market. However, home buyers are being squeezed by multi-decade high borrowing costs.

It is all quite a quandary. However, taking all the factors into consideration, sellers still have the upper hand but not enough to move the needle from the position it was in last quarter

Given all the factors discussed above, the needle stays in the same position as the last quarter. The market still heavily favors sellers, but if rates rise much further, headwinds will likely increase.

Given all the factors discussed above, the needle stays in the same position as the last quarter. The market still heavily favors sellers, but if rates rise much further, headwinds will likely increase.

U.S. Housing Market 2023: Updated Analysis

Windermere Chief Economist Matthew Gardner gives an updated analysis of the U.S. housing market in 2023, using data released by The National Association of REALTORS® on listing activity, home sales, price growth, and more.

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

U.S. Housing Market 2023

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner and welcome to this month’s episode of Monday with Matthew. The National Association of REALTORS® released their data on the U.S. housing market in August, and it contained a few things which I found interesting and wanted to share with you.

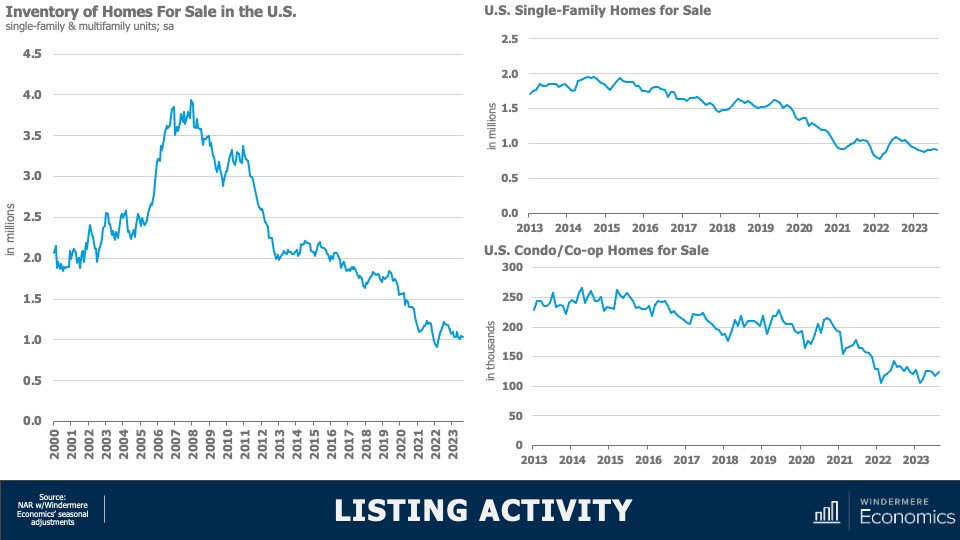

Listing Activity

As you can clearly see here, the number of homes for sale remains at close to historic lows. When adjusted for seasonality, there were just 1.03 million single-family and condominium homes for sale in the month of August, and that’s down 8.3% from a year ago and the second lowest level in 2023. When adjusted for seasonal variations, there were just over 911,000 single-family homes for sale in the month, that’s 15% lower than a year ago and 36% below August of 2019. And the condominium market is not faring any better with just over 123,000 units available for purchase, listing activity was down year-over-year by just over 9%.

Homes for Sale August 2023

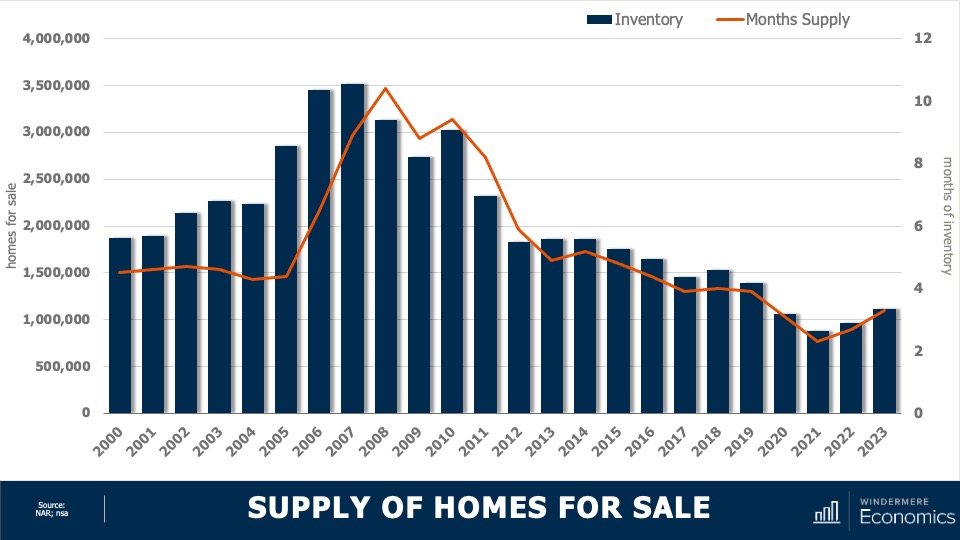

And to give you a little different perspective, this chart shows you the total number of units for sale in the month of August going back more than 20 years and I think it gives a pretty good indication as to how tight the U.S. housing market really is.

Now, we’ve talked before about the reasons why supply is so limited, and the blame is almost totally attributable to mortgage rates with sellers remarkably reluctant to move because that would mean losing the historically low mortgage rate that they currently benefit from. And as the old saying goes, “you can’t buy what’s not for sale,” and this is certainly true in the housing market today.

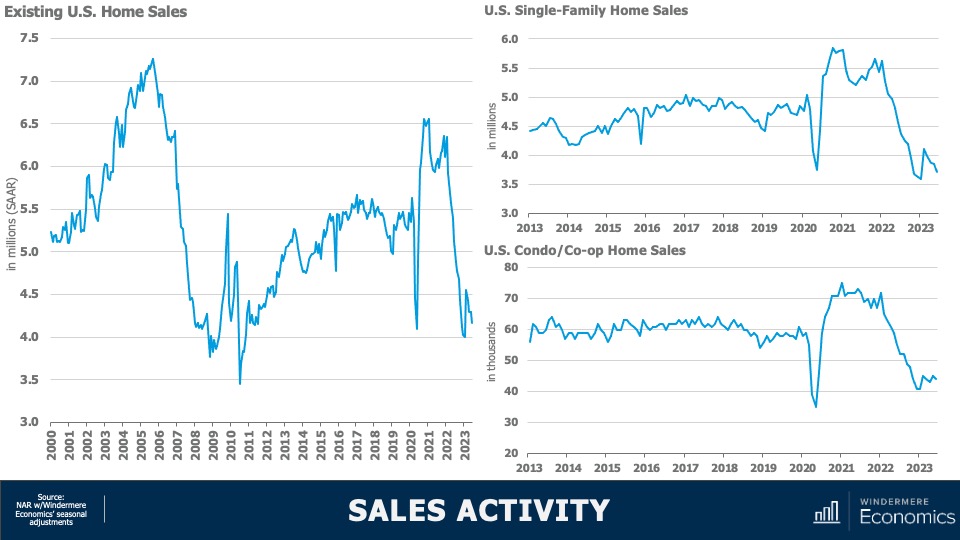

U.S. Housing Market 2023: Sales Activity

With such limited choice in the marketplace, it’s unsurprising to see home sales having plummeted following the pandemic induced surge we saw in 2021. At an annual sales rate of 4.04 million units, that is only 40,000 more than the low seen this January and we are now holding at levels we haven’t seen since 2010. Interestingly, single-family sales did see a little jump at the start of this year, but they have since pulled back—likely a function of rising financing costs, which were getting close to 7% in June.

But the condominium market, while certainly down significantly, appears to be somewhat more resilient. I find this interesting as we have not seen any palpable increase in listing activity for multifamily units.

Home Sale Prices Off All-Time High

When prices started to fall in the summer of 2022, many expected to see them continue to plunge in a manner similar to that seen following 2007 collapse, but that has certainly not been the case. Sale prices have rebounded and remain remarkably resilient—especially given significantly higher financing costs.

- Although we did see a small drop in home prices between June and July of this year, U.S. home prices are only 1.6% below their 2022 peak; they’re up 3.9% year over year; and up by 11.1% from the start of 2023.

Single-family home prices paint a similar picture with prices down by 1.8% from peak; but up 3.7% year over year, and up 11.2% from the start of the year. Interestingly, sale prices in the Northeast were actually 3.5% higher in August than their 2022 peak. And condominium prices are just 0.1% below the high seen in June of last year. Prices are now up 6.2% year over year and are 11.6% higher than we saw at the end of 2022.

Now, of course the data shown here is unlikely to reflect the recent surge in mortgage rates so it will be interesting to see what impact that has not just on sales but sale prices when the September and October data is published.

My intuition suggests that—even with mortgage rates where they are today—as long as they don’t move significantly higher, prices at the national level are unlikely to collapse. But I do see sales volumes pulling back further as listing activity remains very constrained.

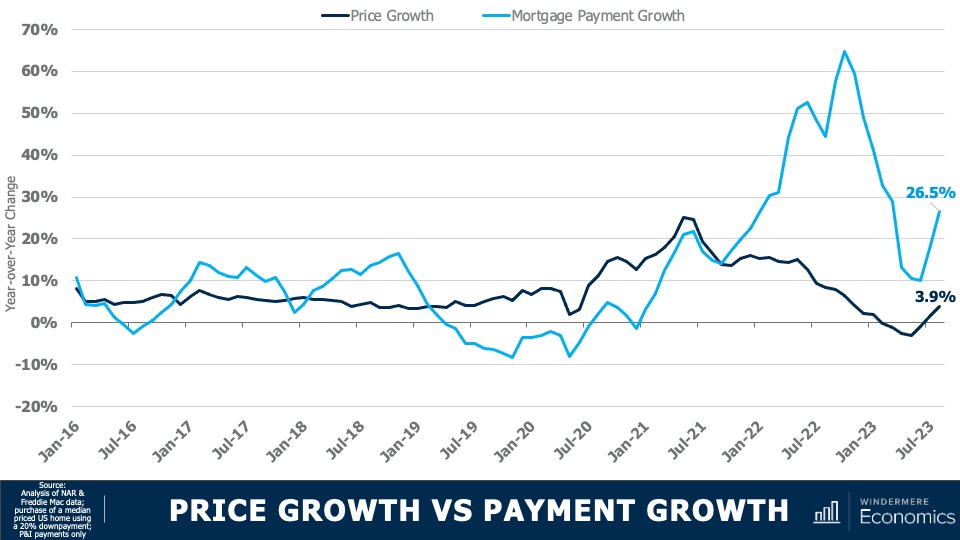

Price Growth vs Payment Growth

This chart shows a different way to look at the impact that mortgage rates are having on the market. The dark blue line shows year-over-year home price growth, and the light blue line shows the 12-month change in average mortgage payments.

Although we did see that annual growth in mortgage payments fall to just 10% in June of this year—the first time we have seen that since 2021—it has subsequently jumped back up. This means that a buyer of a median priced house in the U.S. is faced with payments that are 26 and a half percent higher than they were 12 months ago. At the same time, home price growth has stalled.

As I’ve mentioned in several past videos, I find it unlikely that inventory levels will increase significantly in 2023, and I also believe that supply will be constrained next year as well as rates remain at elevated levels.

As we know, it is this lack of inventory that has helped to support home prices; however, there is a breaking point. 10-year bond yields are holding at multi-year highs and do not appear to be thinking of pulling back at any time soon—especially given new bond issuances that the country is going bring to market in order to address our burgeoning debt levels.

And it’s because of this that I now expect to see rates remaining higher for longer, and the question then becomes how much tolerance will buyers have if mortgage rates hold where they are today or if they head closer to 8%.

Although I am not expecting this to happen, it is possible. And if it does, then sales will fall further and the underpinning of price stability will certainly be eroded. And there you have it. As always, I’d love to hear your thoughts on this subject so feel free to leave your comments below. Until next month, stay safe out there and I’ll see you soon. Bye now.

To see the latest housing data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

How Low Inventory Is Affecting the Housing Market

Windermere Chief Economist Matthew Gardner demonstrates how the U.S. housing market is adapting to low inventory levels. He touches on the new construction industry, supply changes in large metro areas, median home sale prices, and more.

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Low Inventory Housing Market

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner and welcome to this month’s episode of Monday with Matthew. As we are all aware, the housing market has softened considerably with the number of existing homes available to buy close to record lows. Today we are going to talk about supply, and how the market is starting to adapt to low inventory levels.

Housing Market Inventory

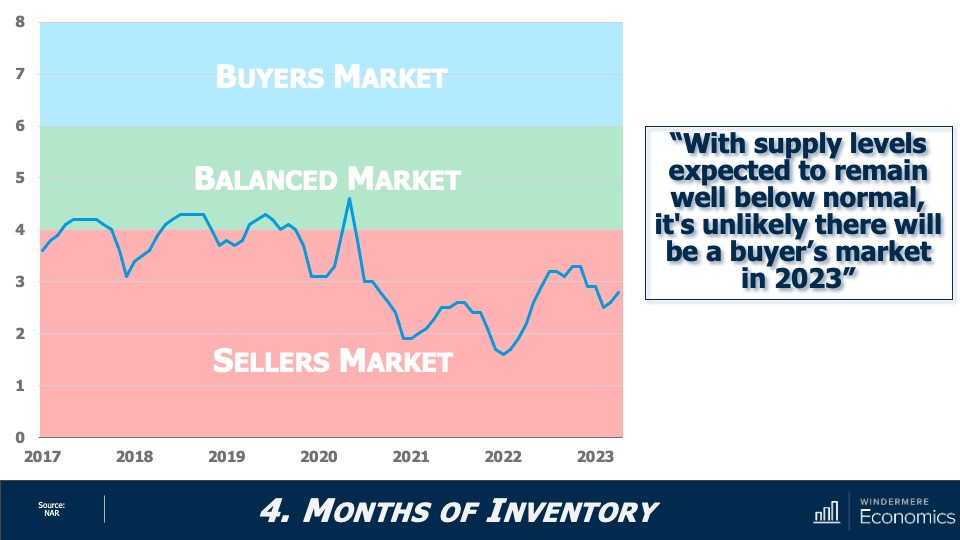

This chart shows the average number of homes on the market by year. Although year to date we have seen a little bit of an uptick, it’s clear the country remains supply-starved. And with just over three months of inventory—as opposed to the normal four to six—the market is clearly out of balance. But even though inventory levels have risen nationally, as I’ve said many times before, not all markets are equal.

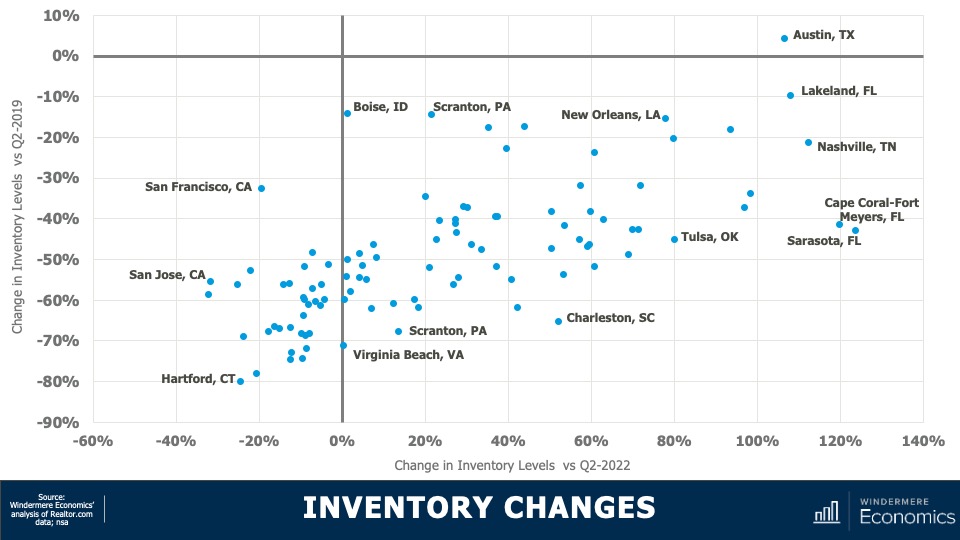

Housing Inventory Changes in Metro Areas

This chart shows how supply levels have changed. The data here is representative of the 100 largest metropolitan areas in the country. The horizontal axis shows the change in inventory versus the second quarter of 2022, while the vertical axis shows the difference and the number of homes for sale versus the second quarter of 2019. I think you’ll agree that the difference is stark. Although two-thirds of the metropolitan areas have seen the number of homes for sale improved versus the same period a year ago, just one (Austin, TX) had more homes for sale higher in the second quarter of this year than it had in the second quarter of 2019.

- And even more stark was the fact that inventory levels in 53 of the 100 largest metropolitan areas were down by more than 50% compared to the same period three years ago.

Interestingly, on a percentage basis, smaller metro areas saw the greatest decline compared to three years ago. For example, in Hartford, CT, the average number of homes on the market in the second quarter was just over 900, down by 80% from the second quarter of 2019 where there was an average of over 4,400 units for sale. Supply levels were down by 78% in Stamford, CT; 75% in New Haven, CT; and 74% in Allentown, PA.

It is true that supply levels are generally higher when compared to a year ago, with the greatest increase being seen in select markets in Florida, Tennessee, Texas, and Oklahoma; however, other than in Austin, supply levels remain well below their long-term averages. So, how is the market adapting? The answer is rather interesting. Even with all the talk of escalating material, land, and labor costs, it’s the new home industry that has been taking advantage of the lack of housing supply.

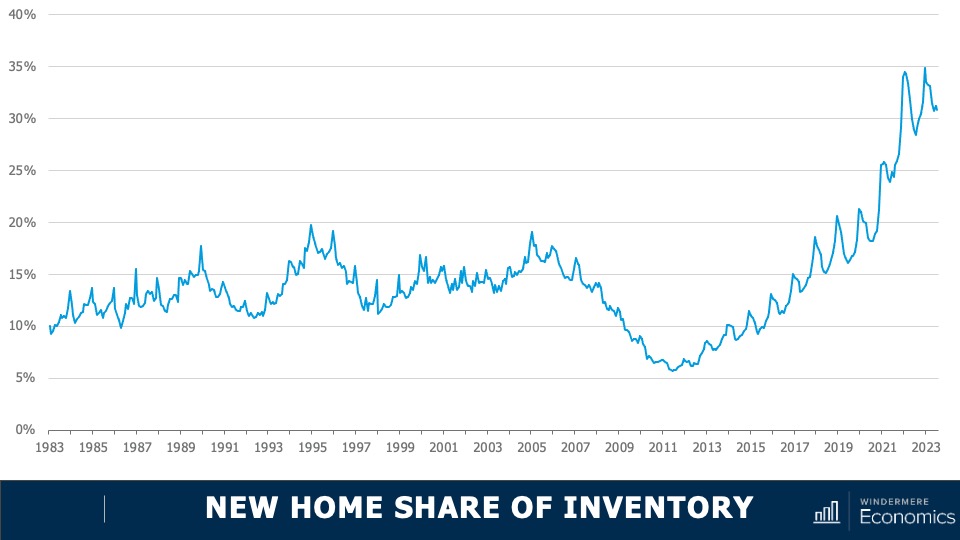

New Construction Market Trends

This chart shows the share of new homes on the market compared to their resale counterparts—here we are just looking at single-family homes. Historically, new construction makes up roughly 10% of active listings at any one time, but as you can see here, that share has been rising not just since the end of the pandemic but for the past several years. Although off the high seen a few months ago, 30% of the single-family homes for sale this July were brand new. I find this particularly interesting because, historically speaking, a premium was paid in order to buy a new home rather than an existing one.

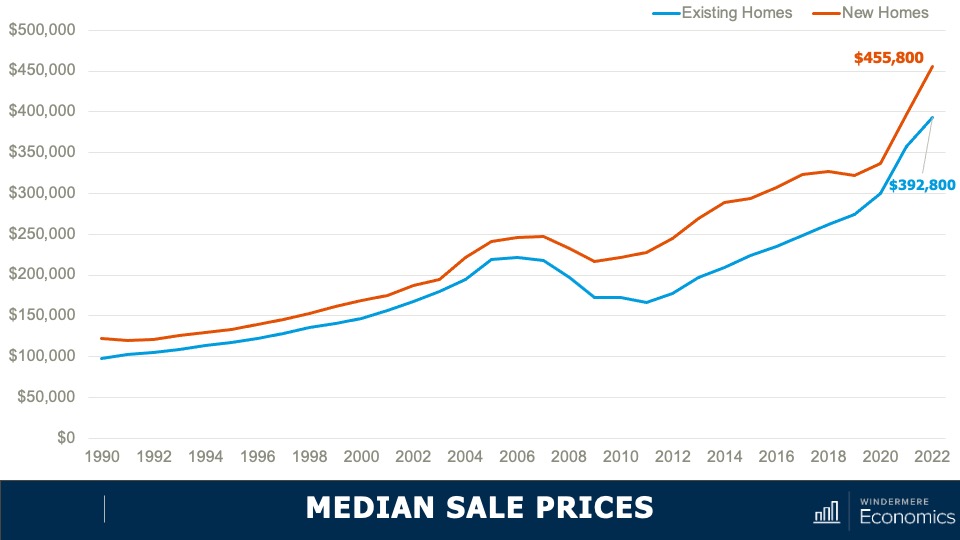

Median Sale Prices: New and Existing Homes

- As you can see here, the spread in median sale prices, which was pretty stable from 1990 until the bursting of the housing bubble, grew significantly starting in 2011 and in 2022. The premium averaged 16%. But when we look a bit closer at the numbers, they gives us a somewhat different picture.

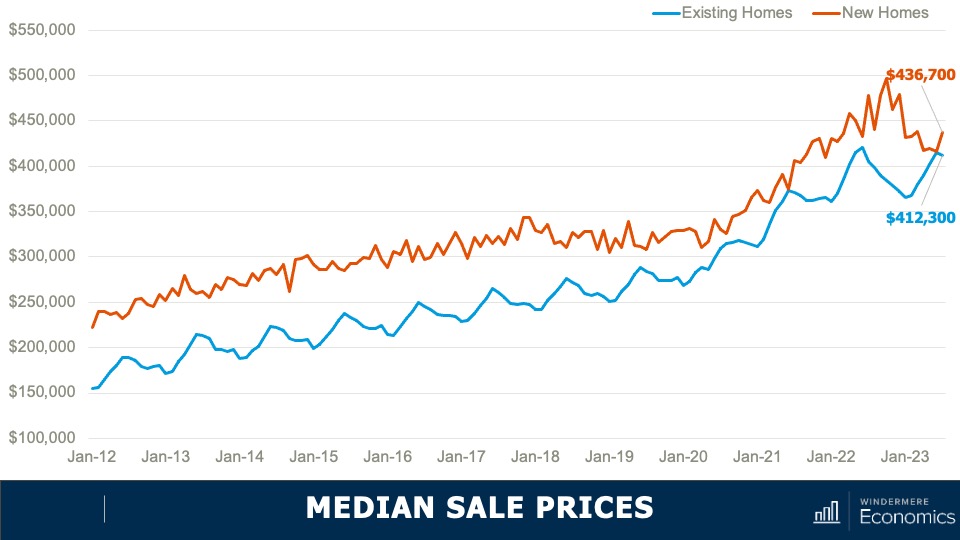

- You can see here the spread has dropped to just 6%. And in June of this year, the difference was a mere $1,000.

With the share of new homes for sale holding at a four-decade high, the share of sales themselves is at a level we haven’t seen since 2005. But even though we know that there is demand for housing, shouldn’t sales be constrained by mortgage rates? Well, what is happening is that builders are attracting buyers through incentives, and here we’re talking about mortgage rate buydowns which are becoming increasingly prevalent across the country.

In fact, a recent survey from John Burns Consulting suggested that 30% of home builders reported using interest buydowns more in the second quarter of this year than they had previously. And this is attracting buyers to visit new development communities.

An example of these buydowns is the 2/1 program that DR Horton—the largest home builder in the country—is offering at some communities. This program gives buyers a mortgage rate that starts at 3% for the first year, rises to 4% in year two, and then goes to 5% for the balance of the 30-year term. That’s pretty compelling, given where mortgage rates are today.

The bottom line is that as far as I can see, the new home industry will continue to take an outsized share of the market for the balance of 2023 and likely through most of 2024. That said, once the market starts to normalize, I expect them to pull back from these incentive programs, making them more likely to start raising asking prices, and we will return to the traditional spread between the prices of new and resale homes.

Although it’s pleasing to see more homes being built, I still believe that the country will still be running a housing deficit when it comes to meeting demographic demand and this will continue to hurt first-time buyers who continue to be priced out of the market.

As always, I’d love to hear your thoughts on this subject so feel free to leave your comments below. Until next month, stay safe out there and I’ll see you soon. Bye now.

To see the latest real estate market data for your area, visit our Market Update page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

U.S. Home Prices and Housing Affordability in 2023

Windermere Chief Economist Matthew Gardner gives an updated look at U.S. home prices and housing affordability in 2023 by examining two key second-quarter reports from ATTOM Data Solutions and the National Association of Home Builders (NAHB).

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

U.S. Home Prices 2023

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner and welcome to this month’s episode of Monday with Matthew. Today we are going to look at home prices and housing affordability. To do this I will be looking at the second quarter sales price data from ATTOM Data Solutions and we will also look at the just released National Association of Home Builders Housing Opportunity Index for the second quarter.

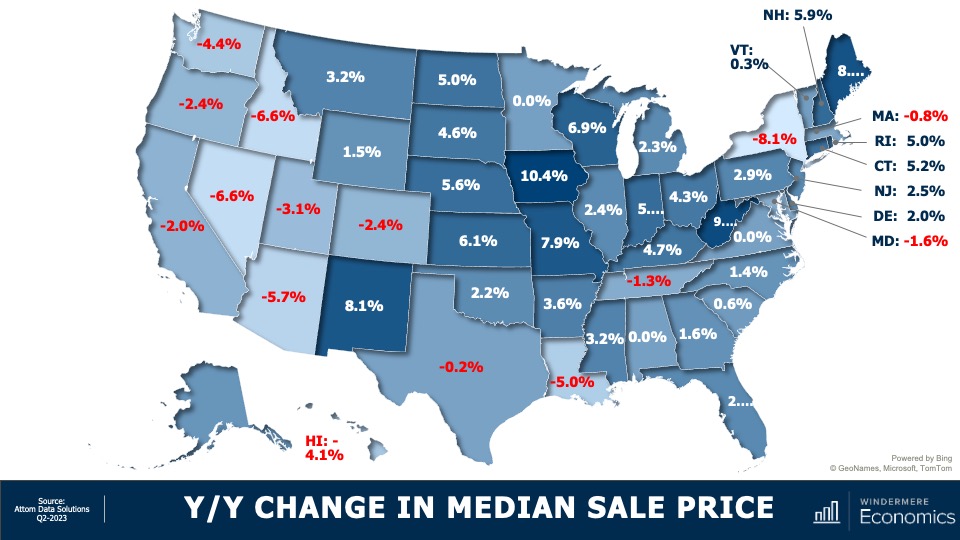

Are home prices dropping?

Starting with the year-over-year change in sale prices at the state level, there aren’t any great surprises. For the past several months I’ve been saying that as the Western U.S. saw the greatest price growth during the pandemic, so it’s not surprising to see most states sale prices in the quarter below the level seen a year ago. But it was pleasing to see that sale prices in 36 states either matched the level seen a year ago or were higher, and in some instances quite significantly so.

U.S. Home Sale Prices 2023 By State

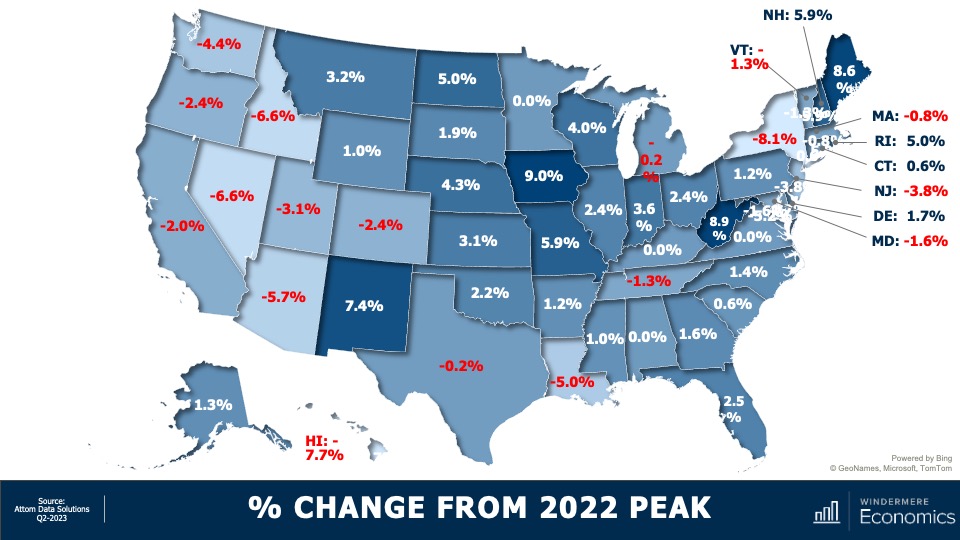

And when we compare second quarter sale prices to their 2022 peaks, 33 states are at or above the highs seen last year, but most of the Western States have yet to fully recover. In the South, Louisiana is still lagging by a good amount, as is New York State on the East Coast.

But as you are all very aware, all markets are different. I thought it would be interesting to dig a little deeper into the data to see which metro markets have seen significant gains over the past 12 months. It’s going to be interesting specifically because of the fact that mortgage rates have risen so much.

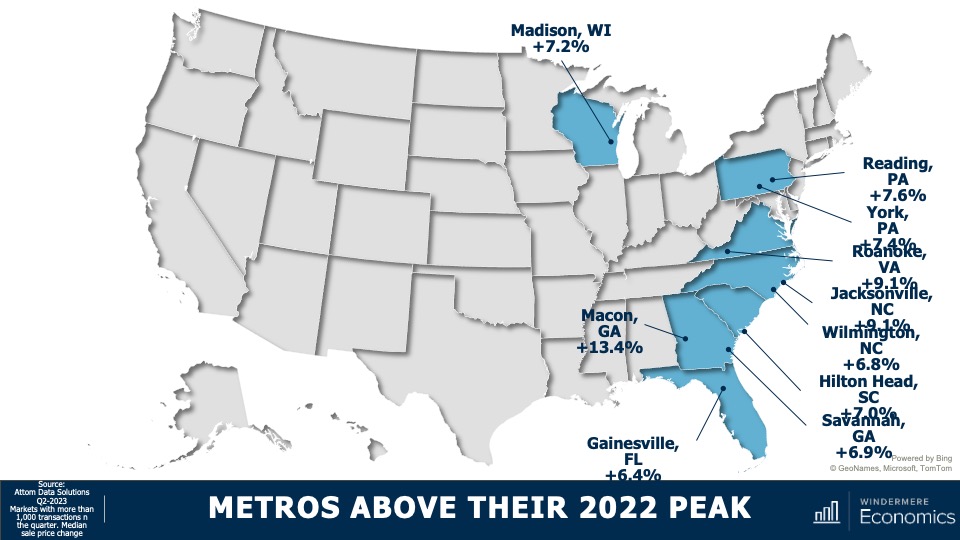

Metro Areas: Home Sale Prices 2023

These are markets where sale prices are far above their 2022 peak sale prices. Now I must add that I only looked at markets where more than 1,000 transactions occurred in the last quarter, which takes out some of the volatility. Notably, even though the state of Virginia’s home prices in the quarter were flat when compared to their 2022 peak, the Roanoke market was up by over 9%. And in Pennsylvania, where state prices were only 1.2% above their 2022 peak, Reading is up by 7.6% and York by 7.4%. And in Georgia, where state sale prices were up a modest 1.6%, homes in Macon have leapt by over 13% and prices are up by 6.9% in Savannah.

But, on the other end of the spectrum, there are markets which are underperforming their respective states and, unsurprisingly, California tops the list with three of their metros seeing prices significantly below that of the state as a whole. In other parts of the country, several metro areas which were relatively affordable before the pandemic saw an influx of remote workers and this led prices to skyrocket, and these will take some time to recover. This is particularly true in the Austin and Boise market areas.

I would add that, of the counties across the country where there were more than 1,000 transactions in the second quarter, half have met or exceeded their prior peak and—of the half where sale prices were still lower—the average shortfall is only around 4% and there are just seven counties in the country where sale prices are down by more than 10% from their 2022 peaks.

Now, what I see in the data is that the U.S. housing market, although certainly not fully healed, is headed in the right direction even when faced with mortgage rates that remain remarkably high. So, with sale prices recovering and still faced with stubbornly high financing costs, what does affordability look like?

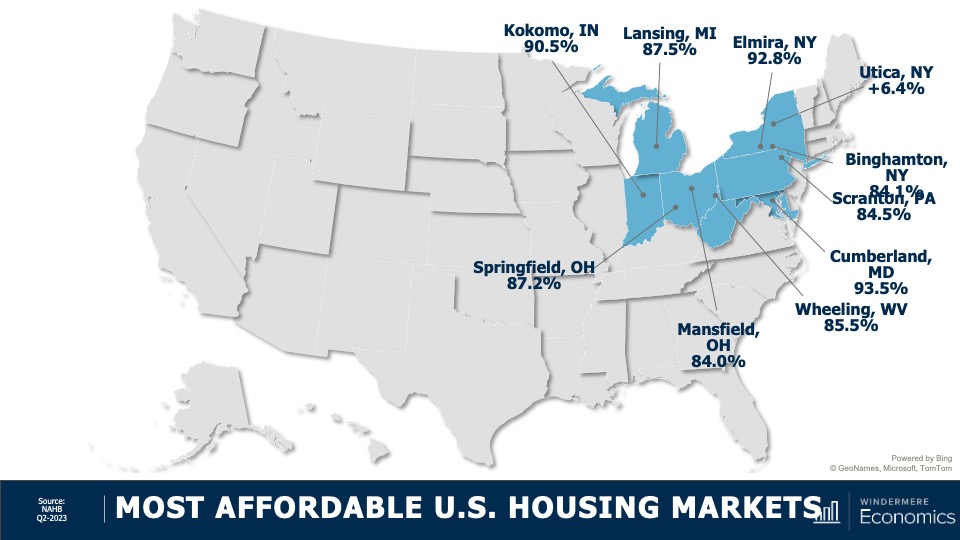

U.S. Housing Affordability 2023

Well, according to the National Association of Homebuilders (NAHB), of the 241 metros that they track, just 40.5% of sales in the second quarter were affordable to households making the area’s median income—that’s the second lowest share of sales seen since they started generating this dataset a decade ago. Now, their data does go back to 2004, but the interest rate series that they used to use was discontinued, so it’s not accurate to compare their data today with anything before 2012.

Most Affordable U.S. Housing Markets

These were the most affordable markets in the second quarter and their locations should not be of any great surprise. Average sale prices in these markets were measured around $203,000—that’s just marginally above 50% of the national sale price in the quarter, which was $402,600.

Least Affordable U.S. Housing Markets

And unfortunately this should not surprise you either. On the other end of the spectrum, the top-10 least affordable housing markets were all in California, but it gets worse than that. The top 15 least affordable markets again, all in California, and 19 out of the top 25 were in the Golden State!

As far as I can see, the ownership housing market is still showing remarkable resiliency, especially given that mortgage rates have more than doubled from their lows and they’ve risen from 4.8% at the start of the second quarter of last year to 7% at the end of the second quarter of 2023.

Now, I still expect to see rates starting to slowly move lower as we go through the second half of the year. This will help with prices and, to a degree, affordability, but until we see a significant increase in the number of homes listed for sale, the market is going to remain unbalanced.

As always, I’d love to hear your thoughts on this subject so feel free to leave your comments below. Until next month, stay safe out there and I’ll see you soon. Bye now.

To see the latest real estate market data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Housing Market 2023: Home Prices, U.S. Demographics, and More

Harvard University’s latest edition of “The State of the Nation’s Housing” has arrived, and Windermere Chief Economist Matthew Gardner is here to break down what the data presented in the report means for the U.S. housing market in 2023 and beyond.

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Housing Market 2023

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner, and welcome to this month’s episode of Monday with Matthew. I spend a lot of time reading reports that relate to the housing market, but there is one in particular I’m always impatiently waiting for, and it’s published by my colleagues at the Joint Center for Housing Studies at Harvard University. Every year they release the The State of the Nation’s Housing report and it’s packed full of fascinating data about the ownership and rental housing markets, demographics, and it also discusses the challenges that lay ahead. So today, I wanted to touch briefly on just a few of the report’s high points, but I highly recommend you download it from their website.

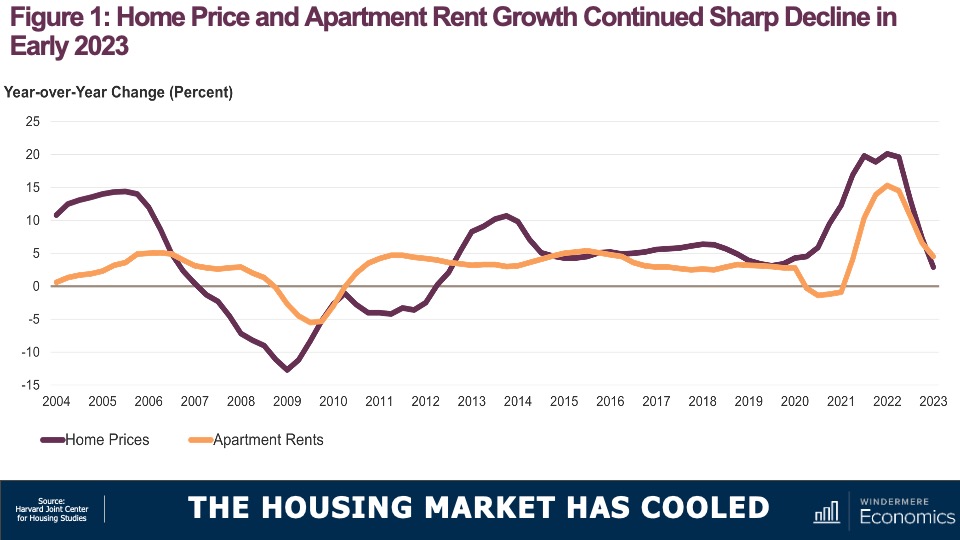

What’s happening in the housing market?

As we all know, the for-sale housing market started softening in mid 2022 in response to rising interest rates and deteriorating affordability. What was particularly notable was that seasonally adjusted home prices fell month over month last July and that was the first monthly drop in over a decade. And over in the rental market, asking rents—while still up year over year—also saw their pace of growth slow considerably, and that is a concern.

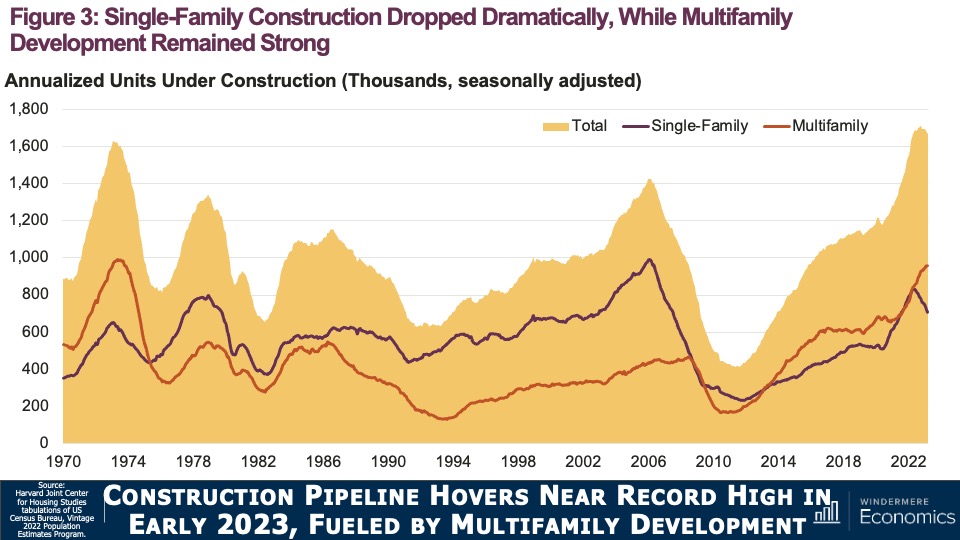

Is home construction slowing down?

As you see here, multifamily construction continued to rise last year even as rental demand was softening. In fact, 547,000 new multifamily units were started in 2022, the highest number since the mid-1980s, and the 960,000 units under construction in March 2023 was the highest number seen in half a century. On the ownership side, it wasn’t surprising to see single-family construction falling significantly as buyers reacted to sharply higher borrowing costs.

The report also suggested that the decline in new construction was particularly acute for lower-priced homes. Builders just can’t produce entry-level product with current material, labor, and land costs; limited lot availability; and regulatory barriers such as minimum lot sizes that restrict production of entry-level housing production.

U.S. Population Demographics

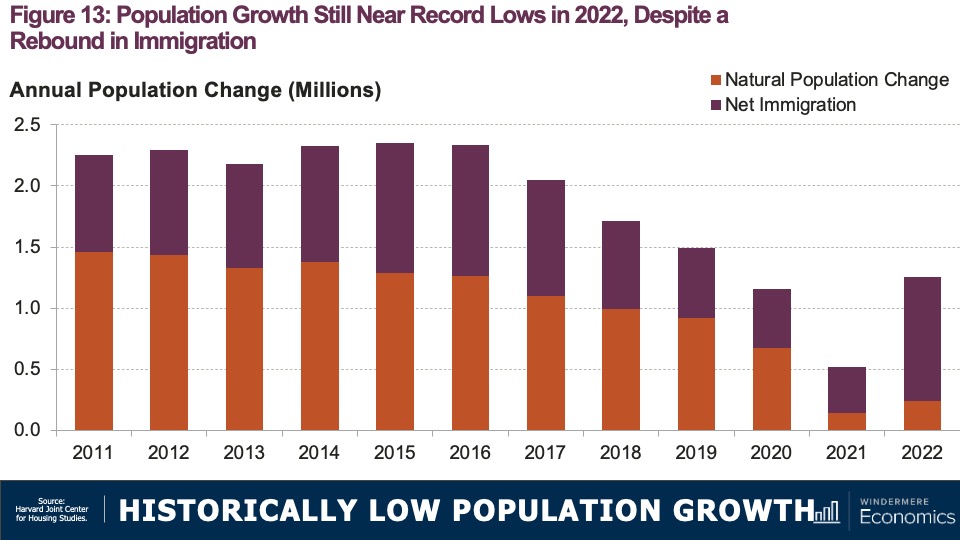

Now turning to demographics. Population growth—naturally the primary long-term driver of household growth—remains historically low. Overall, the U.S. population grew by 1.26 million people last year, or just 0.38%. Now, while this does represent a slight uptick from previous years that’s really not saying much as U.S. population growth hit 100-year lows in 2019, 2020, and 2021.

Increases in a country’s population come in two ways. The first is “natural” growth—which equals the number of persons born minus the number that have died—and the second is via immigration. Now, gains from immigration can be fickle because they are subject to unpredictable government policy changes as well as economic cycles here in the U.S. as well as in other countries. But natural growth is more predictable because it is driven by slow-moving factors like birth and mortality rates. Until last year, natural growth had been the primary source of population growth in the U.S., but, as you saw in that last chart, things have shifted.

U.S. Population Growth & Migration

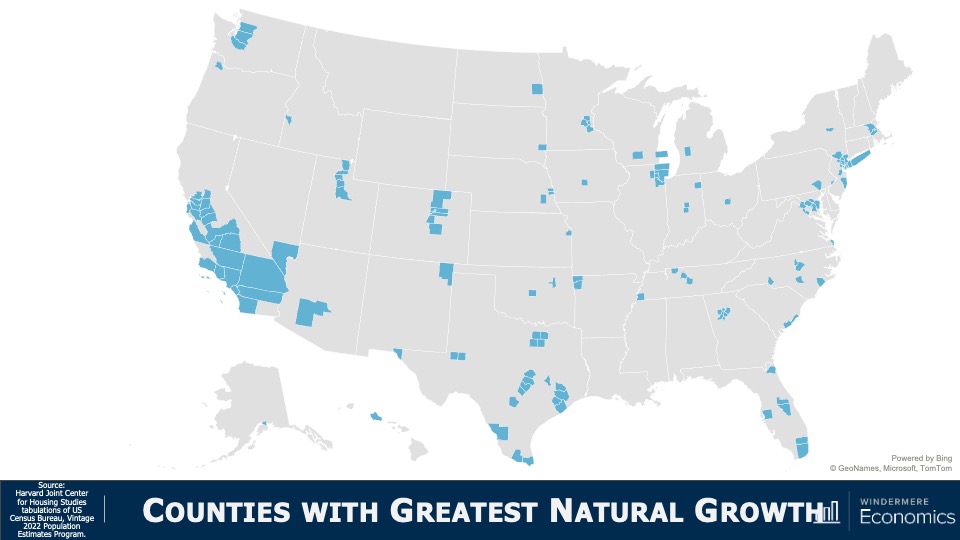

This map shows counties with the highest level of natural growth and it’s dominated by large metro markets in California, Texas, Southern Florida and parts of the Northwest. But, what I found very interesting was that the numbers were remarkably low. Only six counties—three in California, two in Texas, and one in New York—saw natural growth above the 10,000 level and 75% of counties across the country saw negative natural growth.

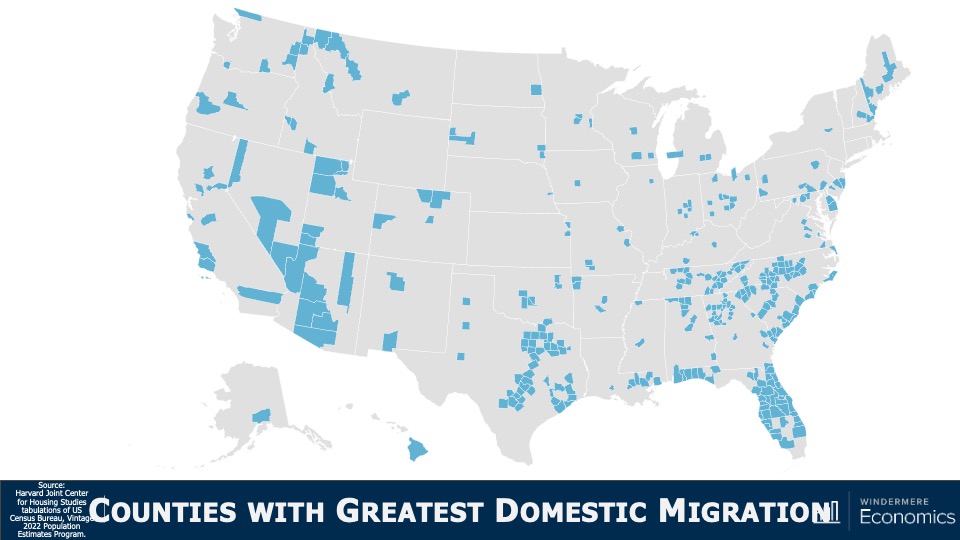

So with natural growth slowing, states will understand the importance of attracting new residents from other markets as domestic migration will become a more important driver of household growth and housing demand. Here you see that Maricopa County, AZ saw the largest gains from domestic migration but, statewide, Florida dominated last year with 319,000 people moving there. Texas came in second with a net gain of over 230,000 people. But on the other end of the spectrum, California was the biggest loser with net 343,000 people leaving, followed by New York who lost 300,000 residents.

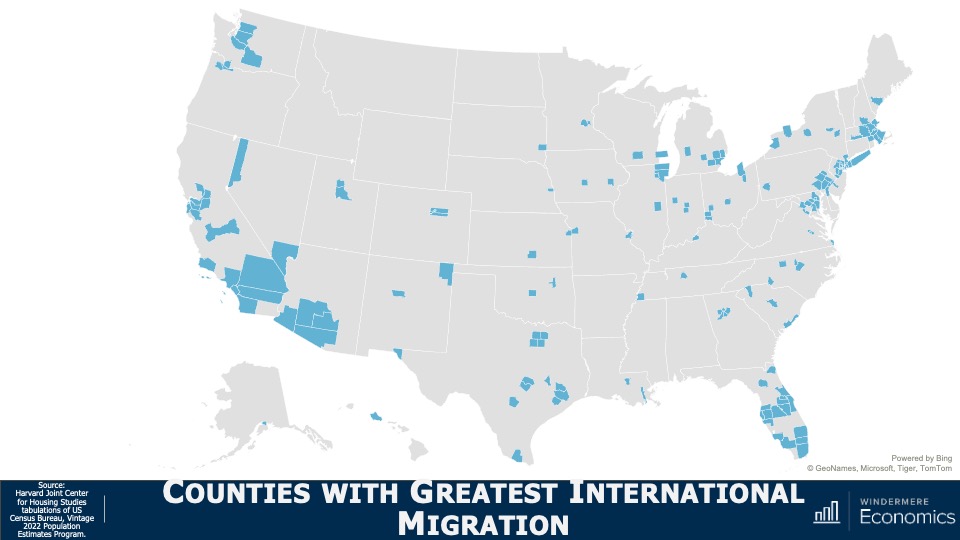

It was international migration that accounted for a full 80% of total growth last year and it was the largest source of total population growth for 26 states and 29% of all counties across the country. The biggest winners were LA County in California, Miami-Dade County in Florida, and Harris County, Texas.

These were just some of the highlights of the report and the biggest conclusions I found were that, in the ownership market, supply will remain tight in the resale arena and new construction will not fill that void, especially as it comes to the entry level product. Housing affordability will not improve. This will continue to be a big issue across the country.

An oversupply of apartments coming online will further moderate rents, but renters will also find affordability to be a big concern. Demographic trends suggest that low domestic population growth going forward will lower new household formations and it’s quite likely that population and household growth will start to rely wholly on immigration earlier than the government expects.

So, there you have it. As always, I’d love to hear your thoughts on this subject so feel free to leave your comments below. Until next month, stay safe out there and I’ll see you soon. Bye now.

To see the latest real estate market data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

2023 Top 10 Predictions | Mid-Year Update

Windermere Chief Economist Matthew Gardner revisits his Top 10 Predictions for 2023. Reviewing his forecasts for home prices, mortgage rates, and more, he highlights recent changes in the real estate market and updates his predictions for the near future.

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Top 10 Real Estate Market Predictions 2023 | Mid-Year Update

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner and welcome to this month’s episode of Monday with Matthew. You may remember that at the end of last year, I published my Top-10 Predictions for 2023 and, as we hit the mid-year mark, some of you have been asking me how well my forecasts have been holding up. So, I thought it would be interesting to take another look at them to see how accurate they have or have not been! These were the predictions I made last November, and they covered everything from my expectations for home sales and prices to shifting government policies.

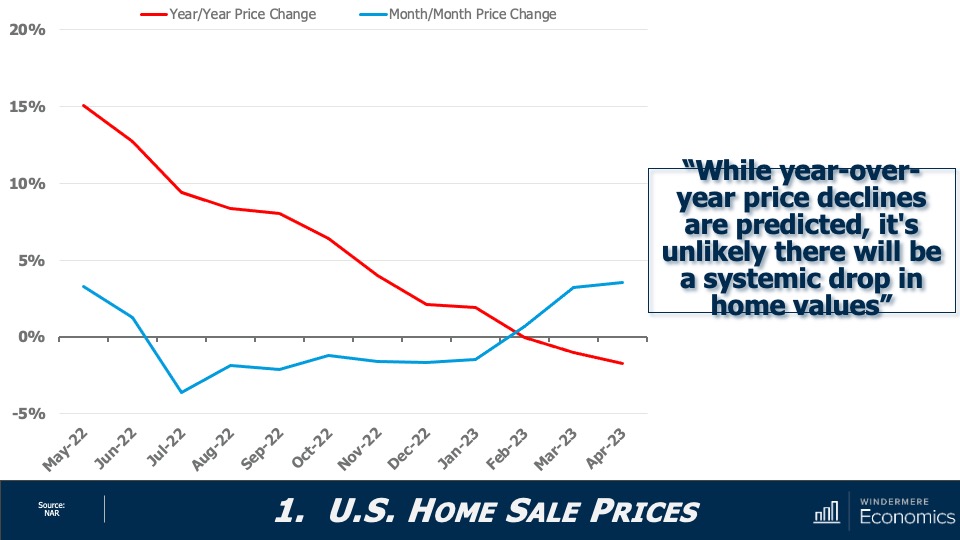

U.S. Home Sale Prices

My first forecast suggested that sale prices would fall in 2023; however, I was not expecting any sort of systemic decline in values. Here you can see that year-over-year prices are down by a bit less than 2%, but when you look at how prices have changed month over month, they rose by 3.6% in April and are up by more than 6% since the end of last year.

I stand by my forecast that the median sale price in 2023 will be modestly lower than the 2022 number; and the monthly increase in sale prices that we have seen so far this year also supports my forecast that we are not seeing any long-term decline in home values.

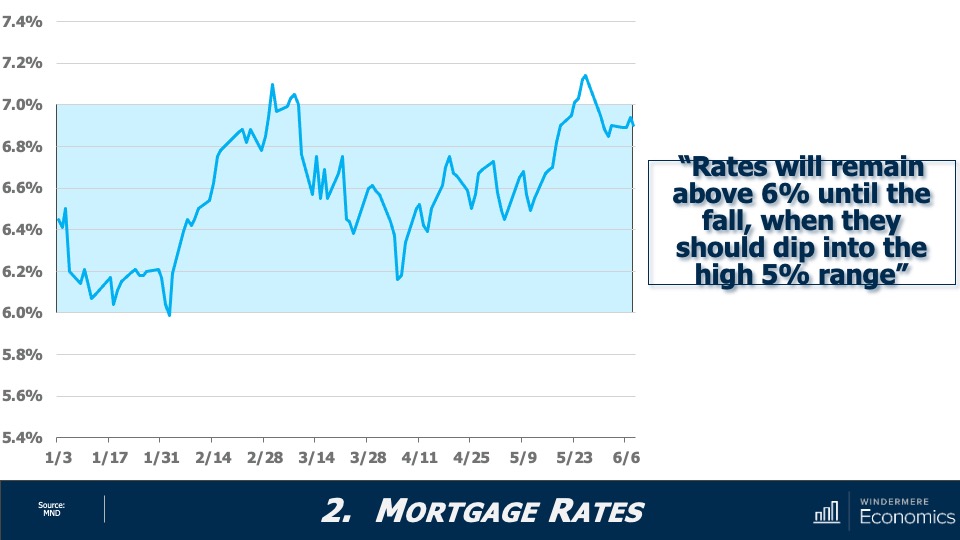

2023 Mortgage Rates

Although mortgage rates have broken above 7% eight times so far this year—the first time because of the banking crisis, and the second because of the looming debt ceiling—I expect them to become a little less frantic as we move through the second half of the year. That said, my call for them to drop below 6% this year is now likely to be inaccurate given where they are today. I still expect them to drop into the “fives” though, but not until early next year.

Is housing inventory increasing?

Listing activity saw a very modest late spring bump, but for perspective, the number of homes for sale is running at about 40% of its long-term average, and I still don’t see much growth this year. Why? Well, by my calculations, there could be over 20 million homeowners with mortgage rates around 3%. Why would they move!

Is 2023 a buyer’s or seller’s market?

And with limited inventory, the market still “technically” favors home sellers. Now, this is a little speculative because what defines a traditional “buyer’s” or “seller’s” market varies by location, but with relatively few homes on the market and the share of homes with price reductions dropping and list prices rising again, I just can’t see a buyer’s market appearing this year.

Are home prices falling?

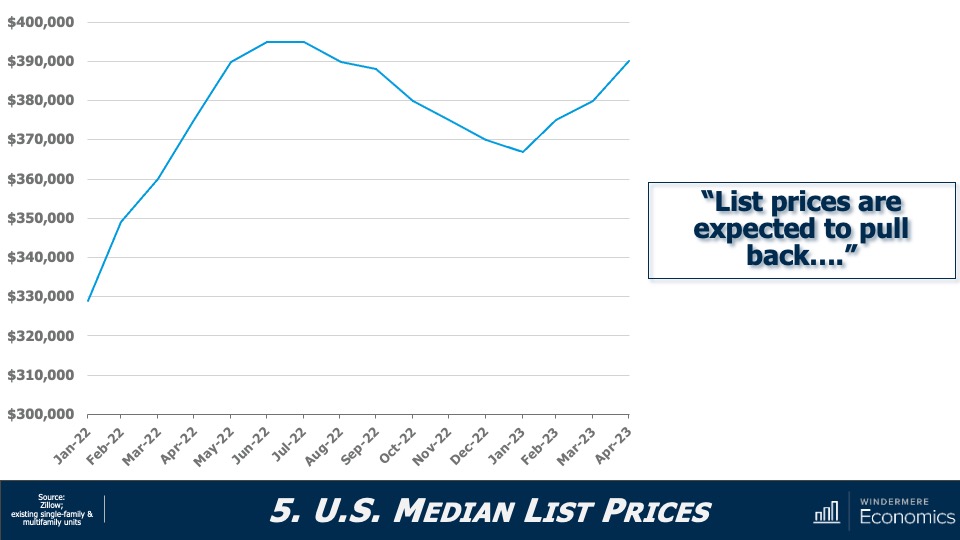

Well, this doesn’t look to be meeting my forecasts, does it! Sellers have been pretty bullish so far this year, but I would add that this is not true across the whole country. List prices are still down significantly in markets such as Hailey, Idaho; Jasper, Alabama; and Elko, Nevada, where list prices for single-family homes are down between 30 and 50% from their peak. So, I admit that the country has outperformed my forecast for list prices.

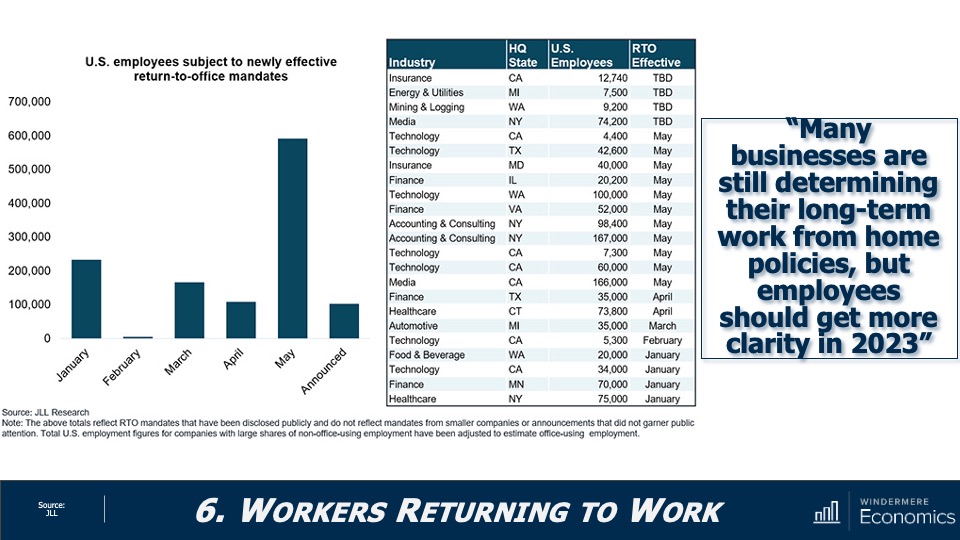

Return to Office Statistics 2023

As I had expected, the pace of workers heading back to the office has not been very robust. In fact, the share of people in the office full time dropped to 42% in the second quarter of 2023, down from 49% in the first quarter, that according to The Flex Report. Meanwhile, the share of offices with hybrid work arrangements hit 30% in the quarter, up from 20% the previous quarter. But I still expect to see more workers heading back to their offices, albeit very reluctantly.

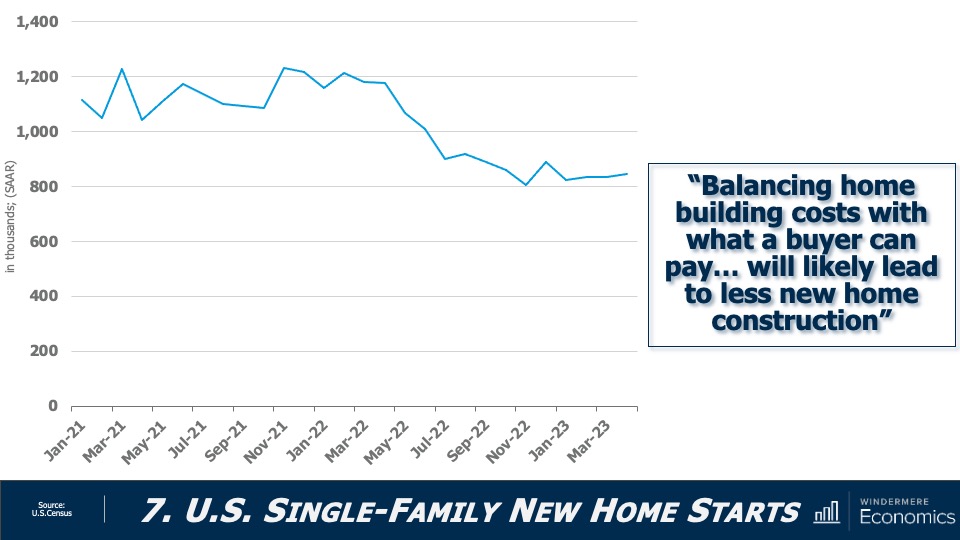

New Home Permits and Starts Have Fallen

With new home permits down 21% year-over-year, and new home starts off by 28%, I think its accurate to say that activity in the new construction sector has slowed. Builders continue to be hit by high financing rates as well as high material prices.

Are U.S. home prices dropping?

As we all know, not all markets are created equal, and this chart shows how far below their 2022 highs some of the country’s metro areas are. On the opposite end of the spectrum, there are some markets where prices have already exceeded the highs seen last year (see map below).

Housing Affordability 2023

Affordability has not improved, mainly due to home prices that remain out of sync with incomes as well as financing costs that remain well above the level that buyers had become used to. I still believe that this will not improve in 2023.

And finally, I told you that governments would start to move to address the significant housing shortage that the country is experiencing, and they have. As you can see, in Washington State, Governor Inslee recently signed House Bill 1110 into law which allows the development of duplex up to six-unit buildings within any area zoned for single-family-only development. Additionally, jurisdictions in a significant number of states are either pursuing legislation to tackle this problem or have at least created task forces to look at the issue. It’s a good start, but more needs to be done.

Although it’s really cheating to grade one’s own work, I think that I have been pretty accurate with my forecasts. Yes, I was too pessimistic when it came to list prices and a little optimistic regarding the direction of mortgage rates. But other than those two items, the data seems to suggest that the housing market is headed in the direction that I had suggested.

What do you think? I’d love to hear your thoughts on this subject so leave your comments below. As always, stay safe out there and I’ll see you all next month. Bye now.

To see the latest real estate market data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Article originally appears on windermere.com

Would the FHFA Mortgage Fee Changes Have Favored Buyers with Low Credit Scores?

The Federal Housing Finance Authority recently put a hold on raising upfront mortgage fees given pushback that suggested home buyers with good credit were being penalized. Windermere Chief Economist Matthew Gardner looks at Loan Level Price Adjustments (LLPAs) to explain why some headlines were misleading.

This video on the proposed FHFA mortgage fee changes is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

FHFA Mortgage Fee Changes

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner, and welcome to this month’s episode of Monday with Matthew. As most of you are aware, the Federal Housing Finance Authority announced that they were going to raise the upfront fees for mortgages backed by Fannie Mae and Freddie Mac, and that led to significant backlash from some suggesting that borrowers with good credit would now be paying more than borrowers with bad credit.

And as these voices grew louder, Congress stepped in with House Financial Services Committee Chair Patrick McHenry and Housing and Insurance subcommittee Chair Warren Davidson announcing a plan to repeal these fee increases if they were introduced. Well, this did not go unnoticed, and the FHFA announced on May 10th that they were putting a hold on a new fee structure in order to engage industry stakeholders and better understand their concerns.

So, for now nothing has changed, but I still think it’s a subject worth discussing because we will see another proposal from the FHFA at some point in the future. So, what’s going on?

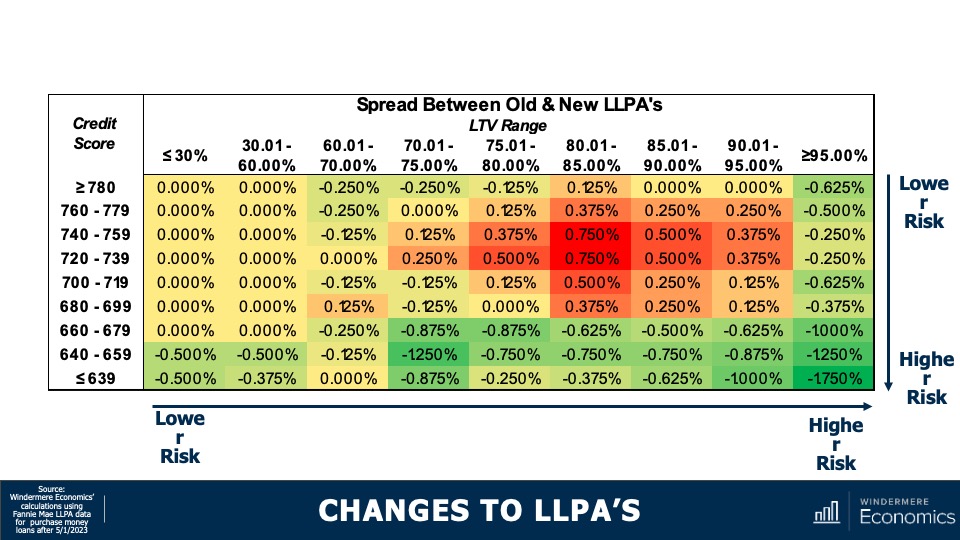

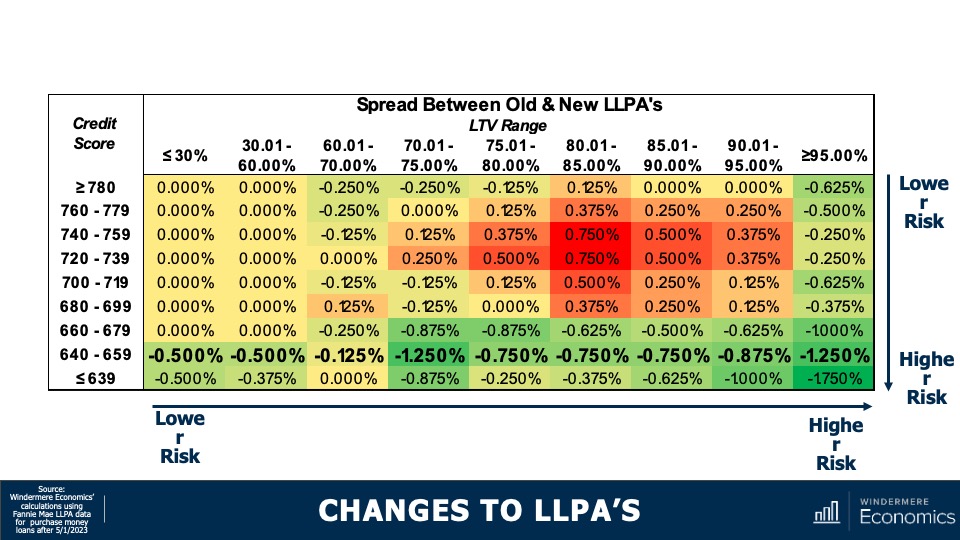

Well, periodically the FHFA raises the upfront fees that the Agencies charge borrowers for the purchase and refinance of mortgages that they guarantee, and these fees are called Loan Level Price Adjustments, or LLPAs.

In April of 2022, these fees went up for several types of loans including ones in expensive markets that have a higher conforming loan limit than seen nationally, and they also raised fees on second home mortgages. But to support affordable housing, the lower rates for certain programs including HomeReady, Home Possible, and HFA Advantage weren’t increased. And they didn’t raise fees for loans to first-time home buyers in high-cost areas if they earned at or below the area median income.

And the new round of fee increases that was scheduled to start in May of this year has many believing that it was just another subsidy given to households with lower credit that’s being paid for by households with better credit. But is that really an accurate statement? I don’t necessarily think so.

First off, the FHFA had to increase fees this year simply because they needed the money to cover higher capital requirements that went into effect last year, but that’s a topic for another day. For now, let’s take a look at the changes that would have been made.

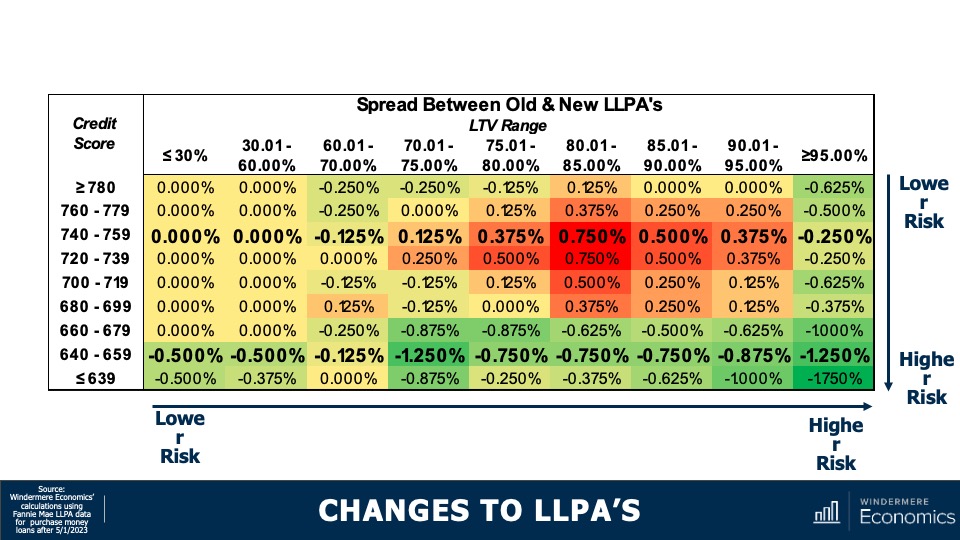

Changes to LLPAs

The matrix you see here shows you the difference between the fee that was in place and the one that was proposed. Remember, this is not the actual fee itself, but the spread between the old and new pricing. And, as you can see, on face value it really does look to benefit borrowers with lower credit scores and penalize households with better credit. For example…

Changes to LLPAs: Credit Score 640 – 659

A household with a credit score of between 640 and 659 would see savings across all loan-to-value ranges versus the following:

Changes to LLPAs: Credit Score 740 – 759

A household with a credit rating of 740 to 759 who would be paying the same or more in all bar two scenarios with fees increasing between 0.125% and three quarters of a percent.

But is this really something to be worried about?

There are two things that stand out to me. The first is that a household putting down less than 20% has to buy private mortgage insurance. So, in reality, these households are actually less of a risk to the agencies than those who don’t, so isn’t it right that they should pay less in fees? Secondly, although I can’t disagree with anyone who states that families with lower credit will see fees go down and, generally speaking, they will go up for those with better credit, but people are confusing the CHANGE in the fee with the ACTUAL fee itself.

What I am saying is that low credit borrowers aren’t paying less than high credit borrowers. It’s just the spread in the rates between households with lower credit and those with higher credit has simply gotten smaller.

There is absolutely no scenario where someone with lower credit gets a lower fee. Let me show you.

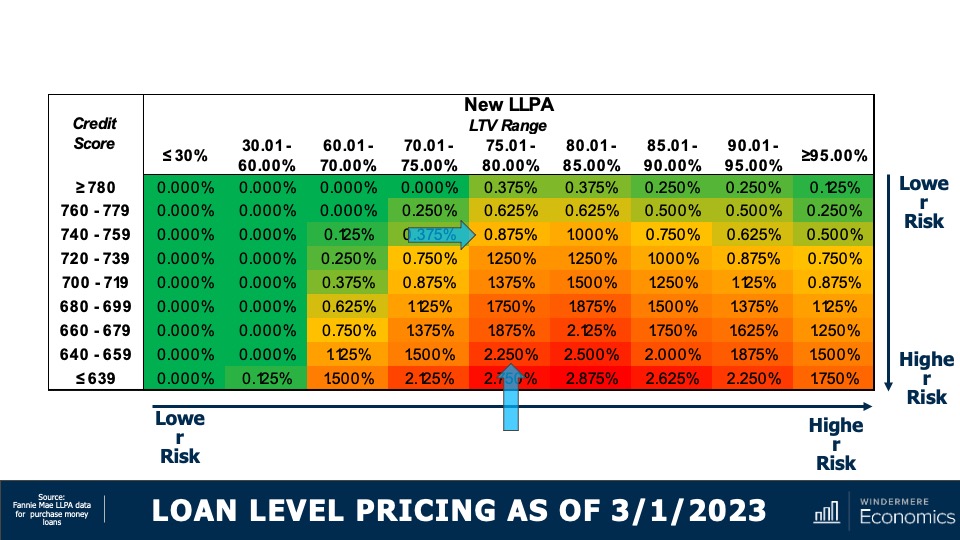

Loan Level Pricing as of March 1, 2023

This was the new pricing schedule had it actually come into effect. Now let’s say there are two households wanting to buy houses for $500,000 and both looking to borrow 80% of the purchase price.

One buyer has a credit score of 640, so their LLPA would be 2.25% of the loan amount, or $9,000. The other buyer had a credit score of 740 so their fee would be 0.875%. That means the household with higher credit would be paying $5,500 less than the household with lower credit on a $400k loan.

No one is arguing that households with lower credit scores would have paid less in upfront fees, but I actually don’t see a problem with that. Remember, Fannie and Freddie’s mission is, in part, to facilitate access to affordable housing. Moreover, these fees don’t even apply to non-conforming or jumbo loans and they don’t impact FHA or VA loans either.

Although I certainly don’t know where the FHFA will end up regarding fee changes, they will have to do something at some point. I just hope that any modified plan is presented in a way that fully describes the situation and isn’t one that’s able to be interpreted in a manner which allows for headlines that don’t describe the full picture.

As always, I’d love to hear your thoughts on this subject but, in the meantime, stay safe out there and I’ll see you all next month. Bye now.

To see the latest housing data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Article originally appears on windermere.com

Q1 2023 Western Washington Real Estate Market Update

Download the printable PDF by clicking this link!

The following analysis of select counties of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The pace of employment growth in Western Washington continues to slow. The region added only 90,340 new jobs over the past 12 months. That said, the annual pace of employment growth was a respectable 3.6%. Three counties have not recovered completely from their pandemic job losses: Whatcom, Skagit, and Snohomish. However they are short by just under 10,000 jobs, which should be recovered by this fall. Regionally, the unemployment rate in February was 4.1%, which was marginally above the 3.8% level of a year ago. The employment outlook has improved modestly, with the likelihood of a recession in 2023 down to about 50%. That said, I expect the pace of job growth to continue to slow as businesses remain concerned about a contraction in consumer spending, as well as facing tighter credit conditions following recent bank failures.

Western Washington Home Sales

❱ In the first quarter of the year, 10,335 homes sold. This was down 30.9% from the same period in 2022 and 18.9% lower than in the fourth quarter of 2022.

❱ Lower sales activity was more a function of the limited number of homes for sale than anything else. Listing activity in the first quarter of 2023 was down 43% from the final quarter of 2022.

❱ Home sales fell across the board compared to the same quarter of last year and were lower in every county compared to the final quarter of 2022.

❱ Pending sales rose in all but three counties compared to the fourth quarter of 2022. This suggests that sales in the second quarter of the year may tick higher. That said, the region is in dire need of more inventory.

Western Washington Home Prices

❱ Home prices fell an average of 6.9% compared to the first quarter of 2022 and were 1.3% lower than in the fourth quarter of 2022. The average home sale price in the first quarter of 2023 was $692,866.

❱ Compared to the fourth quarter of 2022, prices were higher in Kitsap, Skagit, Lewis, San Juan, and Whatcom counties.

❱ Even though prices fell in the region, five counties saw sale prices rise very modestly from the first quarter of 2023.

❱ It’s worth noting that median listing prices rose in all but two markets compared to the previous quarter. This suggests that sellers are getting a little more comfortable with the market. If listing prices continue to rise, one can surmise that home prices will follow suit.

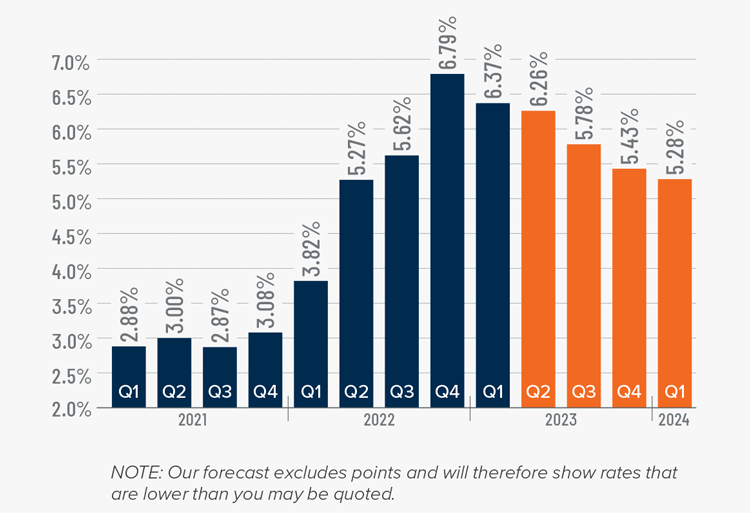

Mortgage Rates

Rates in the first quarter of 2023 were far less volatile than last year, even with the brief but significant impact of early March’s banking crisis. It appears that buyers are jumping in when rates dip, which was the case in mid-January and again in early February.

Even with the March Consumer Price Index report showing inflation slowing, I still expect the Federal Reserve to raise short-term rates one more time following their May meeting before pausing rate increases. This should be the catalyst that allows mortgage rates to start trending lower at a more consistent pace than we have seen so far this year. My current forecast is that rates will continue to move lower with occasional spikes, and that they will hold below 6% in the second half of this year.

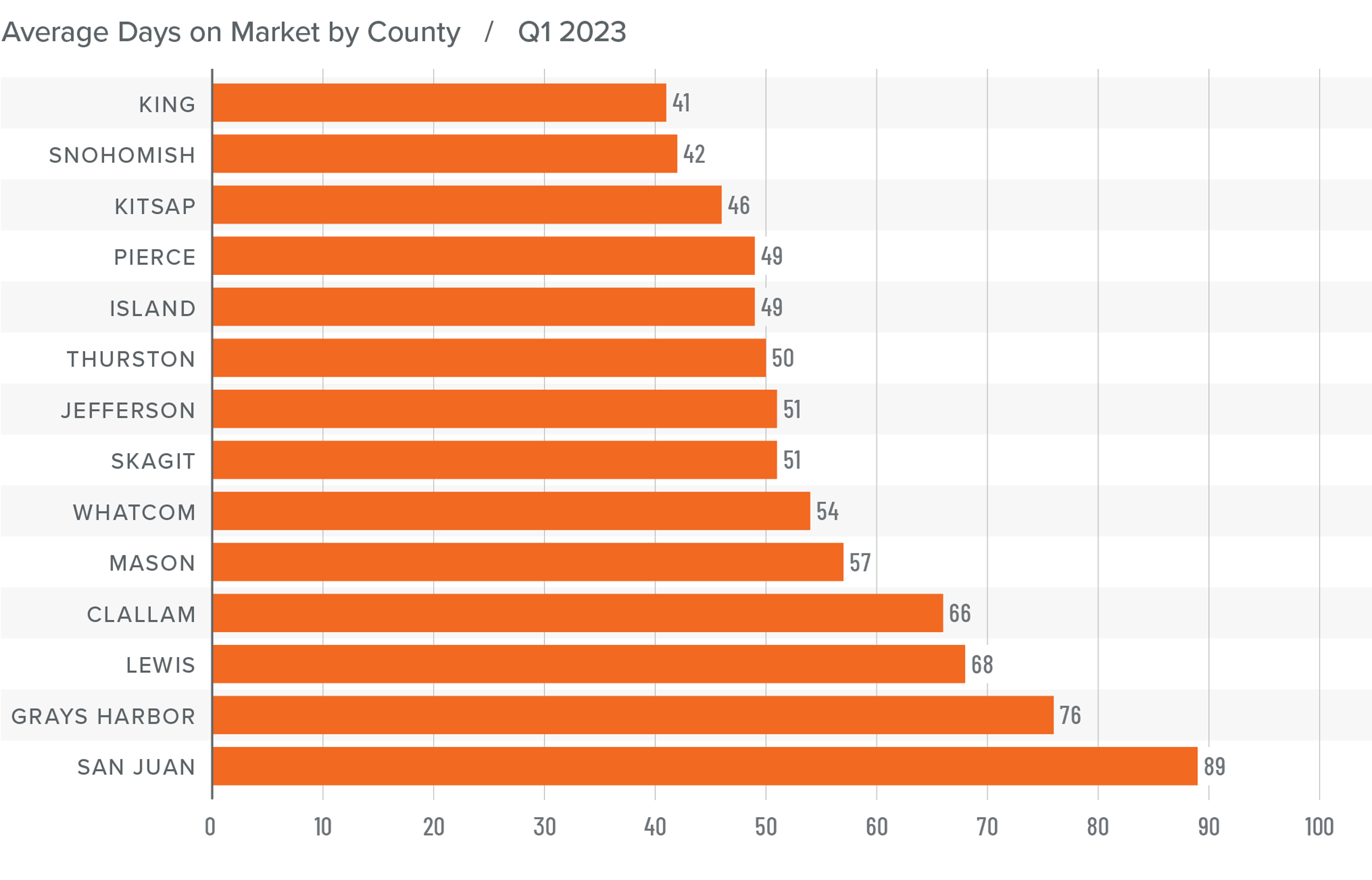

Western Washington Days on Market

❱ It took an average of 56 days for a home to sell in the first quarter of this year. This was 32 more days than in the same quarter of 2022 and 16 days more than in the fourth quarter of last year.

❱ King County remains the tightest market in Western Washington, with homes taking an average of 41 days to sell. Homes in San Juan County took the longest time to sell.

❱ Market time rose in all counties contained in this report compared to the same period in 2022 and compared to the fourth quarter.

❱ The greatest increase in market time compared to a year ago was in Grays Harbor County, where it took an average of 41 more days for homes to sell. Grays Harbor County also saw the greatest increase in market time compared to the final quarter of 2022 (from 46 to 76 days).

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although the regional economy is still expanding, it continues to show signs of slowing. With the probability of a national recession this year now fifty-fifty, I do not see any reason for buyers to lose confidence in their housing decisions based purely on economic factors. Sellers appear to be a little more confident in the market as demonstrated by rising listing prices. Periods of lower mortgage rates and the lack of homes for sale are both likely contributors to this. Whatever the case may be, I am not seeing any signs of panic in the market.

Even in the face of higher financing costs, low inventory levels support home values, and the data suggests that the worst of the price declines are now behind us. The region had fewer sales, modestly lower prices, and higher average days on market, all of which favor home buyers. However, lower inventory levels, higher pending sales, higher listing prices, and a higher absorption rate of homes that are for sale favor sellers. As such, I am moving the needle towards a balanced market, but one that ever so slightly favors sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.